I. VIETNAM STOCK MARKET WEEK 18-22/11/2024

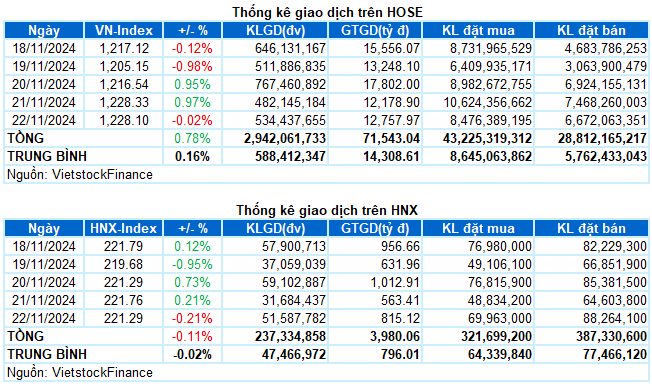

Trading: The main indices edged lower in the final trading session of the week. At the close on November 22, VN-Index dipped 0.02% to 1,228.1 points; HNX-Index fell 0.21% to 221.29 points. For the week, the VN-Index gained a total of 9.53 points (+0.78%), while the HNX-Index lost 0.24 points (-0.11%).

Vietnam’s stock market experienced a volatile trading week. Starting with a sharp plunge on Monday, the VN-Index once again returned to the historic 1,200-point level. However, strong buying support quickly helped the index recover, despite persistent foreign sell-off. Nonetheless, investors remain cautious amid the current unpredictable developments, resulting in market liquidity staying below the 20-week average. At the close of November 22, the VN-Index ended the week at 1,228 points.

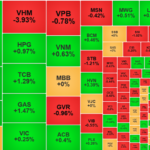

In terms of impact, the top 10 contributing stocks helped the VN-Index gain more than 3 points in the final session, with GAS, TCB, HVN, and BID contributing nearly 2 points. On the other hand, VHM was the biggest drag on the index, causing the VN-Index to lose 1.7 points on its own, while other stocks had negligible impacts.

Most sectors were in the green, but stocks within each group were quite diverse. The telecommunications group led the market with a gain of over 2%, mainly due to the industry’s largest stock by market capitalization, VGI (+2.85%). Other stocks in this sector only fluctuated slightly around the reference level.

In the financial sector, buyers dominated in stocks such as VCB (+0.11%), BID (+0.77%), TCB (+1.29%), ACB (+0.4%), NAB (+1.29%), and ABB (+1.37%), among others. Meanwhile, sellers remained in control in stocks like STB (-1.21%), VPB (-0.78%), TPB (-0.92%), SSI (-1.02%), HCM (-1.25%), and VND (-1.44%).

On the declining side, real estate was the only sector that ended in the red. It faced significant pressure from stocks like VHM (-3.93%), NVL (-2.22%), DXG (-2.61%), SNZ (-3.46%), DIG (-1.2%), PDR (-1.43%), and CEO (-2.07%), to name a few.

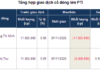

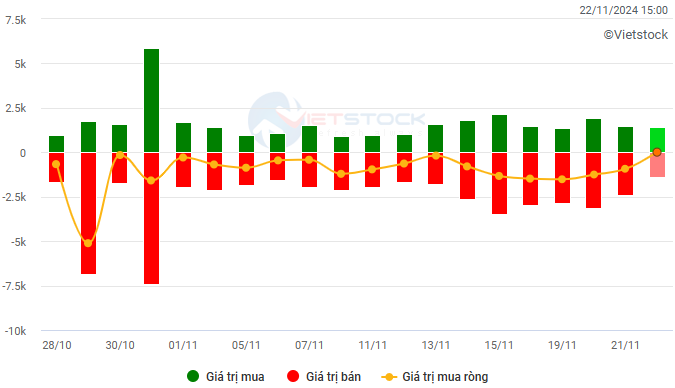

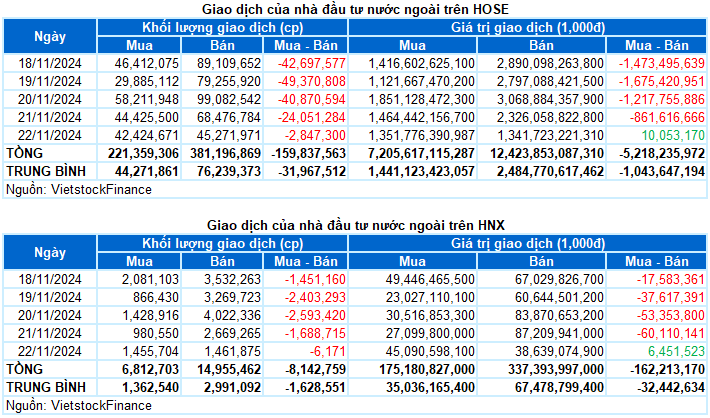

Foreign investors continued to offload their holdings, with a net sell value of nearly VND 5.4 trillion on both exchanges this week. They net sold over VND 5.2 trillion on the HOSE and more than VND 162 billion on the HNX exchange.

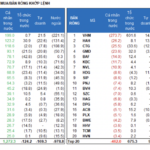

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

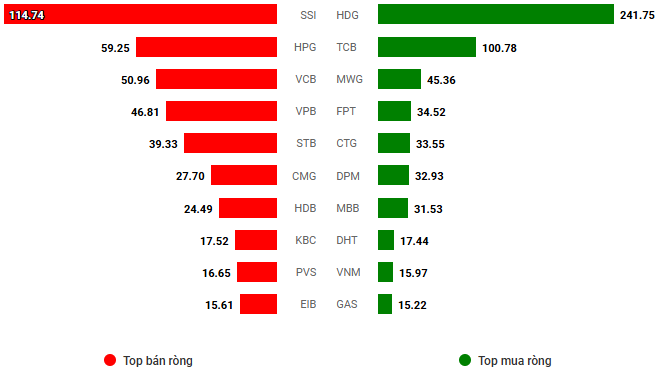

Net trading value by stock code. Unit: VND billion

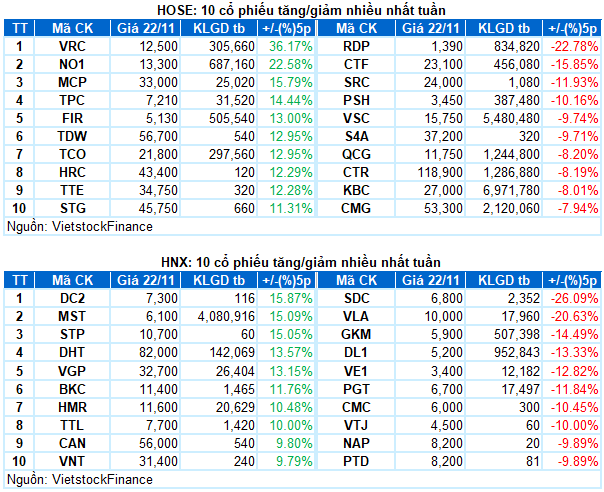

Stocks with notable gains this week include VRC

VRC rose 36.17%: VRC witnessed a vibrant trading week, surging 36.17%. The stock consistently climbed and closely followed the Upper Band of the Bollinger Bands, indicating a very optimistic investor sentiment. Moreover, the trading volume surpassed the 20-day average, reflecting increasing market participation.

However, the Stochastic Oscillator has ventured deep into the overbought zone. Investors should exercise caution if sell signals reappear.

Stocks with significant losses this week include RDP

RDP declined 22.78%: RDP underwent a negative trading week as the downward trend reemerged. The stock continuously plummeted, and the trading volume spiked above the 20-day average, reflecting investors’ pessimistic outlook.

Additionally, the Stochastic Oscillator and MACD continued their descent after issuing sell signals, suggesting that short-term downside risks persist.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economics & Market Strategy Division, Vietstock Consulting

Technical Analysis for the Afternoon Session on November 21st: Market Sentiment Clouded by Indecision

The VN-Index and HNX-Index both climbed, forming a Doji candlestick pattern, indicating investor indecision. This pattern suggests a potential shift in market sentiment, as investors appear uncertain about the future direction of the market. With the indices hovering at these levels, it’s a pivotal moment for Vietnam’s stock market, leaving investors wondering if this is a mere pause or a sign of things to come.

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.