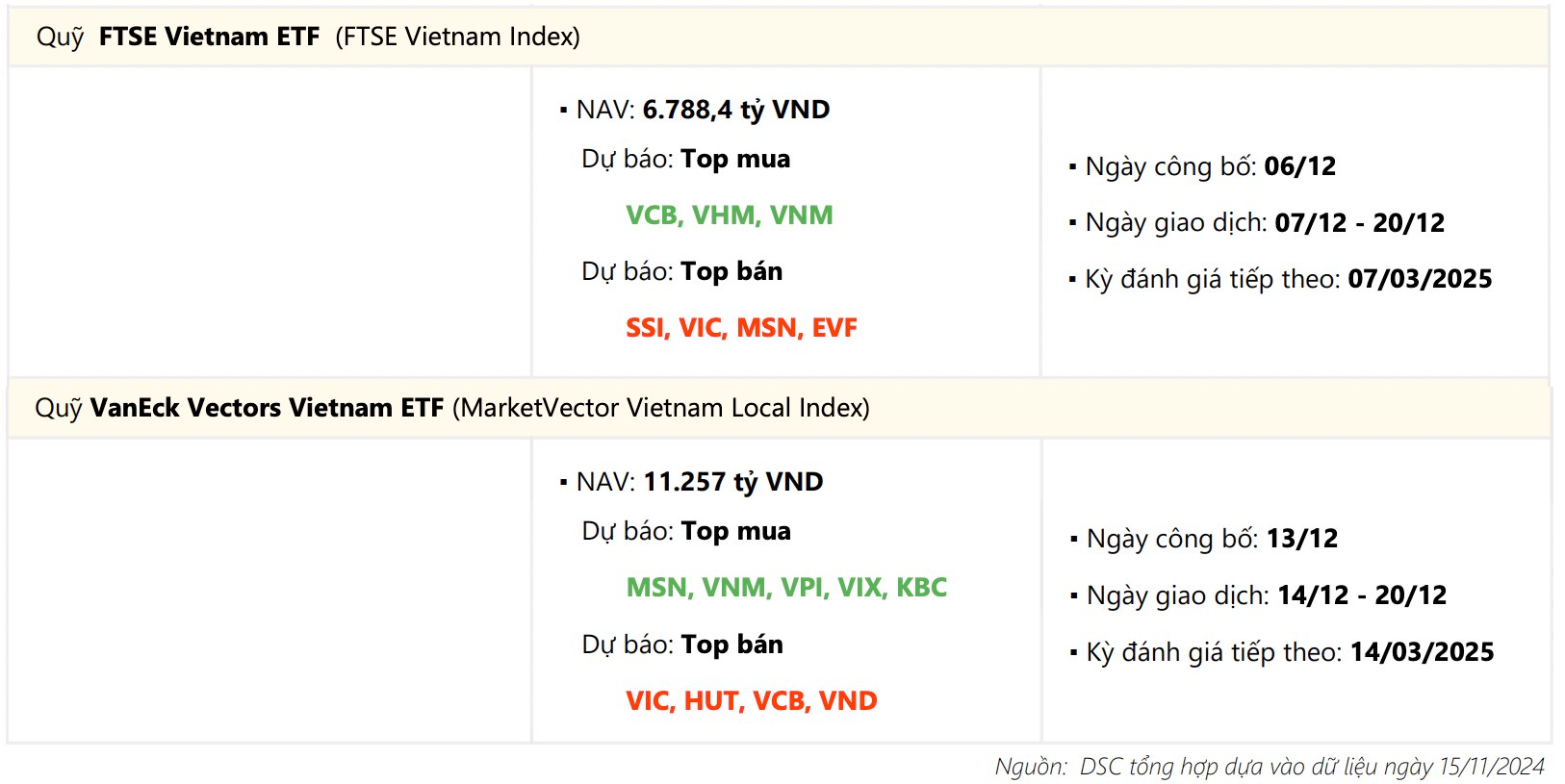

On December 6, FTSE Russell is expected to announce the constituent stocks of the FTSE Vietnam All-share and FTSE Vietnam Index (FTSE ETF reference). On December 13, MarketVector will also announce the MarketVector Vietnam Local Index (VanEck Vectors Vietnam ETF – VNM ETF reference).

December 20 is expected to be the day for the completion of the restructuring of the portfolios of the reference ETFs according to these indexes, and the new portfolios will take effect from December 23, 2024.

In its latest report, DSC Securities has made predictions about the constituent stocks and the number of stocks to be bought/sold for the reference ETFs according to the indexes.

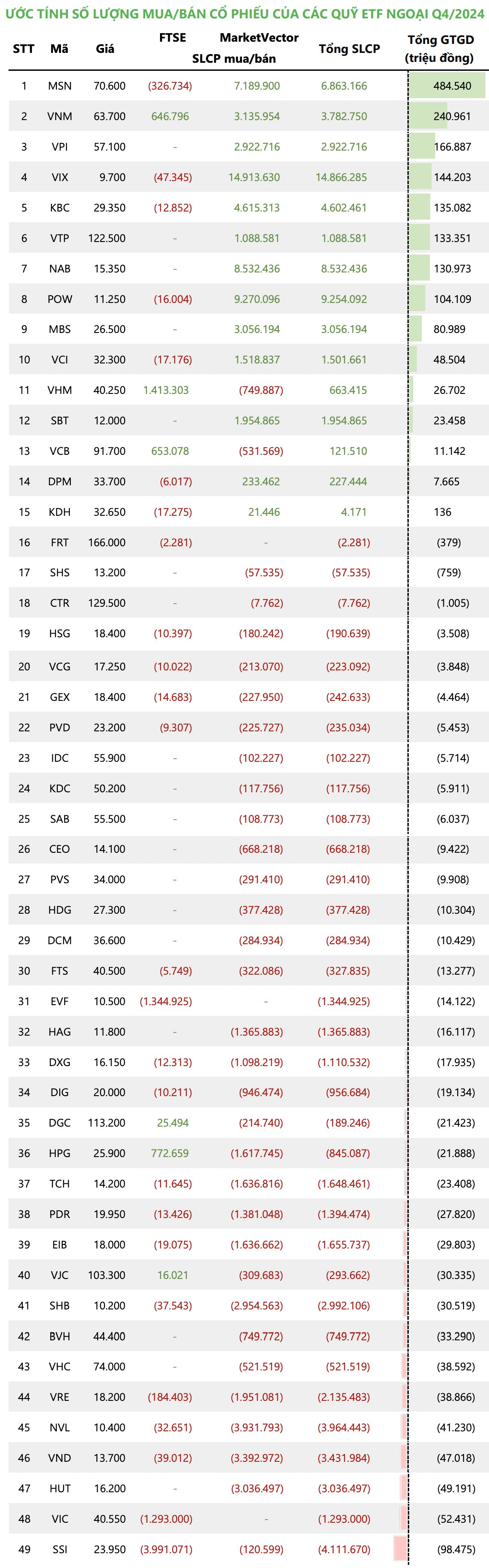

For the MarketVector Vietnam Local (VNM ETF reference) index, DSC predicts that the index will add three new stocks: Viettel Post (VTP), NamA Bank (NAB), and MB Securities (MBS). According to DSC, thanks to the significant increase in free-float market capitalization and liquidity, the number of stocks meeting the screening criteria has increased considerably. However, according to the rule of selecting the top 85% of capitalization, these three stocks are likely to be included in the portfolio.

Conversely, no stocks are expected to be removed from the index during this quarter’s review.

The new index portfolio will focus on the real estate sector (~29%), food and beverage (~15%), and securities (~12%). The five stocks with the highest expected weights are VHM (8%), VNM (8%), VIC (7%), HPG (6.5%), and VCB (6%), accounting for a total of 35.5% of the total portfolio weight.

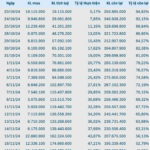

With these changes, DSC estimates that the VNM ETF will buy a significant additional amount of VIX (14.9 million shares), MSN (7.2 million shares), NAB (8.5 million shares), and VNM (3.1 million shares). The ETF will also sell VIC (2.5 million shares), HUT (3 million shares), VND (3.4 million shares), and NVL (3.9 million shares) to restructure its portfolio.

Currently, VNM ETF is the second-largest foreign fund in the Vietnamese market, with total assets under management of more than VND 11,257 billion and 38.2 million shares outstanding. Since the beginning of the year, the fund’s total assets have decreased by more than 8%, and it has experienced net outflows of more than VND 788 billion.

Regarding the FTSE Vietnam Index (FTSE ETF reference) , DSC projects that no new stocks will be added to the index, while EVF may be removed due to failing to maintain the required market capitalization. The new index portfolio will focus on the real estate sector (~30%), securities (~14%), and banking (~13%). The five stocks with the highest weights are expected to be HPG (13.2%), VHM (10.0%), VCB (9.2%), VNM (8.7%), and VIC (7.6%).

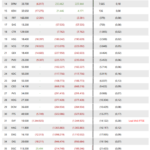

With these changes, DSC estimates that the FTSE ETF will buy VHM (1.4 million shares), HPG (772,000 shares), and VCB (653,000 shares). The ETF will also sell SSI (3.9 million shares), EVF (1.3 million shares), and VIC (1.3 million shares) during the restructuring.

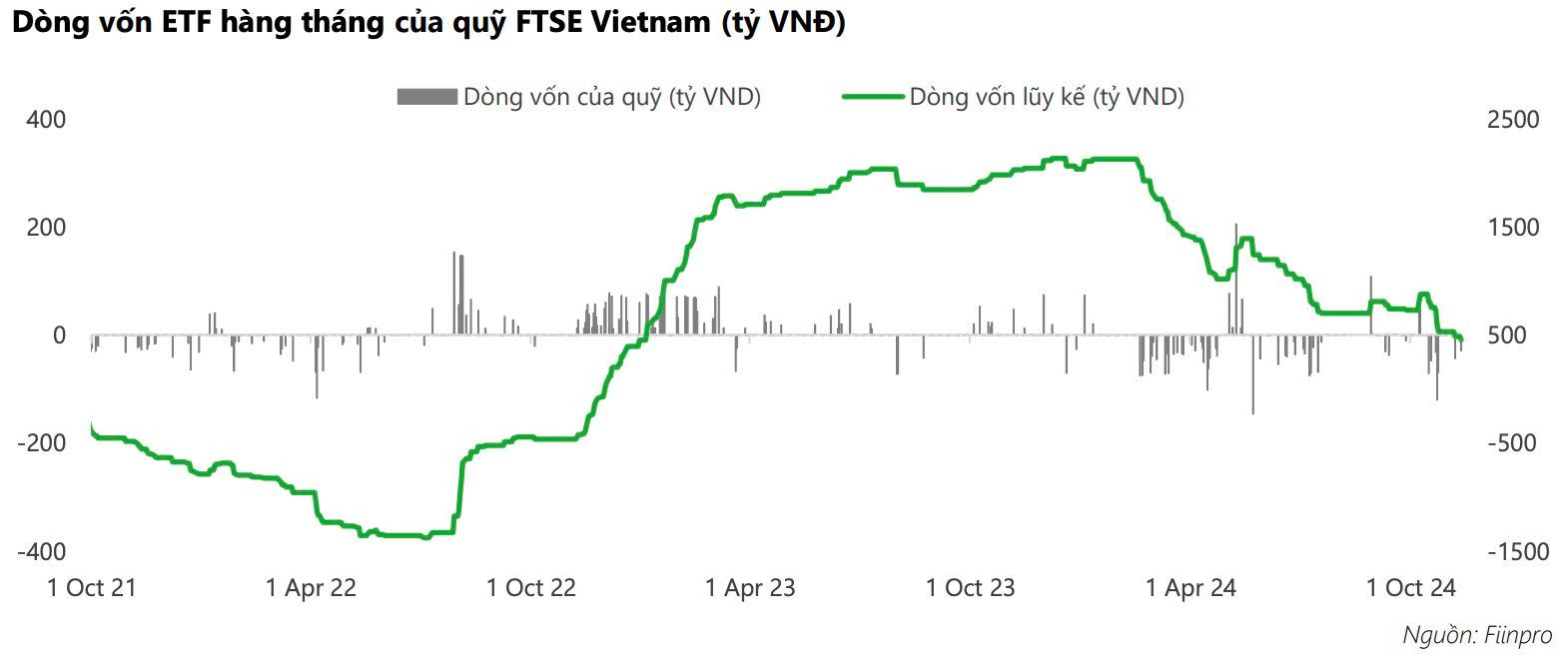

Currently, the FTSE ETF is the third-largest foreign fund in the Vietnamese market, with total assets under management of more than VND 6,788 billion and over 10.6 million fund certificates. Specifically, the fund’s total asset value has decreased by -21%, and net outflows have reached -VND 1,582.6 billion compared to the beginning of the year.

What Stocks are Propping Up the Stock Market?

Yesterday’s trading session (November 20) saw a boost in investor confidence with bottom-fishing funds pushing the VN-Index up by 11 points, leading to a market recovery with improved liquidity. However, many securities firms remain cautious about the market’s outlook for short-term investors and advise a prudent approach to trading.

The Final Countdown: Vinhomes Makes History with Over 211 Million Treasury Shares Sold

Vinhomes is set to purchase an enormous amount of treasury stock, making it the largest such deal in the history of the Vietnamese stock market. While they may not be able to purchase all the registered shares, this move underscores their commitment to making a significant impact.

Market Beat: Real Estate and Finance Sectors Lead the Recovery, VN-Index Surges Over 11 Points

The market closed with strong gains, as the VN-Index rose by 11.39 points (0.95%) to reach 1,216.54, while the HNX-Index climbed 1.61 points (0.73%) to 221.29. The market breadth tilted heavily in favor of bulls, with 471 advancing stocks against 247 declining ones. The large-cap stocks in the VN30 basket painted a similar picture, with 24 gainers, 2 losers, and 4 stocks closing flat.

The Market Beat: Foreigners End Selling Streak

The market closed with slight losses, as the VN-Index dipped by 0.23 points (-0.02%) to finish at 1,228.10, while the HNX-Index shed 0.47 points (-0.21%), closing at 221.29. The market breadth tilted towards decliners, with 371 tickers in the red versus 341 in the green. Meanwhile, the large-cap VN30 index displayed a more balanced performance, with 11 tickers losing ground against 13 advancing stocks and 6 remaining unchanged.