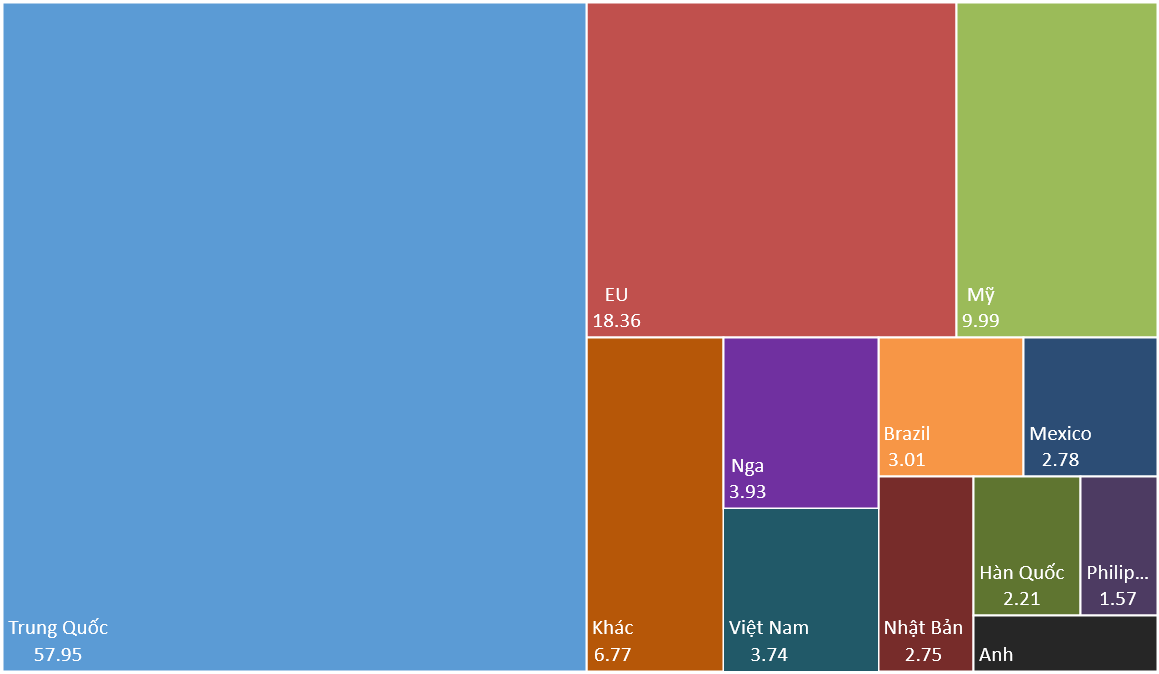

Vietnam is among the top pork-consuming countries globally

In its recently released October 2024 report, “Livestock and Poultry: World Markets and Trade,” the United States Department of Agriculture (USDA) provided forecasts and insights into the global pork market. According to the USDA, world pork production in 2025 is expected to decrease by 0.8% to 115 million tons due to reduced output in China and the EU, outweighing growth in the US, Vietnam, and Brazil.

Specifically, Vietnam’s pork production is forecast to increase by 3%, reaching 3.8 million tons, attributed to anticipated herd expansion as African Swine Fever (ASF) control measures improve. Vietnam is among the top six pork-consuming regions, including China, the EU, Russia, the US, and Brazil.

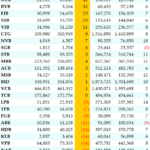

Global Pork Consumption Statistics for 2024

(In Million Tons)

Source: USDA

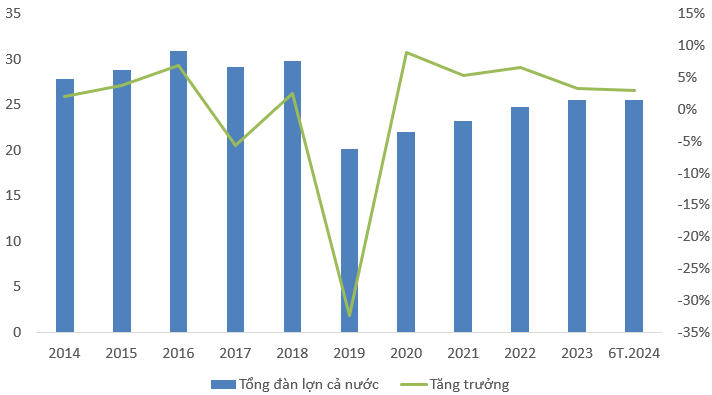

According to Vietnam’s General Statistics Office, the country’s pig herd was estimated at over 25.5 million head as of June 2024, marking a 2.9% increase compared to the same period in 2023. This growth in the pig population corresponded to an increase in pork output. In the first six months of 2024, pork production reached nearly 2.54 million tons, reflecting a 5.1% year-on-year increase.

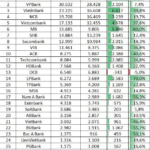

Vietnam’s Pig Herd Statistics for 2014-6T.2024

(In Million Head)

Source: General Statistics Office (GSO) of Vietnam

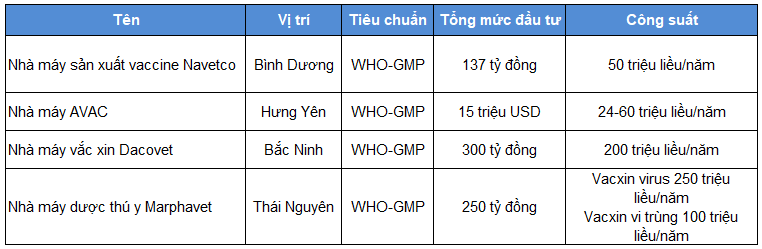

Expediting the Commercialization of the African Swine Fever Vaccine, Dacovac-ASF2

In August 2024, DBC received the Good Manufacturing Practice (GMP-WHO) certification and proceeded with the final steps to synchronize its vaccine production facility and complete pre-commercialization testing. The Dacovet vaccine factory, owned by the Dabaco Vietnam Group, began construction in August 2022 with a total investment of approximately VND 300 billion and an annual capacity of 200 million doses.

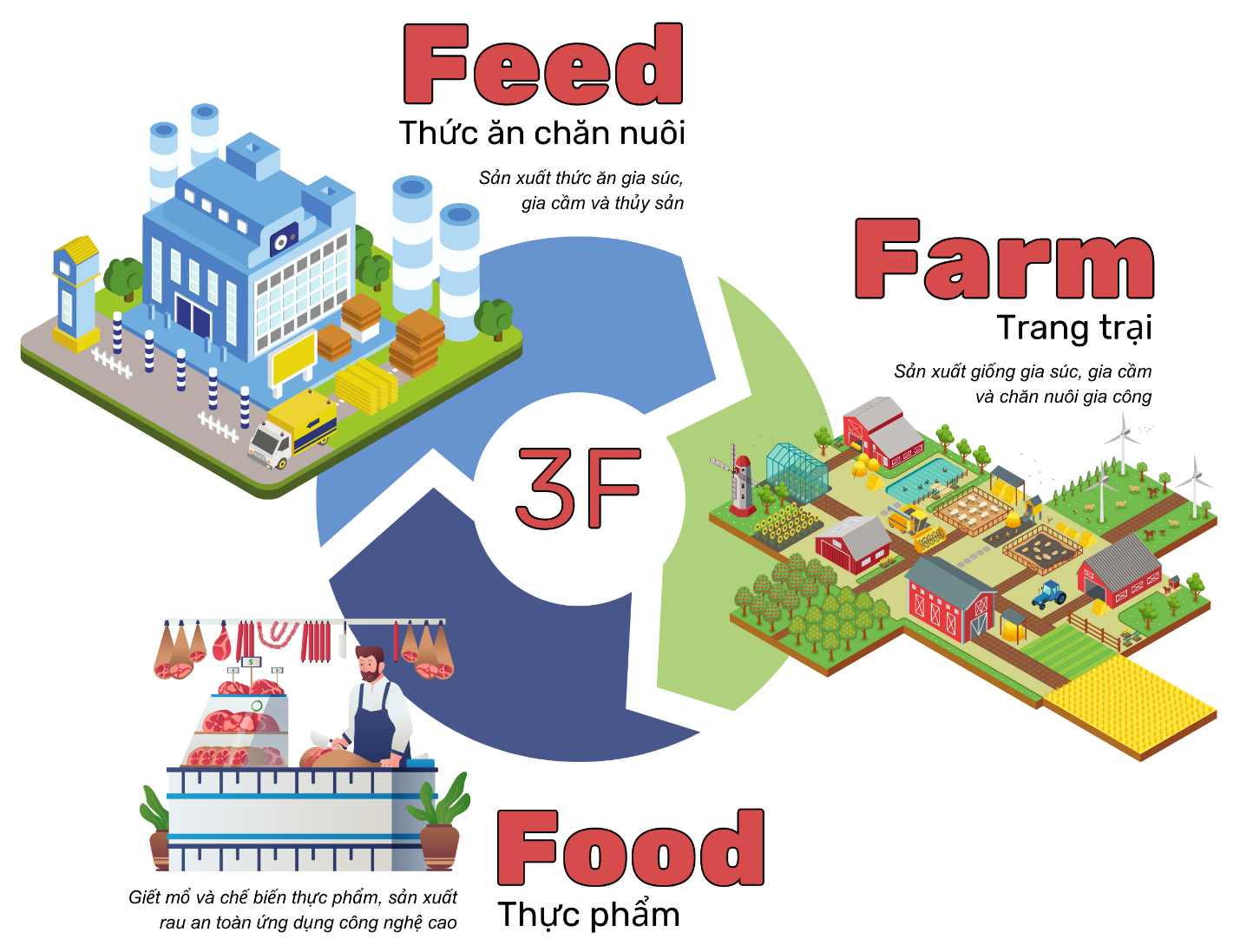

DBC’s venture into vaccine production completes its 3F (Feed – Farm – Food) ecosystem, which also includes breeding, feed, farming, and food processing. This integration allows for better control over product quality and supply chain management, ultimately providing consumers with reasonably priced, high-quality, and safe food products.

List of Veterinary Vaccine Manufacturers in Vietnam

Source: Company Websites

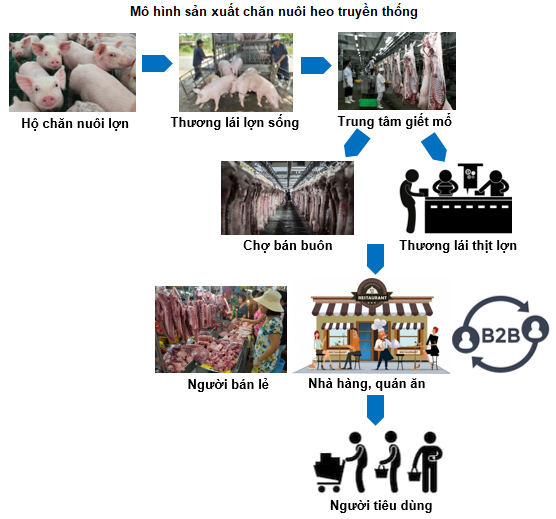

Embracing the 3F Model

By focusing resources on research and development and implementing solutions for its core agricultural and food businesses within the closed-loop 3F (Feed – Farm – Food) value chain, DBC can reduce intermediary costs compared to the traditional value chain. This approach eliminates the need for live pig traders and pork traders, enabling the company to offer competitively priced products to consumers.

Source: Vietnam Livestock Association

Furthermore, the 3F model ensures better quality control in pork production, addressing the issue of banned substance use in livestock farming. This strategy guarantees consumers receive high-quality, nutritious food products that meet food safety standards.

The 3F (Feed – Farm – Food) Model

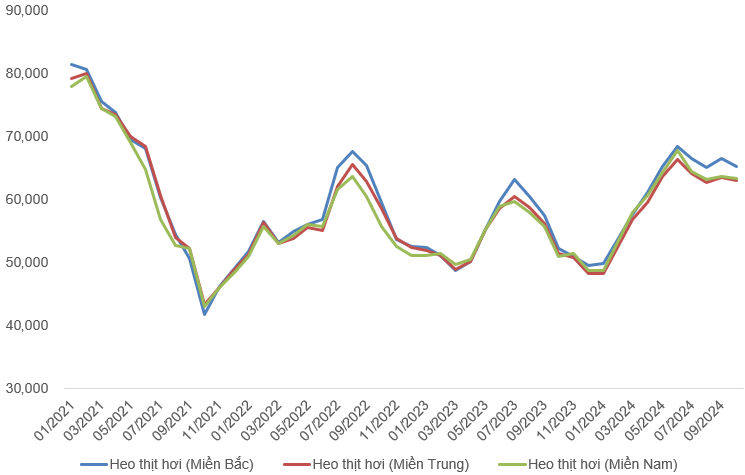

Pork Prices Showed Strong Growth in 2024

Vietnam’s pork prices in 2024 witnessed a significant increase compared to the previous year, mainly due to reduced supply and the severe outbreak of African Swine Fever (ASF). Starting from an average of VND 49,000/kg in late 2023, pork prices in various provinces reached VND 63,000-65,000/kg in October 2024. This high price level is expected to persist due to increased consumption during the upcoming year-end and Tet holidays in 2025.

Domestic Pork Prices from 2021 to T10.2024

(In VND/kg)

Source: Vietnam Livestock

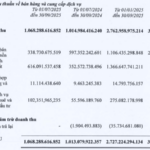

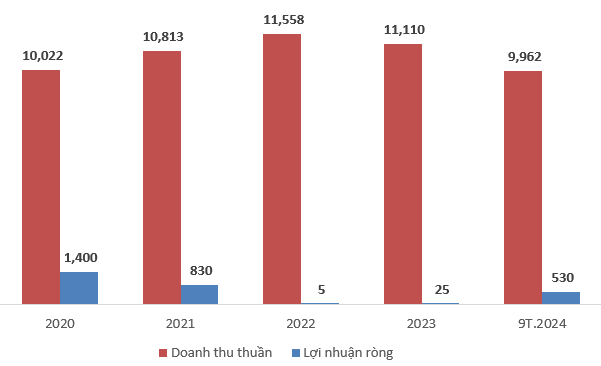

DBC’s Financial Performance from 2020 to 9T.2024

(In Billion VND)

Source: VietstockFinance

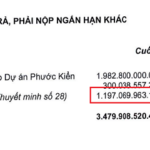

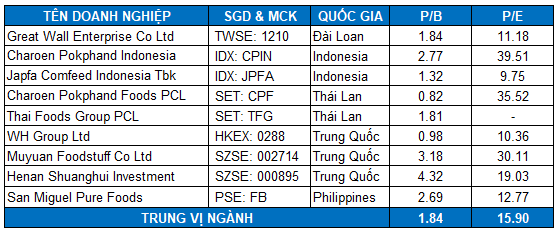

Stock Valuation

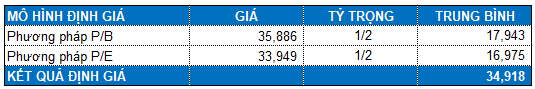

DBC is currently a leading player in Vietnam’s livestock farming, slaughtering, and meat processing industry. To determine a fair value for the company’s stock, a comparison was made with global peers in the same industry, with a market capitalization equal to or greater than DBC. Companies were selected from Asian countries, including China, Thailand, Indonesia, and Taiwan, to ensure relevance.

Source: Investing.com and VietstockFinance

Using the Market Multiple Models (P/E, P/B) approach with equal weights, the predicted fair value for DBC stock is VND 34,918. Therefore, the current market price presents an attractive opportunity for long-term investment.

Vietstock Enterprise Analysis Department, Advisory Board

Introducing the “Vietnam Pavilion – National Pavilion of Vietnam” on the Alibaba E-Commerce Platform

To support international businesses, especially European enterprises, in seeking product information, business partners, and market expansion in Vietnam, the Trade Promotion Agency – Ministry of Industry and Trade of Vietnam is pleased to introduce the “Vietnam National Pavilion – Vietnam Pavilion” on the Alibaba.com e-commerce platform.

“Vietnamese Agricultural Products Synced with Chinese E-commerce Platforms”

The Vietnamese agricultural products store on Chinese e-commerce and social media platforms will operate under a “goods-seeking-people” model. This innovative approach empowers Vietnamese suppliers to sell directly to Chinese consumers and establish their branded products in the Chinese market.