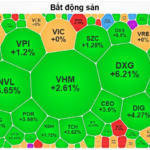

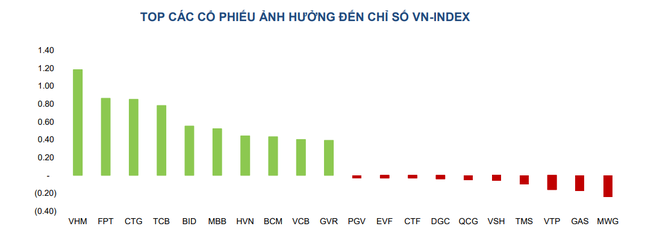

The 10 stocks that contributed to the VN-Index’s gain in yesterday’s trading session included VHM, FPT, CTG, TCB, BID, MBB, HVN, BCM, VCB, and GVR. BIDV Securities Company (BSC) pointed out that the catalyst for this green-filled session was the “real estate sector stocks leading the gains” among the stocks of 14 out of 18 sectors that ended in the green. Stocks in the tourism and entertainment, and information technology sectors also performed well.

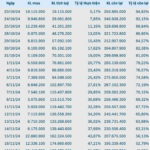

Buyers prevailed in the 10 stocks with the most significant impact on the stock market on November 20

In the stock market, real estate stocks, after a deep retreat, seemed to have found their bottom and attracted bottom-fishing funds, with liquidity increasing significantly: More than 14.5 million PDR shares were matched yesterday; about 28 million VHM shares were matched. Regarding Novaland, after the obstacle was removed for the Aqua City project, more than 20 million NVL shares were matched, a substantial increase compared to the previous session.

The upward momentum of these stocks continues to bring hope to investors for today’s trading session (January 21) as this group benefits from the new Land Law, which took effect on August 1, and the actual increase in real estate prices.

In addition, in terms of business efficiency, in the real estate sector, the stocks of industrial real estate enterprises had high profits in the first nine months of 2024. Notable names include IDC, BCM, and SZB, which benefited from land and infrastructure leasing…

Many stocks in the real estate, tourism, and information technology sectors have been bottom-fished.

In the top 10 stocks selected by the analysis team of Techcom Securities Company (TCBS) for November, the company also newly added KBC stock. KBC was included in TCBS’s recommended portfolio due to its growth momentum, as KBC’s third-quarter business results recorded revenue of 950 billion VND and after-tax profit of 196 billion VND.

Despite these positive market signals, some securities companies remain pessimistic about the market. BSC believes that, in the short term, the VN-Index may continue its upward momentum towards the 1,220 threshold. However, investors should be cautious, as profit-taking pressure at this level emerged in the same session, with all futures contracts increasing following the strong movement of VN30 (November 20).

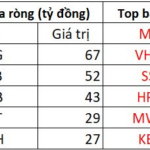

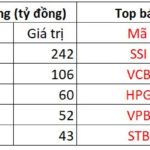

In yesterday’s trading session, foreign investors continued to net sell strongly, up to 1,198 billion VND on the HoSE. VHM stock increased by 3.43% but was still net sold by foreign investors, with a value of up to 337.94 billion VND. The proprietary trading team also continued to net sell, with a value of about 305 billion VND, of which HCM stock was sold for 53.58 billion VND.

In an updated investment strategy report based on momentum factors released on November 20, FPT Securities Company assessed that the market had gone through about six months of fluctuating consolidation, and the efforts of buyers could not help the VN-Index surpass the psychological resistance level of 1,300 points.

“We believe that the market’s Bull Cycle is gradually entering its late stage (Late Bull) and is not favorable for short-term investment strategies,” said the analysis team of FPT Securities Company.

The VN-Index Soars by Nearly 12 Points, Real Estate Stocks in Full Bloom

The stock market successfully breaks its losing streak, with the VN-Index surging by nearly 12 points today. Real estate stocks took center stage, with notable gainers including DXG, NVL, DIG, PDR, BCM, and VHM, among others.

The 9-Million Account Market: Why is the VN-Index Stuck Around the 1,200 Point Mark?

The domestic and global macroeconomic factors present a positive picture, boding well for the stock market’s upward trend. However, with 9 million accounts, the VN-Index continues to hover around the 1,200-point mark.