On November 21st, HSC Securities hosted a C2C (Connecting to Customers) workshop, exploring the theme “The Steel Industry and Hoa Phat’s Health.” At this workshop, representatives from Hoa Phat’s leadership and HSC analysts will help investors understand the company’s unique strengths and the prospects of the steel industry in general and Hoa Phat in particular, with a vision towards 2025.

The global steel industry is declining, but Vietnam is a bright spot

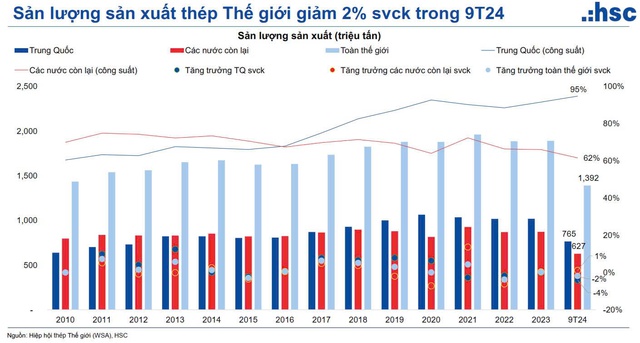

Kicking off the workshop, Ms. Vo Thi Ngoc Han, HSC’s Senior Research Director for Industry & Technology, provided updates on the context of the global steel industry and its specific dynamics in Vietnam. Citing a report from the World Steel Association, HSC’s expert revealed that global steel production in the first nine months of 2024 decreased by 2% year-on-year to 1.4 billion tons. Of this, China produced 765 million tons, a 4% drop, while the rest of the world produced 627 million tons, a 1% increase.

According to HSC’s expert, any fluctuations in China will impact the global steel market as the country currently accounts for 55% of global production. Chinese steel mills have proactively cut back on production due to weak steel demand in their domestic market.

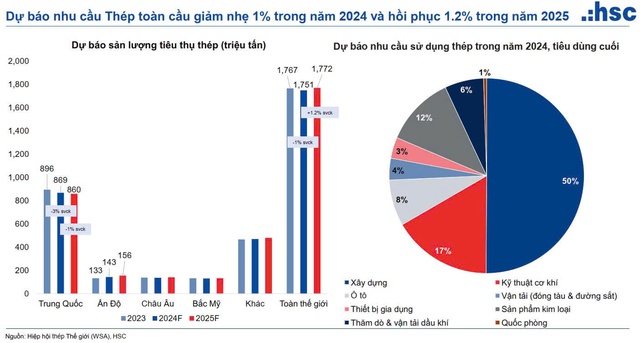

The World Steel Association forecasts a 1% decline in global steel demand in 2024, followed by a 1.2% recovery in 2025. Within this, steel demand in China – which consumes 51% of the world’s steel – is expected to drop by 3% this year. Ms. Han also noted that steel demand could face further pressure in the coming period as the construction industry (which consumes 50% of global steel) faces challenges. This is mainly due to the stagnation of the Chinese real estate sector in recent years.

As a result of the Chinese market dynamics, companies there are forced to boost exports in large quantities. Chinese companies are also consistently undercutting steel prices. Evidence of this can be seen in the 25 investigations launched worldwide as of November 15, 2024, to apply anti-dumping duties on Chinese steel.

However, Ms. Vo Thi Ngoc Han believes that Vietnam is a bright spot in the global steel industry. According to data from the Vietnam Steel Association, total steel consumption in the first ten months of 2024 reached 26 million tons, a 17% increase year-on-year. This growth is impressive compared to the 1% decline globally and is attributed to strong domestic market demand, particularly from public investment projects and a recovering real estate market.

In terms of import and export activities, Vietnam’s steel imports surged by 32% year-on-year to 12.3 million tons, and according to HSC’s observations, the actual import figures may be higher than the official statistics. Vietnam also exported nearly 10 million tons in the first nine months of 2024, a 21% increase. Government agencies have been actively investigating anti-dumping cases, demonstrating their support for domestic steel companies. HSC Securities also forecasts a 14% growth in domestic steel consumption in 2024 and an 11% increase in 2025.

Dung Quat 2’s timely completion will bolster Hoa Phat’s financial health

With many positive factors on the horizon, Hoa Phat – Vietnam’s largest steel producer by market share – is expected by investors to continue leveraging its growth potential. This is especially true as Hoa Phat is focusing its efforts and investments on its “ace in the hole,” the Dung Quat 2 project, with a capacity of 5.6 million tons of HRC per year.

According to Ms. Pham Thi Kim Oanh, Hoa Phat’s CFO, Dung Quat 2 is a crucial project in the company’s long-term development strategy. With this project, HRC production capacity will increase from 3 million tons per year to 8.6 million tons. Once this plant is operational, the company can consider expanding its production capacity for other high-quality steel products.

However, with an investment of 85,000 billion VND (including working capital) in this project, some investors have questioned Hoa Phat’s financial health. Addressing this concern, the CFO shared that the company’s projects are on schedule. Additionally, Dung Quat 2 will launch its first products by the end of this year, stabilizing cash flow. By 2025, this project is expected to contribute significantly to the company’s business results. Furthermore, Hoa Phat’s profit margins are gradually improving as input material costs are decreasing.

“These advantages have bolstered Hoa Phat’s financial strength. When discussing health, we refer to financial health. I assure you that we are closely monitoring our debt-to-equity ratio weekly and optimizing our cash flow to maximize profits for the Group,” affirmed Ms. Pham Thi Kim Oanh.

Ms. Kim Oanh shared that after 2025, the capital pressure for Dung Quat 2 will ease, and the company will enter an accumulation phase to focus on subsequent projects. She emphasized that the timely completion of the plant will significantly enhance Hoa Phat’s long-term strength and resilience.

The company’s leader also noted that Hoa Phat approaches every project with caution. They have meticulously calculated the risks involved in the Dung Quat investment. “We typically choose locations with favorable timing, geographical advantages, and harmonious relationships to execute our projects. For instance, our projects are always located near ports, allowing us to independently manage logistics costs and easily connect with our agencies. We move steadily and surely, like a road roller,” asserted Ms. Kim Oanh.

Dung Quat 2’s depreciation won’t impact Hoa Phat’s profits

According to Hoa Phat’s CFO, the company has disbursed approximately 70,000 billion VND in fixed capital for the Dung Quat 2 project. In 2025, the Group will disburse the remaining amount. By the end of 2024, a small portion of commercial products will be launched. Half of the project’s funding comes from debt (approximately 35,000 billion VND), and the disbursement process is even ahead of schedule. 2025 will mark the peak of the Group’s debt as banks disburse the remaining funds. The net debt-to-EBITDA ratio remains favorable and well within manageable limits.

Ms. Kim Oanh also shared that Dung Quat 2’s first blast furnace is expected to operate at 50-60% capacity in 2025, producing an estimated 1.5 million tons of HRC. By 2026, the project is projected to reach 80% capacity for the first blast furnace and 50% for the second. Dung Quat 2 is anticipated to operate at full capacity by 2028.

Regarding depreciation, Ms. Kim Oanh stated that the average total depreciation period for the entire project is around 18 years for the 70,000 VND investment, equivalent to nearly 3,900 billion VND per year. Therefore, the depreciation cost of the Dung Quat 2 project will not reach its highest level in 2025-2026, and it will be recorded at 3,900 billion VND per year from 2027 onwards.

“Many people have asked me if this depreciation will erode the Group’s profits. I believe that if our profit growth remains in the double digits, it won’t have a significant impact. Currently, our depreciation cost is 7,000 billion VND per year. With the addition of Dung Quat 2, this figure will increase to 10,000-11,000 billion VND per year for depreciation. As a result, our resources will become even stronger in the future, so shareholders need not worry,” assured the CFO, adding that the depreciation funds will be recycled back into production.

Ms. Kim Oanh also mentioned that Dung Quat 2 adds sales pressure on Hoa Phat. Currently, 30% of the company’s revenue comes from exports. Once Dung Quat 2 reaches full capacity, the company expects to sell its production output in both export and domestic markets.

According to Hoa Phat’s CFO, the company targets 140,000 billion VND in revenue for 2024. When Dung Quat 2 is fully operational in four years, Hoa Phat’s revenue may surpass the 10 billion USD mark (approximately 255,000 billion VND). This projection is feasible if HRC prices remain around the current level.

“Hòa Phát: Forging Ahead as Vietnam’s 16th Most Valuable Brand”

Brand Finance, the renowned brand valuation consultancy, has unveiled its latest report on Vietnam’s Top 100 Most Valuable Brands for 2024. Hoa Phat, a prominent Vietnamese brand, has secured the 16th rank in this prestigious listing, marking its 9th consecutive year of inclusion in this esteemed ranking.