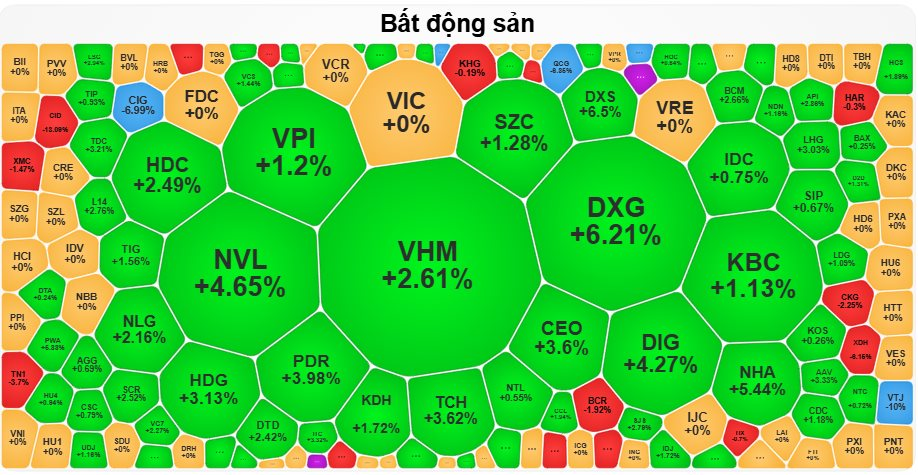

The stock market witnessed an impressive performance from the “LandX” family of stocks, with both DXG and DXS surging over 6% on today’s trading session. Specifically, DXS, the stock of LandX Services Joint Stock Company, ended the session on November 20th, at 7,050 VND per share, a 6.5% increase, with a trading volume of nearly 6.5 million units – an almost eightfold rise compared to the previous session.

Similarly, DXG, the stock of LandX Group Joint Stock Company, closed the day 6.21% higher at 17,100 VND, with a trading volume surpassing 48.8 million units, a fivefold increase from the previous session.

LandX has been making headlines with leaks about their upcoming project, Gem Riverside, located in the prime location of Thu Duc City. According to reliable sources, this project is set to be relaunched in early 2025, promising a substantial revenue stream of approximately 18 trillion VND.

As a result of this development, the stock prices of LandX’s DXG and DXS have been on a steady upward trajectory, despite the overall stock market undergoing significant corrections.

Real Estate Stocks Soar During the November 20 Trading Session

Following the lead of the LandX family of stocks was NVL, the stock of Novaland Investment Group Joint Stock Company.

NVL concluded the November 20 session at 11,250 VND per share, reflecting a robust 4.65% increase from the previous session, with a trading volume of nearly 20.3 million units.

NVL’s surge came on the heels of Dong Nai province’s adjustment to the master plan for Bien Hoa city up to 2030, with a vision towards 2050.

This move is expected to clear legal hurdles for Novaland’s Aqua City project and numerous other real estate ventures within the C4 subdivision, spanning approximately 1,500 hectares.

Other real estate stocks that experienced a remarkable performance during today’s session include DIG (+4.27%), PDR (+3.98%), CEO (+3.6%), TCH (+3.62%), HDG (+3.13%), BCM (+2.66%), VHM (+2.61%), and NLG (+2.18%), to name a few.

On the opposite end of the spectrum, QCG, the stock of Quoc Cuong Gia Lai Joint Stock Company, suffered its second consecutive session of decline after the SSC’s decision to suspend the auditors who signed off on the company’s 2023 financial statements.

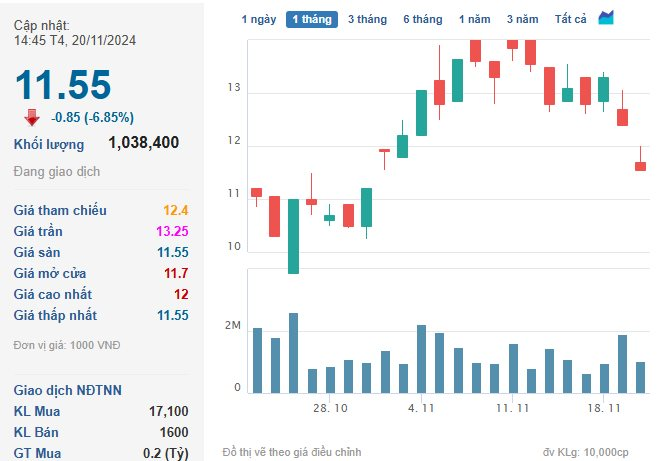

QCG Stock Plummets for the Second Straight Session (Source: Cafef)

At the close of the November 20 session, QCG’s stock price stood at 11,550 VND per share, a 6.85% drop from the previous session, with a trading volume of over 1 million units, nearly halving from the preceding session.

Market Successfully Breaks Losing Streak

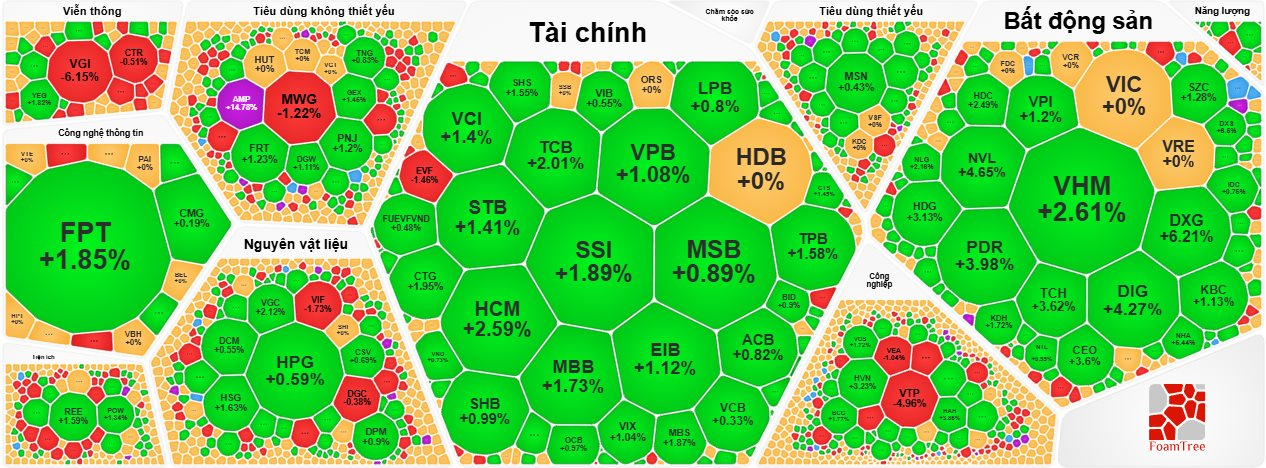

A wave of bottom-fishing propelled the main index, VN-Index, to gain nearly 12 points during today’s session.

The November 20 session concluded with the VN-Index climbing 11.39 points to reach 1,216.54. The HNX-Index rose 1.6 points to 221.29, while the UPCoM-Index gained 0.79 points to end at 91.09.

Market liquidity witnessed a significant improvement, with the total trading value across all three exchanges surpassing 19.6 trillion VND. The HoSE exchange alone accounted for nearly 17.8 trillion VND of this figure.

Today witnessed a substantial influx of bottom-fishing funds across various industry groups.

Bottom-fishing Emerges, VN-Index Breaks Losing Streak

The real estate sector took the lead, followed by strong performances from banking, securities, steel, fertilizer, information technology, and agriculture sectors, among others.

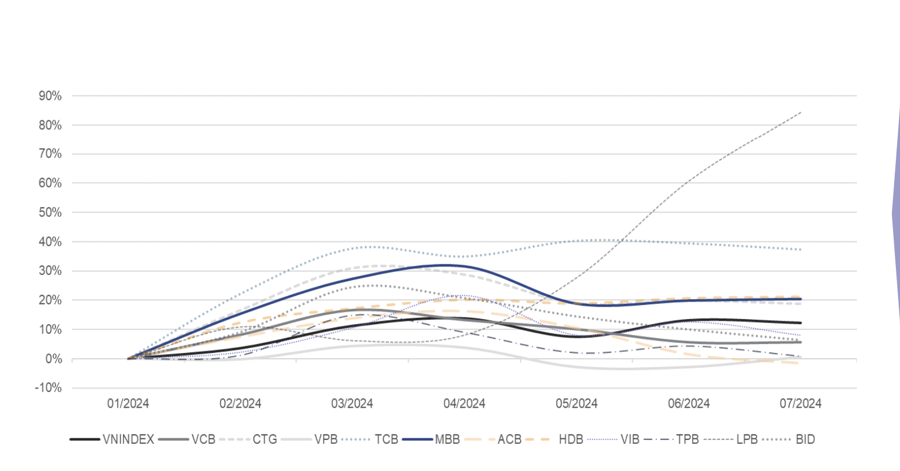

Banking stocks rebounded with notable gains: TCB (+2.01%), CTG (+1.95%), MBB (+1.73%), TPB (+1.58%), STB (+1.41%), ABB (+1.35%), EIB (+1.12%), VPB (+1.08%), SHB (+0.99%), BID (+0.9%), and OCB (+0.97%), to name a few.

Similarly, securities stocks also witnessed a strong rally: DSE (+6.41%), HCM (+2.59%), FTS (+2.1%), BVS (+2.17%), BSI (+2.53%), VCI (+1.4%), SSI (+1.89%), VIX (+1.04%), MBS (+1.87%), and CTS (+1.45%), among others.

Steel stocks joined the rally with HPG (+0.59%), HSG (+1.63%), NKG (+1.08%), and VGS (+1.95%).

Agriculture stocks also surged, led by BAF (+4.26%), HAG (+2.19%), DBC (+1.16%), HNG (+4.08%), and NAF (+2.67%).

Additionally, a host of blue-chip stocks across various sectors witnessed robust gains, including HAH (+3.86%), HVN (+3.23%), FPT (+1.85%), BSR (+2.11%), FRT (+1.23%), PNJ (+1.2%), GVR (+1.32%), and POW (+1.34%), to name a few.

Foreign investors continued their net-selling trend, offloading nearly 1.3 trillion VND worth of stocks. VHM topped the selling list, with foreign investors dumping nearly 339 billion VND worth of the stock. This was followed by FPT (289.64 billion VND), MSB (176.04 billion VND), HPG (157.27 billion VND), and SSI (100.71 billion VND), among others.

On the buying side, foreign investors cautiously picked up stocks like CTG (50.02 billion VND), DIG (48.08 billion VND), MWG (39.11 billion VND), and HAH (24.12 billion VND).

The Stock Market Under Pressure from Foreign Investors’ Net Selling

The stock market is under intense pressure as foreign investors continue their selling spree, with no end in sight. Adding to the woes, proprietary trading desks are also offloading stocks, further dampening market sentiment. As the selling momentum builds, investors are left wondering when this tide will turn.

The Optimistic Outlook: Can We Expect a Positive Shift?

The VN-Index surged amidst a recent spate of losses, indicating a strong rebound. Accompanying this rise was a surge in trading volume, surpassing the 20-day average, signifying a return of liquidity to the market. The Stochastic Oscillator, a key technical indicator, has now entered oversold territory and is signaling a buy. Should this indicator continue to climb, we can expect a further positive shift in market sentiment.

The Market Beat: A Resilient Market Bounces Back, Easing Traders’ Concerns.

The market is finally showing signs of recovery, with a rebound of over 20 points in the last two sessions, offering a glimmer of hope after a challenging period of consistent losses. However, this recovery is not without its concerns, as trading volume has noticeably dropped, indicating a potential lack of conviction in the market’s upward trajectory.