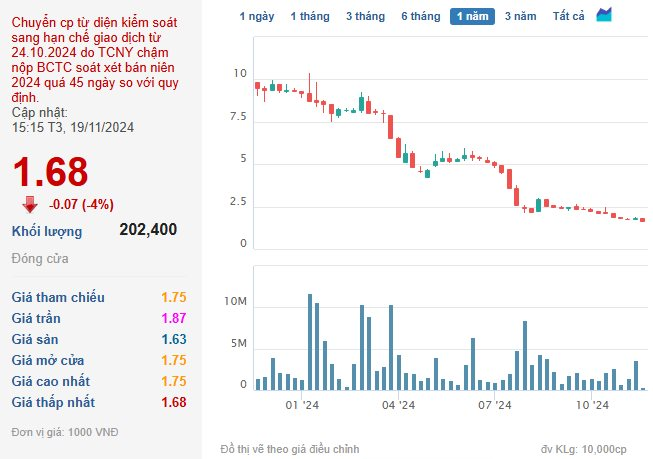

On October 17, 2024, the Ho Chi Minh City Stock Exchange (HoSE) issued Decision No. 588/QD-SGDHCM to transfer RDP shares of Rang Dong Holding Joint Stock Company from control to restricted trading from October 24, 2024 (only allowed to trade in the afternoon session on the same day) due to the listing organization being late in submitting the 2024 semi-annual reviewed financial statements (separate and consolidated) more than 45 days later than the prescribed time limit.

After being put under restricted trading, Rang Dong Holding continued to violate information disclosure regulations. HoSE had to issue Official Letter No. 1720/SGDHCM-NY on November 1, 2024, for the first reminder and Official Letter No. 1739/SGDHCM-NY on November 6, 2024, for the second reminder regarding the company’s delay in announcing the Q3/2024 financial statements (separate and consolidated). As of now, HoSE has not received the 2024 semi-annual reviewed financial statements and Q3/2024 financial statements of Rang Dong Holding.

According to Point c, Clause 1, Article 41 of the Listing and Trading Regulations of the Vietnam Stock Exchange: “1. Securities shall be suspended from trading if one of the following cases occurs: c) The listing organization continues to violate the information disclosure regulations on the securities market after being put under restricted trading.”

Accordingly, RDP shares of Rang Dong Holding have fallen into the case of securities being suspended from trading. HoSE will consider transferring RDP shares from restricted trading to suspension from trading as prescribed.

In terms of business results, according to the consolidated financial statements for Q2/2024, Rang Dong Holding recorded net revenue of VND 246.5 billion, down 68.24% over the same period last year. As a result, the company reported a post-tax loss of VND 65.6 billion, while in Q2/2023, it made a profit of VND 10.4 billion.

For the first six months of the year, Rang Dong Holding reported a loss of VND 64.5 billion, while in the same period last year, the company reported a profit of over VND 11 billion.

As of June 30, 2024, Rang Dong Holding’s total assets were VND 1,996 billion, down 6.92% from the beginning of the year. Short-term assets were VND 1,350 billion, down 8.5%. Of which, the majority of short-term assets were Accounts Receivable at VND 477.8 billion and Inventories at VND 781.4 billion.

On the other side of the balance sheet, as of the end of June 2024, Rang Dong Holding’s payables were VND 1,716 billion, down 4.66% from the beginning of the year. Short-term debt was VND 1,515 billion, down 5.12%. Loans and financial leases (both short-term and long-term) were VND 1,232 billion.

RDP share price has evaporated nearly 82% since the beginning of the year. (Source: Cafef)

In the stock market, at the end of the November 19 session, the RDP share price was at VND 1,680 per share, down 4% compared to the previous session, with a matched volume of VND 202.4 billion.

RDP shares welcomed the New Year 2024 at a price of VND 9,300 per share, meaning that since the beginning of the year, the share price has evaporated nearly 82%.

The Mastermind Behind Mercedes-Benz in Vietnam Unveils His New “Game”: Taking the MG Car-Selling Subsidiary Public

PTM is the proud distributor of MG motors, partnering with Haxaco to bring these vehicles to customers across Vietnam. With a nationwide network of 7 dealerships, PTM is committed to delivering an exceptional automotive experience to all MG enthusiasts in the country.

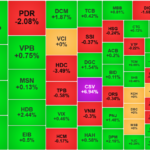

The Surprising Surge of Penny Stocks: A Market Phenomenon

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.