VN-Index’s trajectory on November 20, 2024

The market exhibited downward inertia and briefly breached the 1,200-point support level before consistent buying pressure propelled the VN-Index to recover and reverse its course, ultimately closing the session on November 20 with an 11-point gain to reach 1,216 points.

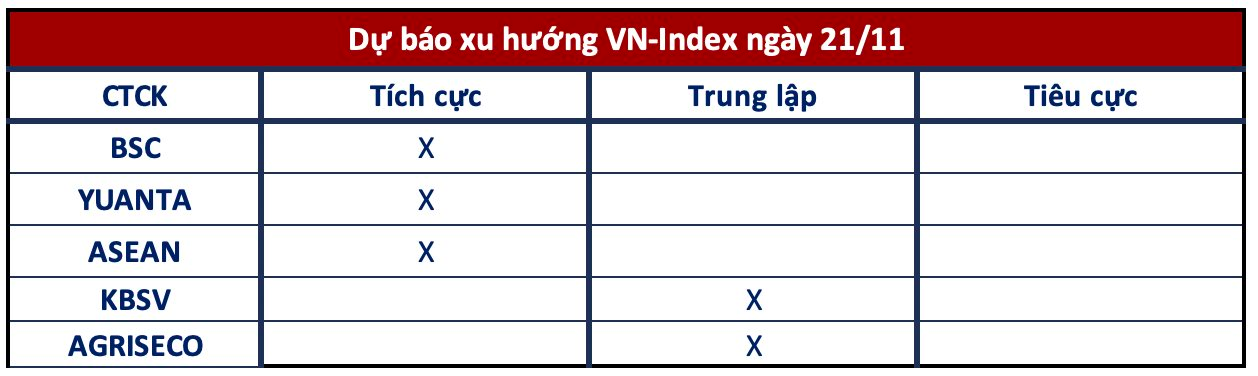

Looking ahead to the next trading session, most securities companies anticipate a continuation of the market’s upward momentum, but caution is warranted due to potential fluctuations during the derivatives expiry.

Market to Extend Gains

BSC Securities

In the short term, the VN-Index may continue its upward momentum towards the 1,220-point threshold. However, investors should exercise caution as profit-taking pressure at this level emerged during today’s session.

Yuanta Securities

The market is likely to extend its gains in the next session, with the VN-Index potentially retesting the resistance zone of 1,238 – 1,240 points. Nonetheless, we maintain our view that this is merely a technical rebound and does not signify a confirmed short-term bottom. While bullish reversal patterns are emerging, they remain unconfirmed. On a positive note, liquidity has improved compared to the previous three sessions, but further observation is necessary to ascertain the trend in liquidity.

Asean Securities

The real estate and securities sectors will be the two key factors attracting capital inflows and providing strong momentum for the market to firmly establish its recovery trend. On the macroeconomic front, the slight easing of the DXY and domestic exchange rates at the beginning of the day helped boost market sentiment. The market will continue to witness gradual recoveries, making it an opportune time to consider prudent investments with reasonable allocations.

Potential Fluctuations During Derivatives Expiry

KBSV Securities

The formation of a long-bodied bullish candle with improved liquidity indicates a somewhat more favorable technical signal. The VN-Index is currently holding above the lower edge of an ascending triangle pattern on the weekly chart. Nevertheless, as the short-term downtrend remains prevalent, considerable latent selling pressure at higher resistance levels could trigger an early reversal for the index.

Agriseco Securities

From a technical perspective, the VN-Index rebounded with larger-than-average liquidity after briefly breaching the 1,200-point support level. Investor sentiment improved following the reversal, encouraging active buying participation. The RSI indicator is pointing upward and has temporarily exited the oversold region. Agriseco Research considers this rebound to be technical in nature, and the market requires additional time to consolidate before confirming a resumption of the uptrend. The 1,180-1,200-point zone is anticipated to serve as a crucial mid-term support level for the market.

Investors are advised to gradually build long-term positions as the market’s valuation becomes relatively more attractive. High-risk investors can consider T+ trading with the aforementioned sectors attracting capital inflows, preferably during consolidations or after the formation of equilibrium zones. Note that tomorrow is the expiry date for November 2024 futures contracts, so it is prudent to maintain a low stock proportion in portfolios to manage potential volatility.