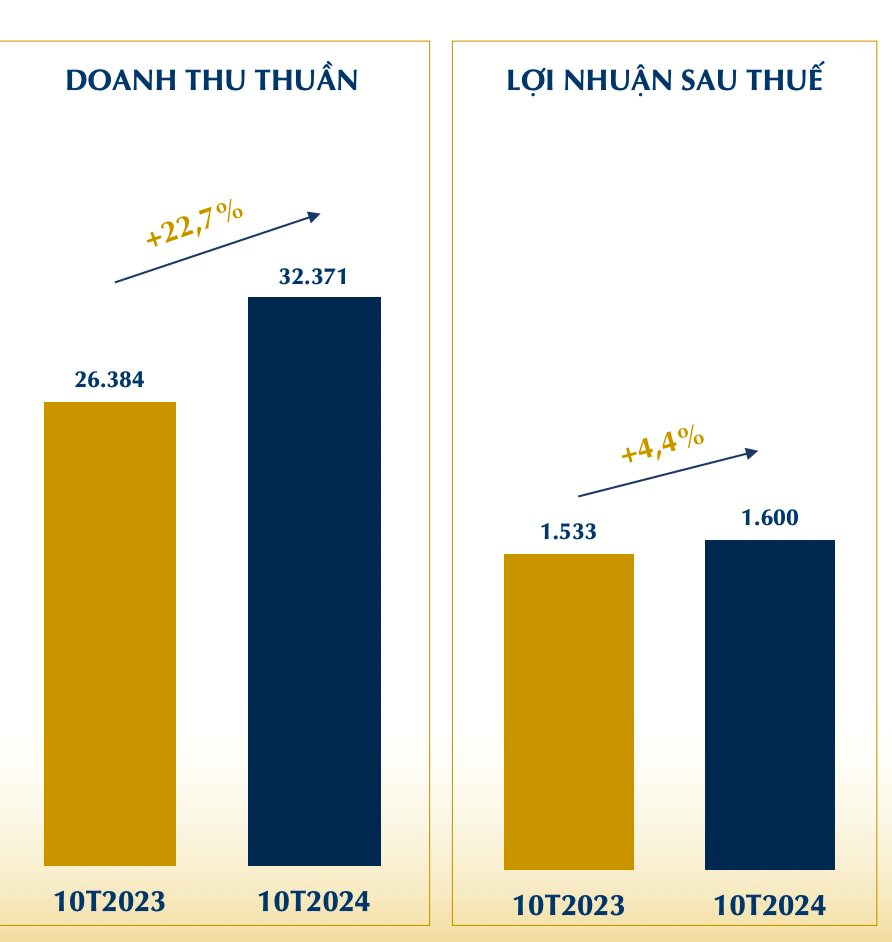

**PNJ Reports Strong Financial Results for the First Ten Months of 2024, with a 23% Increase in Revenue**

Phu Nhuan Jewelry Joint Stock Company (PNJ) has released its financial report for the first ten months of 2024, revealing impressive growth. The company achieved a cumulative revenue of VND 32,371 billion, representing a 23% increase compared to the same period last year. PNJ also reported a 4% rise in after-tax profit, reaching VND 1,600 billion for the ten-month period.

This translates to an average daily profit of nearly VND 5.3 billion for the “giant” in the jewelry industry during this period. With these results, PNJ has accomplished 87% of its revenue plan and nearly 77% of its profit plan for the full year 2024.

Focusing on October alone, PNJ posted a revenue of VND 3,129 billion and an after-tax profit of VND 218 billion for the month.

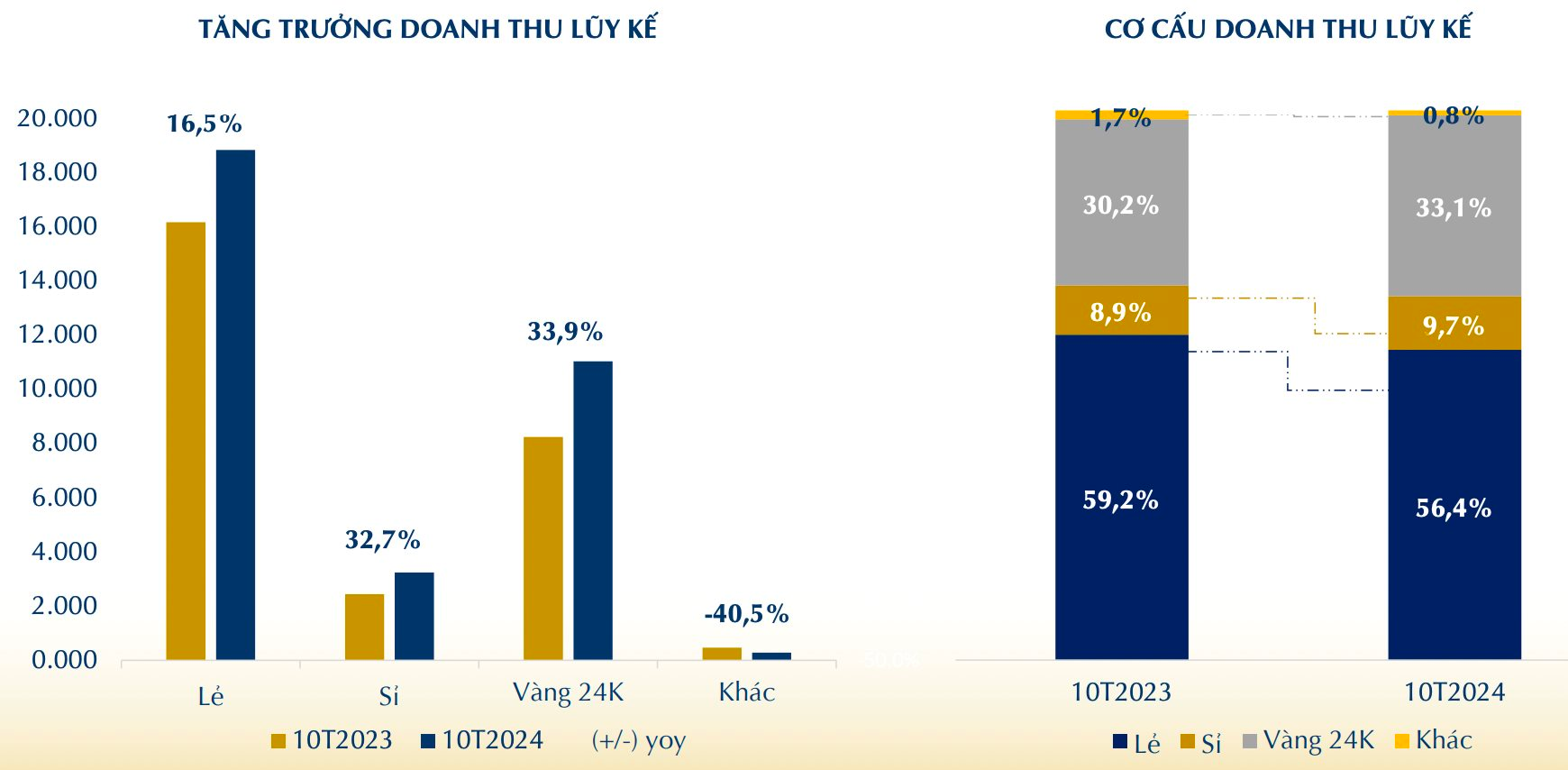

Analyzing the performance of different business channels, PNJ’s retail jewelry revenue increased by 16.5% year-on-year over the ten months. This growth can be attributed to the company’s strategic initiatives, including expanding its store network, enhancing its customer service, introducing new products and collections that align with market trends, and successfully executing marketing strategies and sales programs. PNJ also effectively targeted new customer groups and increased the return rate of existing customers.

The wholesale jewelry revenue witnessed a significant jump of 33% in the first ten months of 2024 compared to the same period in 2023. This remarkable growth is a result of wholesale customers shifting their demand towards reputable and well-organized manufacturers, demonstrating their preference for transparency and professionalism in the industry. Similarly, the 24K gold revenue increased by 34%, mainly due to the vibrant market conditions in the first half of the year.

Despite market fluctuations, PNJ maintained a healthy gross profit margin of 16.9% for the ten-month period, although it was slightly lower than the 18.5% achieved in the previous year. This stability in profit margin can be attributed to factors such as consistent profit margins from retail and wholesale channels, effective resource optimization strategies, and enhanced operational efficiency in production. These measures helped mitigate the impact of increased revenue proportion from 24K gold sales, rising material costs, and inventory management for the next phase.

In terms of system development, PNJ opened 32 new stores and closed 11 stores during the ten-month period, resulting in a total of 421 stores in its network. Specifically, PNJ now operates 412 PNJ stores, 5 Style by PNJ outlets, 3 CAO Fine Jewellery locations, and 1 wholesale business center.

A New Era for REE: Mrs. Nguyễn Thị Mai Thanh Steps Down as Chairwoman to Take on the Role of CEO

Effective November 22nd, Mrs. Nguyen Thi Mai Thanh stepped down from her role as Chairwoman of the Board of Management. Mr. Alain Xavier Cany, the former Vice Chairman, has been appointed as the new Chairman.

Investing in Funds: Buyers Still “Cautious”

Last week (04-08/11/2024), cautious investors increased their equity holdings as the VN-Index experienced volatility, fluctuating between downward pressure pushing it towards the 1,240-point range and a strong recovery during the US election session, followed by further adjustment pressures.