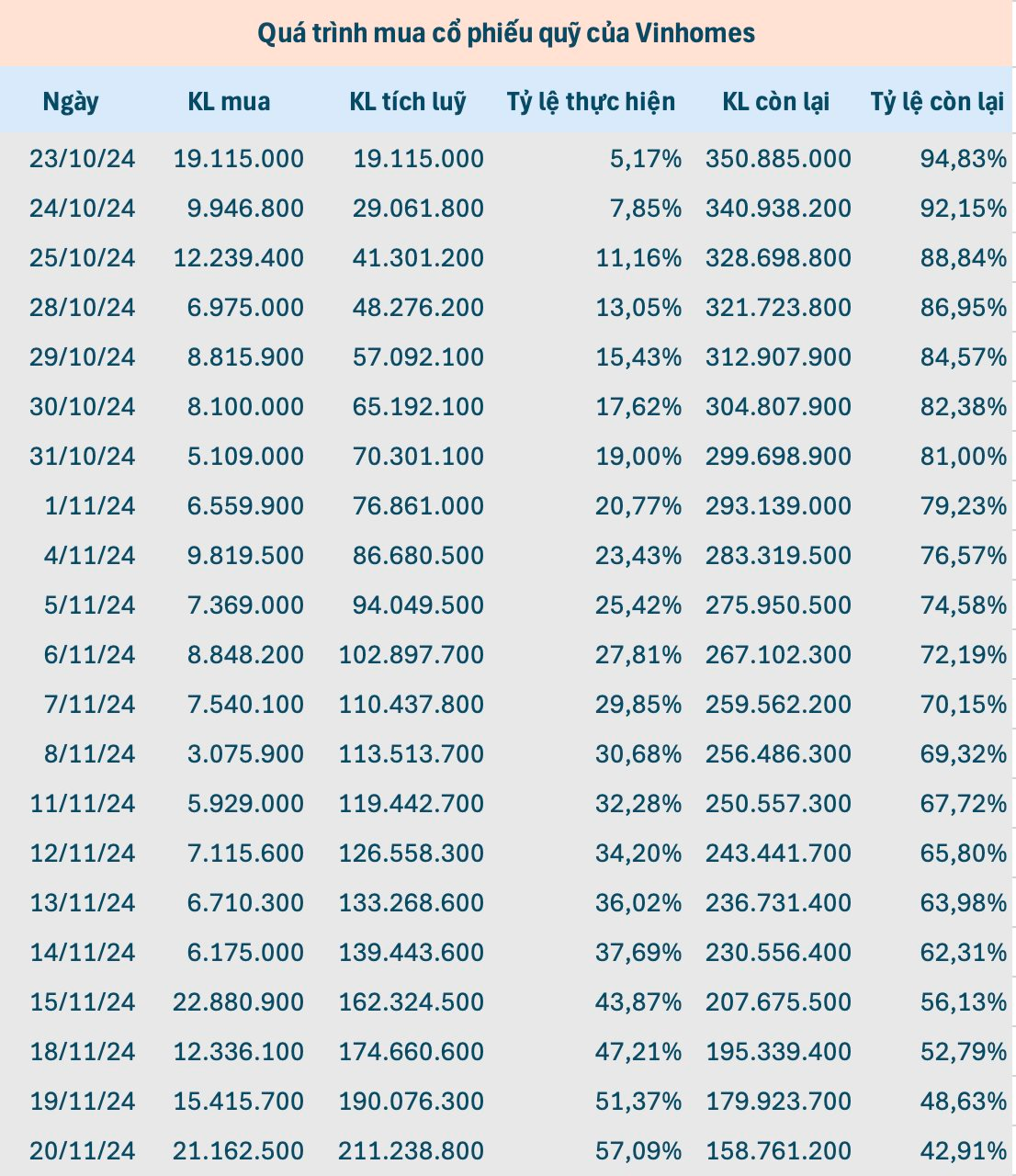

November 21st marks the final day of Vinhomes’ share repurchase campaign. This means there will only be one more session for the company to execute the biggest deal in the history of Vietnam’s stock market. According to updates from HoSE, as of November 20th, Vinhomes had purchased a total of 211.2 million treasury shares, equivalent to 57.09% of the registered amount. It is estimated that after 21 trading days, Vinhomes has spent approximately VND 9,000 billion on buying treasury shares.

In accordance with regulations, Vinhomes will place a minimum order of 11.1 million shares and a maximum of 37 million shares per day during the trading period. As such, the company will definitely be unable to purchase the full amount of registered treasury shares. Nonetheless, this will still be the largest share repurchase deal to date in terms of both volume and transaction value.

Regarding the purpose of the share buyback, Vinhomes believes that the market price of VHM is lower than the company’s actual value. The repurchase of shares is to ensure the interests of the company and its shareholders. The company affirms that the repurchase plan will be financed by available cash and operating cash flow, thanks to revenue from the sale of several projects.

In the market, VHM is experiencing a strong rebound in the final days of the registration period after a deep fall from its one-year high. The share price currently stands at VND 43,300/share, still 10% lower than before the start of the treasury share purchase but nearly 26% higher than the historical low at the beginning of August. Market capitalization stands at approximately VND 189,000 billion.

For the third quarter of 2024, Vinhomes reported net revenue of VND 33,323 billion, a slight increase of nearly 2% over the same period last year. After expenses, net income was over VND 8,980 billion. For the first nine months of the year, Vinhomes recorded consolidated net revenue of VND 69,910 billion and net income of VND 20,600 billion.

As of the third quarter of 2024, Vinhomes’ total assets and equity were valued at VND 524,684 billion and VND 215,966 billion, respectively, an increase of 18% and 18.3% compared to the end of 2023. Of this, cash, cash equivalents, and bank deposits amounted to VND 22,055 billion (~USD 1 billion).

Raising the Capital: Nam Long Investment Seeks to Mobilize 1,000 Billion VND in Bonds to Restructure Debt

Nam Long Investment is set to issue VND 1,000 billion worth of bonds in the fourth quarter of 2024 or the first quarter of 2025. The proceeds from the bond issuance are intended to be utilized for the company’s debt restructuring purposes.

The Radiant East Holding Stock (RDP) Falls into Trading Halt

Rạng Đông Holding (RDP) has once again found itself in hot water with regulators due to non-compliance with information disclosure regulations. As a result, the Ho Chi Minh Stock Exchange (HoSE) has taken decisive action by moving to suspend trading of RDP shares, shifting them from restricted trading to a trading halt.

![[IR AWARDS] Important Disclosure Dates for August 2024](https://xe.today/wp-content/uploads/2024/08/lich-cong-bo-thong-tin.JPG.png)