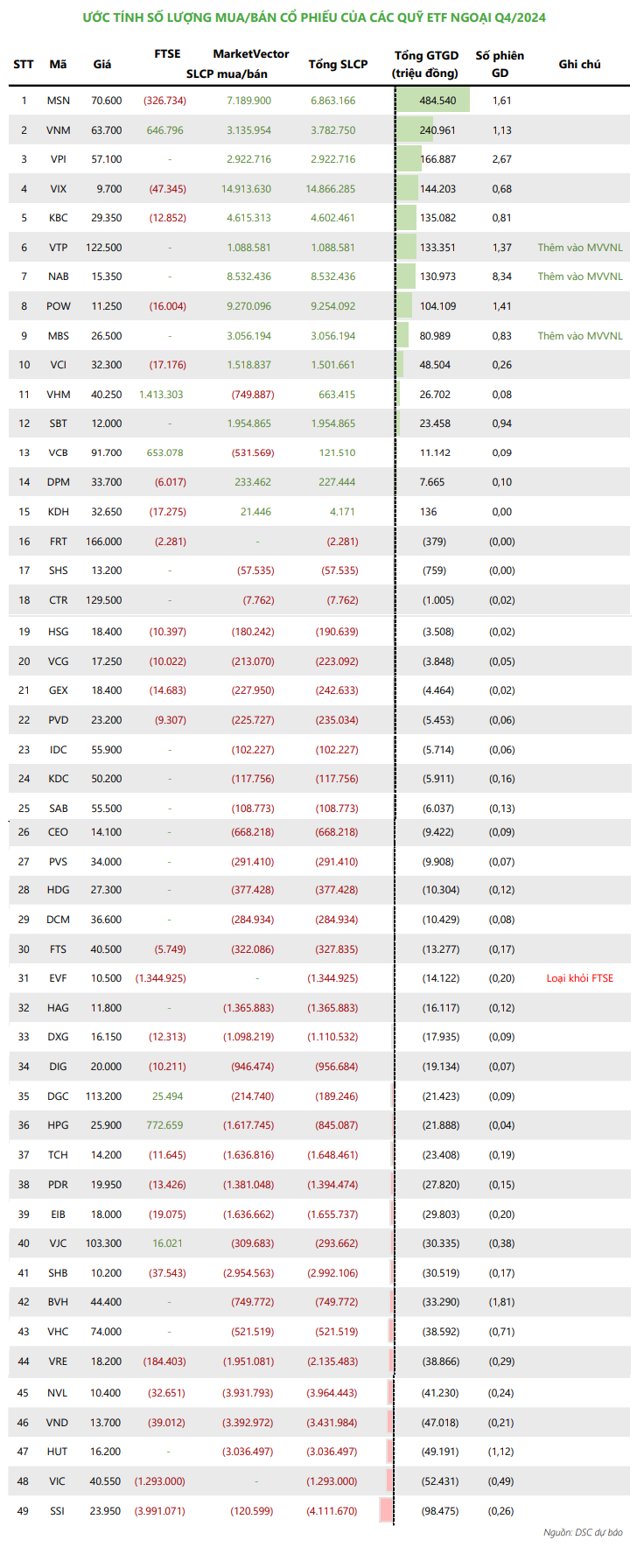

According to forecasts by DSC Securities, the FTSE Vietnam ETF, with a scale of nearly VND 6,790 billion, will exclude EVF stocks from its portfolio as they fail to meet capitalization criteria. Conversely, no new stocks will be added.

Simultaneously, the fund will make significant purchases of large-cap stocks such as VHM (1.4 million shares), HPG (772,000 shares), and VCB (653,000 shares). On the other hand, the fund may heavily offload SSI (3.9 million shares), EVF (1.3 million shares), and VIC (1.3 million shares).

Regarding the VNM ETF, with a scale of nearly VND 11,260 billion, the fund is expected to include three new stocks in its portfolio: VTP, NAB, and MBS. Again, no stocks will be removed.

The fund is projected to buy the most VIX (14.9 million shares), MSN (7.2 million shares), and NAB (8.5 million shares). Conversely, it is expected to sell large volumes of VIC, HUT (3 million shares), VND (3.4 million shares), and NVL (3.9 million shares).

Notably, both funds have experienced net capital outflows since the beginning of 2024. Specifically, the FTSE Vietnam ETF witnessed a net outflow of VND 1,582.6 billion, while the VNM ETF faced a net outflow of VND 788 billion. This somewhat reflects the cautious sentiment of foreign investors towards the Vietnamese stock market amidst a context of persistently high global interest rates.

As per the schedule, the FTSE Vietnam ETF will announce its new portfolio on December 6 and complete the restructuring by December 20, 2024. The VNM ETF will disclose its portfolio on December 13 and finalize the restructuring trades on December 20, 2024.

Vu Hao

The Optimistic Outlook: Can We Expect a Positive Shift?

The VN-Index surged amidst a recent spate of losses, indicating a strong rebound. Accompanying this rise was a surge in trading volume, surpassing the 20-day average, signifying a return of liquidity to the market. The Stochastic Oscillator, a key technical indicator, has now entered oversold territory and is signaling a buy. Should this indicator continue to climb, we can expect a further positive shift in market sentiment.

The Capital is Crumbling: VN-Index Plunges Towards the 1200-Point Region

The large-cap stocks’ plunge today erased the gains from yesterday’s bargain hunting session. VN-Index fell sharply by nearly 12 points to 1205.15, as foreign investors offloaded a net sell of VND 1,658 billion. To make matters worse, the trading volume on the HoSE plunged to a two-week low.

Don’t Miss: “Trump 2.0: Opportunity or Challenge for Goods and Stocks in 2025?”

The US Presidential Election has concluded with Donald Trump reclaiming the White House. With his controversial policies from the previous term, there are expectations for significant global economic shifts. In light of this, Ho Chi Minh City Commodity Trading Joint Stock Company (HCT) hosted a unique offline event titled “Trump 2.0: Opportunities and Challenges for Commodities and Securities in 2025.” This pioneering program in Vietnam offered a comprehensive analysis of the top two investment channels: commodity derivatives and securities, providing insightful predictions for the upcoming year.