Image source: T.L |

External Challenges

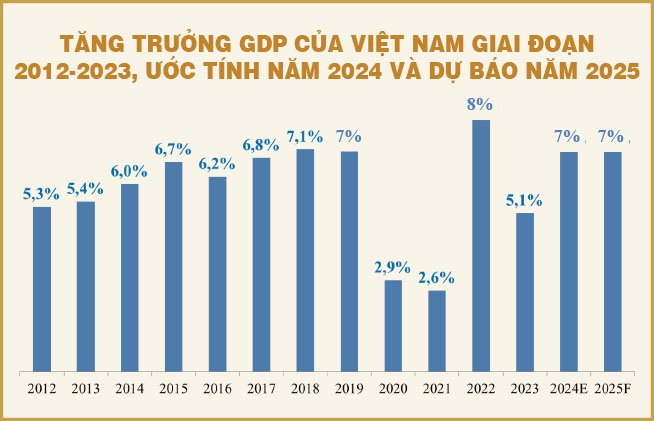

Vietnam’s economic growth (GDP) for 2024 is projected to reach 7% if the fourth-quarter GDP increases by approximately 7.5%. However, this target is not easily achievable, given the recent economic activities have been adversely affected by the damage caused by Typhoon Yagi in September. Meanwhile, the National Assembly has approved a GDP growth target of 6.5-7% for 2025, with an aspiration of 7-7.5%, despite the global economic uncertainties that lie ahead.

In its latest report, the International Monetary Fund (IMF) has lowered its global economic growth forecast for 2025 by 0.1% to 3.2%, as the world faces challenges that could hinder progress, including heightened geopolitical instability, particularly conflicts in the Middle East, and protectionist policies favoring domestic industries and workers. In light of this, the IMF also believes that exports – the main driver of Vietnam’s economy – may weaken if global growth falls short of expectations.

With Donald Trump’s reelection as US President, the risk of an escalating trade war poses the most significant threat to the global economy in 2025. Vietnam’s open economy, heavily reliant on exports and foreign direct investment (FDI), is vulnerable to fluctuations in the larger economies and emerging markets. For instance, the US – Vietnam’s largest trade surplus partner in recent years – may experience slower economic growth, reducing the demand for Vietnamese exports.

According to Morgan Stanley’s recently published 2025 Economic Outlook and Strategy report, the US government has limited fiscal policy room to stimulate economic growth, while the prolonged tight monetary policy has started to have a noticeable impact. Additionally, inflation in the US is expected to surge in 2025 due to the impact of tariff barriers and immigration restrictions, which will put pressure on the supply chain and the labor market. As a result, the Federal Reserve may need to pause its interest rate cut cycle.

China may also witness less efficient economic growth as global demand decreases and trade is disrupted by geopolitical tensions. Notably, China’s manufacturing activities are currently in surplus following previous stimulus phases. If the US significantly increases import tariffs in 2025, China’s excess goods could flood into other countries. Being Vietnam’s neighboring country, the trade deficit with China may worsen, negatively affecting Vietnam’s economic growth.

|

The total debt in the economy has already exceeded the GDP, estimated to surpass the 140% mark this year. Therefore, the goal of further boosting credit growth will be constrained, especially with the continuous rise in bad debts and restructured loans. Additionally, the prolonged weaknesses in the real estate and corporate bond markets negatively affect the banks’ capacity for credit expansion. |

Despite these challenges, international organizations remain optimistic about Vietnam’s economic prospects. HSBC forecasts Vietnam’s GDP to increase by 6.5% in 2025, maintaining the highest growth rate in Southeast Asia. Besides the main driving force from FDI enterprises, the remaining growth momentum will shift from exports to the domestic economy, as consumer confidence recovers and inflation remains controlled at a low level.

Similarly, the World Bank predicts Vietnam’s GDP growth to reach 6.1% in 2024 and increase to 6.5% in 2025, higher than its previous forecasts of 5.5% and 6%, respectively, in April 2024. In its latest economic update on Vietnam, Standard Chartered Bank revised its 2024 GDP growth forecast upward from 6% to 6.8% and projected a 6.7% growth for 2025 (expected to be 7.5% in the first half and 6.1% in the second half, compared to the same period last year).

Internal Difficulties

While the policies of President Donald Trump in the coming years remain unpredictable, a look back at the past four years of his first term shows that Vietnam has benefited, as evidenced by the higher GDP growth rate during 2017-2019 compared to previous years, before weakening in 2020-2021 due to the impact of the Covid-19 pandemic. However, history does not always repeat itself in the same way, especially when Vietnam’s internal economy faces significant challenges.

Firstly, Vietnam’s monetary policy space is currently limited. With the US dollar likely to maintain its strength as the Fed postpones interest rate cuts and Trump’s policy of attracting investment back to the US, the USD/VND exchange rate may face constant pressure. Consequently, interest rates have limited room to decrease and may even face upward pressure in 2025, continuing the rising trend since the beginning of the second quarter of this year.

Regarding credit growth, as mentioned earlier, the total debt in the economy has already exceeded the GDP, leaving limited room for further credit expansion. Bad debts and restructured loans continue to rise, compelling banks to exercise caution in lending. Moreover, the prolonged weaknesses in the real estate and corporate bond markets negatively affect the banks’ ability to expand credit.

On the fiscal policy front, the efficiency remains challenging to achieve due to delays in public investment projects caused by complex administrative procedures, risk aversion, and limited project supervision and management capabilities, resulting in poor capital utilization. This delay in capital disbursement can slow down economic development, particularly in infrastructure and technology sectors that require substantial investment to boost growth. Additionally, the prolonged delay affects investor confidence as projects are not implemented timely and efficiently.

Recognizing these challenges, along with setting the GDP growth target for 2025, the National Assembly has instructed the government to expedite the disbursement of public investment projects from the beginning of the year. They have also emphasized increasing decentralization and empowerment, coupled with enhanced accountability for leaders, to avoid scattered and fragmented investments. Furthermore, there is a need to continue administrative reforms, simplify approval processes and investment capital disbursement procedures, and enhance project supervision and management capabilities through technology application.

Another significant challenge is the demographic pressure and labor force dynamics, as Vietnam is transitioning from a “golden population” structure to an aging one. This shift not only leads to a decline in the workforce of working age but also results in decreased labor productivity, increased pressure on the social security budget, and a direct impact on economic growth. Notably, some major economic hubs are experiencing a declining birth rate and a reverse migration of labor, resulting in a labor shortage.

Lastly, challenges related to technological competition and innovation, energy shortages impacting FDI attraction, and environmental risks and climate change are issues that Vietnam needs to address to sustain high economic growth. Vietnam is highly vulnerable to climate change, with impacts ranging from rising sea levels to extreme weather events, as evidenced by the frequent and severe storms in recent times.

Tuệ Nhiên

The Ultimate Guide to Vietnam’s Mega Project: Unveiling the $67.3 Billion, 1541-km Vision by the Country’s Construction Powerhouses

A host of prominent construction groups in Vietnam have put forward a proposal to ensure the success of the mammoth $67.3 billion super-project.

The Power to Persevere: DBC’s Journey to the Top

The livestock industry in Vietnam continues to face challenges due to the ongoing epidemic situation. Despite these difficulties in 2022-2023, Dabaco Vietnam Joint Stock Company (HOSE: DBC) has emerged stronger than ever, embarking on a journey of expansion to meet the domestic market’s consumption demands.

“Bank Deposits Continue to Flow In: Unraveling the Mystery Behind the Dip in CASA for Q3”

In Q3, most banks witnessed a decline in their CASA ratios. CASA accounts seem to be mere “pit stops” for funds before they are directed towards more “serious” business operations.

Introducing the “Vietnam Pavilion – National Pavilion of Vietnam” on the Alibaba E-Commerce Platform

To support international businesses, especially European enterprises, in seeking product information, business partners, and market expansion in Vietnam, the Trade Promotion Agency – Ministry of Industry and Trade of Vietnam is pleased to introduce the “Vietnam National Pavilion – Vietnam Pavilion” on the Alibaba.com e-commerce platform.