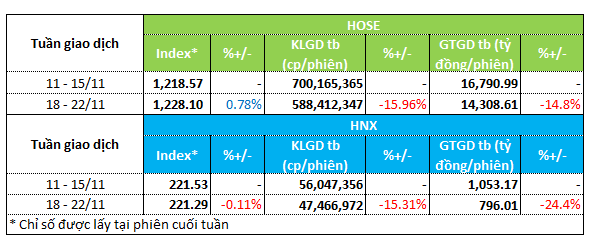

The market indices witnessed positive mid-week recovery during the trading week of November 18-22. As a result, the VN-Index climbed nearly 1% to reach 1,228 points. The HNX-Index, however, fell short towards the week’s end, recording a slight decline of 0.1% to 221.29 points.

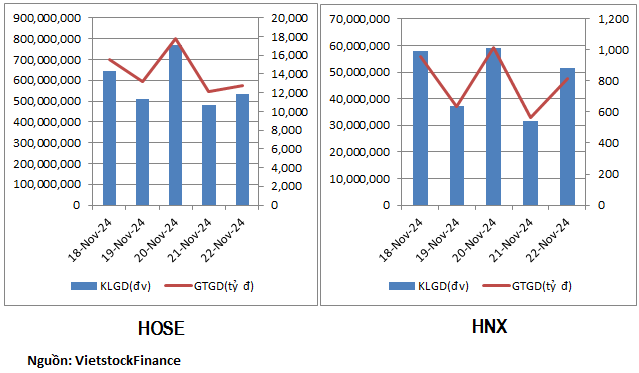

Liquidity dropped again after the previous week’s recovery. On the HOSE exchange, trading volume fell 16% to 588 million units per session, while trading value decreased by nearly 15% to VND14.3 trillion. On the HNX exchange, trading volume dropped by 15.3% to 47.4 million units per session, and trading value witnessed a significant decline of 24%, settling at nearly VND800 billion per session.

|

Market Liquidity Overview for Week of Nov 18-22

|

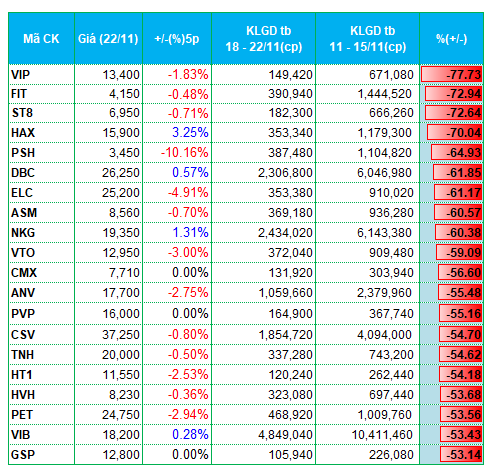

A clear trend of fund withdrawals was observed in several sectors, including transportation, seafood, and oil and gas.

Specifically, in the transportation sector, stocks such as VIP, VTO, PVP, GSP, and DXP experienced volume declines ranging from 50% to nearly 80% compared to the previous week. VIP witnessed the sharpest drop in liquidity, with trading volume falling nearly 80% to 150,000 units per session. This stock also experienced a slight price decline of nearly 2% during the week.

In the seafood sector, ASM witnessed a 60% decrease in average trading volume, while VMX and ANV saw similar declines.

The oil and gas sector, along with petroleum distributors, also experienced a week of low liquidity. Stocks like PSH, PVC, and PVS were among those that saw significant declines in trading activity compared to the previous week.

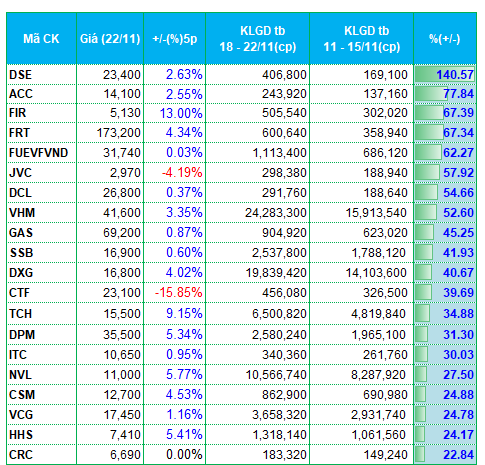

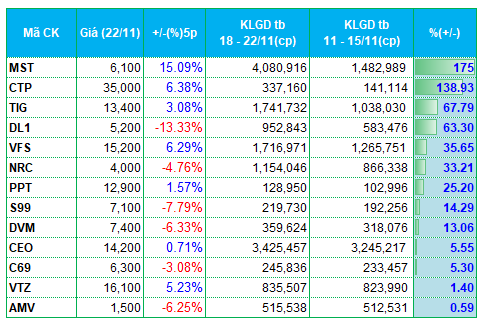

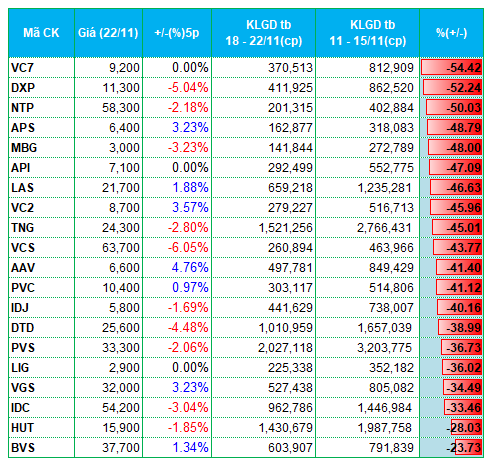

In the context of declining liquidity, the market did not observe any prominent sector attracting funds but rather a tendency towards differentiation. The real estate sector exhibited this differentiation, with stocks like FIR, VHM, DXG, ITC, NVL, TIG, NRC, and CEO attracting funds. In contrast, real estate stocks on the HNX exchange, such as VC7, API, AAV, IDJ, DTD, and IDC, were among those that experienced significant declines in trading activity.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on the HOSE

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on the HNX

|

The list of stocks with the highest and lowest liquidity changes is based on a trading volume of over 100,000 units per session.

The Market Pulse: Adjustment Pressures Linger

The VN-Index closed with a slight decline amid a volatile session that saw significant fluctuations. The index also formed a High Wave Candle pattern, indicating investor indecision. The Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that the short-term outlook remains bearish.

The Endless Gloom on the Vietnamese Stock Market: Foreigners Sell-Off, a Large Cap Stock Takes a Beating

This week, foreign investors unexpectedly sold-off a massive 1,500 billion VND worth of shares in a major stock.

The Stock Market Under Pressure from Foreign Investors’ Net Selling

The stock market is under intense pressure as foreign investors continue their selling spree, with no end in sight. Adding to the woes, proprietary trading desks are also offloading stocks, further dampening market sentiment. As the selling momentum builds, investors are left wondering when this tide will turn.