The market continued its downward trend from the previous session, with fears and selling pressure causing the VN-Index to adjust from the start of the session and quickly fall below the 1,200-point mark.

However, after losing this important threshold, buying pressure returned, pulling the VN-Index back above the reference mark. “Outside” money that had been observing during the recent sharp corrections started to bottom fish, helping the overall index to gradually widen its gains as green dominated the screen.

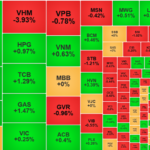

The morning session’s focus was on the real estate sector, with DXG up 6.2%, NVL up 5.1%, VHM up 2%, DIG up 4.5%, and PDR up 5.5% on strong volume.

The stock market posted gains after days of selling pressure.

In the afternoon session, the VN-Index surged more than 10 points at the beginning due to increased buying interest in the real estate and banking sectors, with large-cap stocks such as VHM, BID, and VCB. Mid-session, information technology stocks, led by FPT, reversed course to trade nearly 2% higher, providing further momentum for the market’s recovery of nearly 15 points. However, profit-taking pressure persisted in the retail sector as MWG remained under strong net selling pressure from foreign investors, causing the VN-Index to trim its gains towards the end of the session, closing with a rebound of over 11 points.

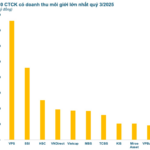

Liquidity also increased significantly compared to recent sessions, indicating a return of money flow. Today’s trading value on all three exchanges exceeded VND 19,410 billion. While domestic investors turned net buyers, foreign investors continued to be net sellers.

In the latter half of the afternoon session, the market’s fear subsided, and green spread to many sectors, helping the VN-Index maintain its impressive gains.

At the close, the VN-Index rose 11.39 points (+0.95%) to 1,216.50, with 250 gainers and 148 losers. Total trading volume reached 767.5 million shares, and value was VND 17,807 billion, up 50% and 34%, respectively, compared to the previous session. There were over 118 million shares worth VND 2,614 billion traded in block deals.

The HNX-Index gained 1.61 points (+0.73%) to close at 221.29, with 100 advancers and 57 decliners. Total trading volume reached 59 million shares, and value was VND 1,011 billion.

The UPCoM-Index climbed 0.79 points (+0.87%) to 91.09, with 167 gainers and 108 losers. Total trading volume reached over 40.4 million shares, and value was VND 596 billion, up 32% in volume and down 2% in value compared to the previous session. Block deals contributed an additional 13.9 million shares worth nearly VND 251 billion.

In the derivatives market, all four VN30 futures contracts gained ground, with the front-month VN30F24111, expiring tomorrow, up 7.70 points or 0.61% to 1,270.0, with over 321,000 contracts traded and open interest of over 56,500 contracts.

The 9-Million Account Market: Why is the VN-Index Stuck Around the 1,200 Point Mark?

The domestic and global macroeconomic factors present a positive picture, boding well for the stock market’s upward trend. However, with 9 million accounts, the VN-Index continues to hover around the 1,200-point mark.

The Optimistic Outlook: Can We Expect a Positive Shift?

The VN-Index surged amidst a recent spate of losses, indicating a strong rebound. Accompanying this rise was a surge in trading volume, surpassing the 20-day average, signifying a return of liquidity to the market. The Stochastic Oscillator, a key technical indicator, has now entered oversold territory and is signaling a buy. Should this indicator continue to climb, we can expect a further positive shift in market sentiment.

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.

The Art of Trading: Navigating the Stormy Seas of Short-Term Risks

The Asean stock market is expected to witness short-term rebounds in the coming sessions. However, investors are advised to remain cautious and avoid a buying frenzy or panic-selling in their short-term trades.