The prospect of President Donald Trump’s second term imposing sweeping tariffs on imported goods has economists predicting a decline for the euro, with some suggesting it could reach parity with the US dollar by 2025. The reelection of Trump on November 5th, along with the Republican Party’s retention of control over both houses of Congress, has sparked concerns about protectionist trade policies. The proposed tariffs would significantly impact global trade and investment flows, potentially disrupting supply chains and affecting the profitability of companies with international operations.

Trump’s proposed tariffs of 60% on Chinese goods and 10% on goods from all other countries, along with his plans to reduce taxes and deport millions of illegal immigrant workers, are expected to increase inflationary pressures in the US. As a result, the Federal Reserve may be forced to slow down interest rate cuts and become more cautious in their monetary policy decisions. This outlook for higher interest rates over a more extended period is supporting the US dollar’s strength.

James Reilly, Chief Economist at Capital Economics, predicts that the euro will bear the brunt of Trump’s election victory, and expects it to reach parity with the US dollar by the end of 2025. He attributes this to the potential for the European Central Bank (ECB) to lower interest rates faster and further if US tariffs weaken Europe’s export sector, damaging the region’s economic growth.

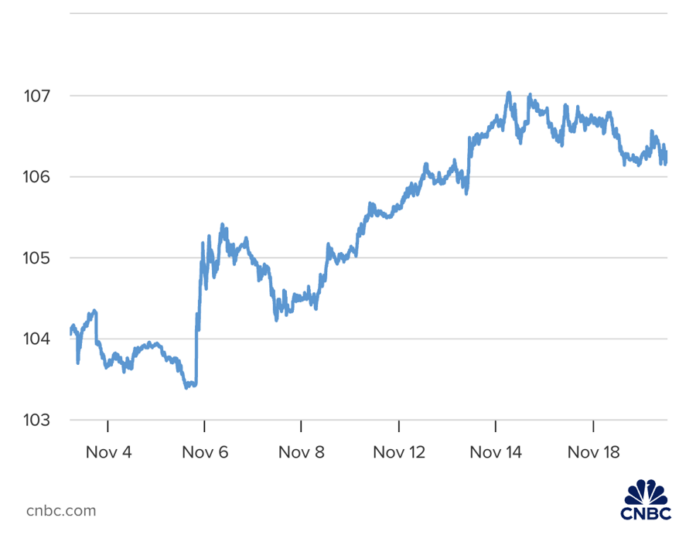

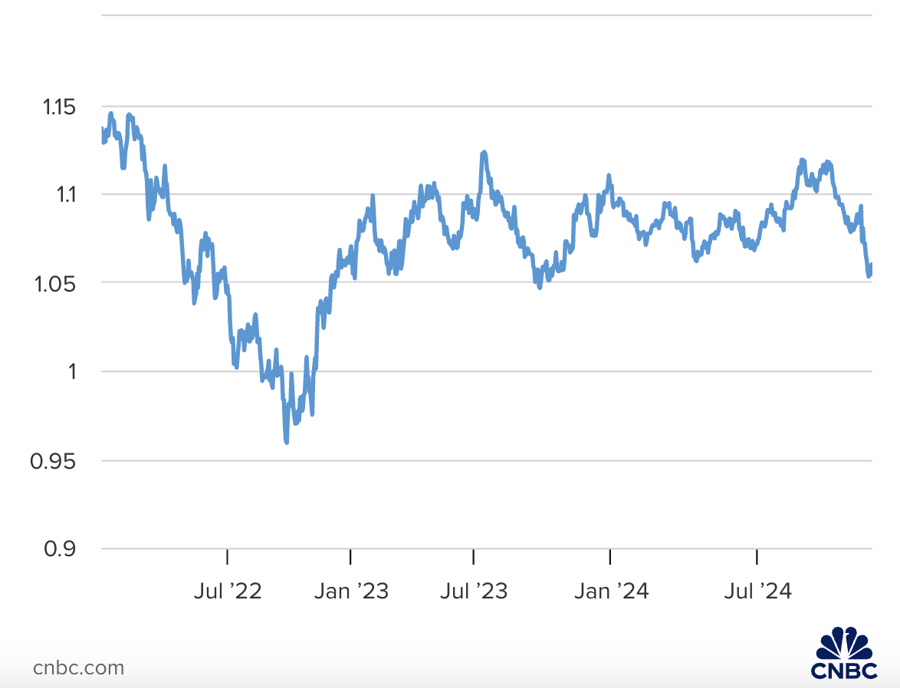

The euro’s decline was already evident in the days following Trump’s reelection. On November 14th, the euro fell below $1.05 per euro for the first time since October 2023. Just two months prior, the exchange rate was around $1.17 per euro. This significant shift underscores the market’s reaction to the potential impact of Trump’s policies on the European economy.

George Saravelos, Global Head of Foreign Exchange Research at Deutsche Bank, also weighs in on the high level of uncertainty surrounding Trump’s policies. He suggests that a full and rapid implementation of Trump’s agenda, without a countervailing policy response from Europe or China, could drive the euro-dollar exchange rate below parity to $0.95 per euro or even lower. On the other hand, a more balanced approach by Trump, with a 10% tariff applied universally over two years and a 30% tariff on Chinese goods, along with more moderate immigration and regulatory policies, could result in a $1 per euro exchange rate.

The potential for euro-dollar parity is also supported by Barclays’ economic model, which predicts parity if Trump imposes a 10% tariff on European goods and Europe retaliates. Additionally, Goldman Sachs has adjusted its forecast, initially predicting a weaker dollar in 2025, to now expecting a stronger dollar over a more extended period due to Trump’s tariff plans and fiscal reform agenda. They also highlight the vulnerability of the European Union to global trade uncertainties and the ECB’s continued lowering of interest rates, in contrast to the Fed’s potential shift in policy.

However, the euro’s future is not set in stone. Goldman Sachs acknowledges that the euro could strengthen if Trump’s trade policies turn out to be softer than expected or if the eurozone’s real interest rates remain higher than anticipated. Additionally, the euro has shown resilience in the past, trading above $1 for two decades before briefly dipping below parity in the fall of 2022 due to recession fears, the Russia-Ukraine war, and an energy crisis.

The recent rise in tensions between Russia and Ukraine has brought back one of the factors that weakened the euro in 2022. Jane Foley, Head of Forex Strategy at Rabobank, notes that the increased demand for safe-haven assets is benefiting the Japanese yen and the Swiss franc while supporting the US dollar. If these tensions persist, the euro could face further downward pressure and potentially fall below parity with the US dollar.

The Crypto Surge: Why Bitcoin’s Value Skyrocketed Post-Trump Election

Bitcoin Surges Towards $100,000: Why Trump’s Presidency Caused a Shock Spike.

A perfect storm of factors, including Trump’s unexpected victory, has sent Bitcoin surging towards the $100,000 mark, shocking investors and experts alike. But why has Trump’s presidency caused such a dramatic rise in this cryptocurrency’s value? In this introduction, we unravel the intriguing connection between Trump’s win and Bitcoin’s unprecedented surge.

Trump Term 2.0: Navigating Turbulent Waters, Vietnam Well-Positioned to Weather the Storm

The analysts’ assessment is that, as short-term volatility subsides, Vietnam has a solid foundation for its market to perform well, given its historical success in adapting to external conditions and the internal commitment to supporting and fostering growth.

Unraveling Trump’s Triumph, Elon Musk’s Billion-Dollar Turnaround, and the Silent Majority: Insights from Professor Ha Ton Vinh

“In a stunning victory, Donald Trump clinched the presidency in the 2024 US elections, winning in 4 out of 7 battleground states. This triumph propelled him to become the 47th President of the United States, marking an unprecedented milestone in the world’s largest economy after 132 years. From the US, Professor Ha Ton Vinh shared with us his insights on the ‘interesting yet simple’ reasons behind Donald Trump’s win.”