The VN-Index fluctuated during last week’s closing session, reaching a high of 1,230 points before retreating to 1,228 points, with low market liquidity. A positive note was that foreign investors ended their 30-session net-selling streak, turning net buyers with purchases worth nearly VND 30 billion.

“The recovery momentum has stalled today. In the coming sessions, the VN-Index may continue to trade sideways around the old resistance level of 1,230, with money flowing through different sectors in search of short-term gains,” stated BIDV Securities Company (BSC) in their November 22 report, consistent with their accurate prediction from the previous week that the VN-Index would move sideways.

Furthermore, in their report “Macroeconomics and Stock Market in October 2024,” BSC provided a monthly outlook: the positive macroeconomic environment, but the market needed confirmation from cash flow to enter a new uptrend after a prolonged period of consolidation. Unfortunately, this confirmation did not materialize by November 22.

Investors have been repeatedly advised by securities companies to “trade cautiously in the coming sessions,” even as new account openings surge and the pace of new stock account openings accelerates. According to the Vietnam Securities Depository (VSD), as of the end of October, the total number of accounts in the stock market reached 9 million.

With 9 million domestic investor accounts (equivalent to 9% of Vietnam’s population) and numerous favorable factors, the market should be more vibrant to match the reality and reflect the stock market as a true channel for capital to the economy, which is growing at a rate of 7%. However, market liquidity has been low for many sessions, according to the Ministry of Finance’s mid-November report on the stock market. The average trading value in October was VND 18,042 billion/session, lower than the 10-month average of VND 22,130 billion.

Many stock investors, but not really contributing to the market’s rebound.

The average trading value for the ten months was 25.9% higher than the 2023 average, but it was still low as the 2023 transactions were significantly impacted by the Covid pandemic and the negative effects of several arrests related to the stock market.

According to experts, the stock market has been trading sideways for more than a month, indicating that the large number of new accounts and rapid growth have had little positive impact on the market in recent months. When the market enters a lull, stock investors also fall into a prolonged “lazy” trading crowd psychology.

In addition, the dominance of small individual investors has been noted but remains unaddressed, and their account values have not improved. The market also lacks appeal for “whale” investors, and the quantity of goods on the stock market has hardly changed, with no necessary addition of new stocks, making investment choices bland.

The slow pace of privatization also contributes to the stock market’s difficulty in attracting new listings. According to the Ministry of Finance, in October 2024, privatization continued according to the approved plan for rearranging state-owned enterprises and enterprises with state capital for the 2022 – 2025 period, which the Prime Minister had approved. However, no enterprise has been approved for privatization by authorized agencies!

Some argue that long-term investors are waiting for “new goods” in the market to diversify their investment portfolios, but the wait seems indefinite. Their feeling is similar to awaiting the market’s upgrade, but the timing remains a prediction.

In a recent report on financial market and financial service management, the Ministry of Finance stated that it is restructuring the stock market. To improve the market, the Ministry is strengthening the management, supervision, inspection, and examination of public companies and securities businesses. Inspection activities aim to ensure the healthy development of the market. Thanks to the determined inspection, the competent authority of the Ministry has issued 439 decisions on handling violations, with a total fine of more than VND 53.97 billion.

In October, BSC Research forecasted several scenarios for the VN-Index in 2024: Scenario 1 (negative): VN-Index approaching 1,200 points, Scenario 2 (positive): VN-Index heading towards 1,425 points. Base scenario: VN-Index at 1,298 points (higher probability). So far, the base scenario remains accurate.

The Stock Market Under Pressure from Foreign Investors’ Net Selling

The stock market is under intense pressure as foreign investors continue their selling spree, with no end in sight. Adding to the woes, proprietary trading desks are also offloading stocks, further dampening market sentiment. As the selling momentum builds, investors are left wondering when this tide will turn.

Technical Analysis for the Afternoon Session on November 20th: A Shift from Pessimism to Optimism

The VN-Index and HNX-Index both climbed, with a significant surge in trading volume during the morning session, indicating an improvement in investor sentiment.

Technical Analysis for the Session on November 22: A Tale of Diverging Fortunes

The VN-Index and HNX-Index rose in tandem, with the emergence of a Doji candlestick pattern indicating investor indecision in the market. This cautious sentiment is reflected in the hesitancy of buyers and sellers, resulting in a stalemate that led to the formation of the Doji. As the markets hover at these levels, investors are carefully weighing their options, considering the potential risks and rewards of their next move.

The Market Beat: Foreigners End Selling Streak

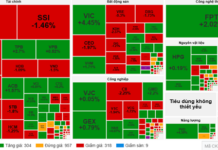

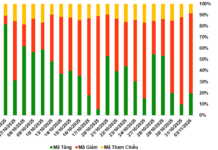

The market closed with slight losses, as the VN-Index dipped by 0.23 points (-0.02%) to finish at 1,228.10, while the HNX-Index shed 0.47 points (-0.21%), closing at 221.29. The market breadth tilted towards decliners, with 371 tickers in the red versus 341 in the green. Meanwhile, the large-cap VN30 index displayed a more balanced performance, with 11 tickers losing ground against 13 advancing stocks and 6 remaining unchanged.