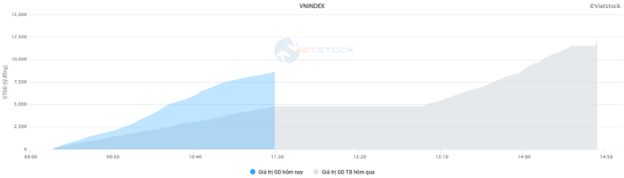

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 674 million shares, equivalent to a value of more than VND 16.5 trillion; HNX-Index reached over 49.6 million shares, equivalent to a value of more than VND 912 billion.

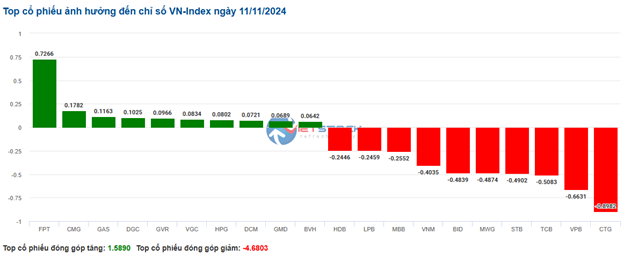

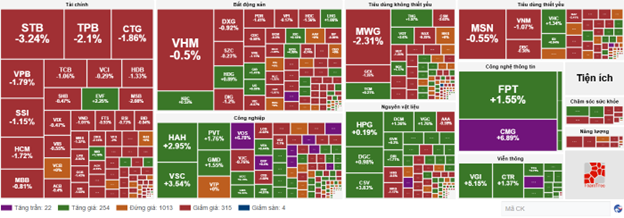

VN-Index opened the afternoon session with buying power returning, helping the index to gradually recover towards the reference level but still closed in the red. In terms of impact, BID, STB, MWG and TCB were the most negative stocks, taking away more than 3.2 points from the index. On the other hand, HPG, FPT, VHM and HVN were the most positive stocks, contributing more than 3.1 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on November 11, 2024 |

Similarly, the HNX-Index also witnessed a lackluster performance, with the index negatively impacted by MBS (-1.71%), PVS (-0.78%), NVB (-2.27%), and CEO (-1.33%)…

| Enter Title |

|

Source: VietstockFinance

|

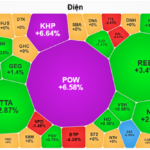

The non-essential consumer goods sector saw the biggest decline in the market at -1.13%, mainly due to MWG (-3.08%), GEX (-0.76%), PNJ (-0.11%), and PLX (-2%). This was followed by the financial and energy sectors, which decreased by 1.03% and 0.83%, respectively. On the other hand, the information technology sector witnessed the strongest recovery in the market, achieving a growth of 2.08% with green signals from FPT (+1.84%), CMG (+6.89%), PIA (+1.52%), and CMT (+10.6%).

In terms of foreign investors’ transactions, they continued to net sell over VND 971 billion on the HOSE exchange, focusing on MSN (VND 245.04 billion), CMG (VND 201.83 billion), STB (VND 112.54 billion), and TCB (VND 70.18 billion). On the HNX exchange, foreign investors net sold over VND 4 billion, focusing on SHS (VND 4.13 billion), CEO (VND 3.93 billion), MBS (VND 3.73 billion), and DTD (VND 3.54 billion).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Pressure from Large-cap Stocks

Market liquidity became more active but in the context of negative indices with heavy selling pressure, especially in the banking group. At the end of the morning session, the VN-Index decreased by 7.51 points, reaching 1,245.05; HNX-Index slightly decreased by 0.09%, standing at 226.66 points. The market breadth inclined towards the sell-side with 343 decreasing stocks and 271 increasing stocks. The VN30 basket exerted strong pressure, with 24 decreasing stocks and only 6 increasing stocks.

The matching volume of the VN-Index in the morning session increased by nearly 80% compared to the previous session, reaching over 346 million units, with a value of more than VND 8.6 trillion. The HNX-Index recorded a matching volume of nearly 25 million units, with a value of over VND 447 billion.

Source: VietstockFinance

|

The top 10 stocks with the most significant negative impact on the VN-Index all belonged to the VN30 group, of which 9/10 were banking stocks (the remaining stock was MWG). The most negative impacts came from CTG, TCB, and VPB, which took away nearly 3 points from the overall index. On the other hand, FPT and HPG were the two pillars that went against the market trend, helping the VN-Index to gain more than 1 point. The remaining stocks did not contribute significantly.

The energy and financial groups were temporarily at the bottom of the market with a decrease of 1.2% at the end of the morning session. Red dominated the energy sector, with notable stocks such as BSR (-1.42%), PVS (-1.04%), and PVD (-0.98%); and banking stocks like CTG (-2.86%), TCB (-1.91%), VPB (-2.05%), BID (-1.05%), STB (-4.23%), MBB (-1.22%), TPB (-2.7%), and HDB (-1.9%), among others.

Despite the market’s negative performance due to significant pressure from large-cap stocks, more than half of the industry groups managed to stay in the green. Among them, the telecommunications group witnessed the most positive performance with a growth of over 4%. The leading stocks in the sector all traded in the green: VGI (+5.02%), FOX (+1.76%), CTR (+0.53%), VNZ (+0.97%), ELC (+1.33%), and FOC (+2.99%).

Following closely was the transportation group, which attracted positive buying power from the beginning of the session, contributing to the growth of the industrial sector by 1.87%. Notable performers in this group included MVN, VOS, and VIP, which hit the ceiling price, along with ACV (+3.09%), SGP (+8.64%), PHP (+7.33%), HAH (+2.95%), VSC (+3.24%), and PVT (+1.23%).

Foreign investors continued their net selling trend, net selling over VND 681 billion on the HOSE exchange in the morning session. MSN and CMG remained the focus of foreign investors’ net selling, with net selling values of VND 227 billion and VND 144 billion, respectively. On the HNX exchange, foreign investors net sold over VND 12 billion, focusing on selling CEO, SHS, and MBS stocks.

10:40 am: Financial Stocks Sold Off, VN-Index Plunged

The trading sentiment remained heavy with selling pressure gradually increasing, causing the main indices to weaken and lose their reference levels. As of 10:30 am, the VN-Index decreased by 6.18 points, trading around 1,246 points. The HNX-Index increased by 0.09 points, trading around 226 points.

The breadth of the VN30 basket showed a relatively balanced performance between green and red stocks, but the selling pressure was slightly stronger. Among the financial stocks, CTG, VPB, TCB, and STB had a negative impact on the VN30-Index, taking away 0.9 points, 0.66 points, 0.51 points, and 0.49 points from the index, respectively. On the other hand, FPT, CMG, GAS, and DGC were the pillar stocks that helped the VN30 basket to regain over 1.2 points.

Source: VietstockFinance

|

The selling pressure continued in the financial sector, which accounts for nearly 35% of the total market capitalization, with red dominating most stocks and an average decline of nearly 1%. Specifically, sellers focused on banking stocks such as TPB, which decreased by 2.1%, STB by 3.24%, CTG by 1.86%, and HDB by 1.14%… Additionally, some securities stocks also witnessed negative performance, including SSI decreasing by 1.15%, HCM by 1.72%, VND by 1.35%, and FTS by 1.37%…

Following closely was the real estate sector, which experienced a certain level of differentiation, with the sell-side having a slightly stronger presence. Specifically, DXG decreased by 0.92%, PDR by 1.41%, DIG by 1.2%, and HDC by 1.17%… On the other hand, some stocks maintained their positive performance, including VHM increasing by 0.75%, KBC by 0.69%, and HDG by 1.07%.

It is worth noting that QCG stock has been continuously increasing since mid-October 2024, after a sharp decline in the previous period from April to July 2024. This was the period when information about the prosecution and detention of Ms. Nguyen Thi Nhu Loan related to the purchase and sale of prime land from many years ago was announced.

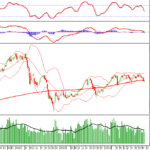

In the morning session of November 11, 2024, QCG stock continued its upward momentum and closely followed the upper band (Upper Band) of the Bollinger Bands indicator. Meanwhile, the MACD indicator remained above the zero level and formed higher peaks and troughs (Higher High, Higher Low), indicating a sustained recovery trend. Currently, the stock price is testing the 61.8% Fibonacci retracement level (corresponding to the 13,000-14,500 range), while the Stochastic Oscillator indicator shows a bearish divergence and has given a sell signal in the oversold region. Therefore, a corrective phase is likely to occur in the upcoming sessions if the indicator falls below this level.

Source: https://stockchart.vietstock.vn/

|

On the contrary, the industrial sector, particularly the transportation group, witnessed strong buying interest. Notable performers in this group included VOS and DXP, which hit the ceiling price, along with HAH increasing by 3.06%, GMD by 1.7%, and PVT by 1.58%…

Compared to the beginning of the session, the sell-side still held the upper hand. There were 315 decreasing stocks and 254 increasing stocks.

Source: VietstockFinance

|

Opening: Continued Consolidation

At the beginning of the November 11 session, as of 9:30 am, the VN-Index fluctuated around the reference level with a slight decrease, reaching 1,249.88 points. Meanwhile, the HNX-Index also witnessed a slight decline, standing at 226.6 points.

Large-cap stocks such as VHM, VPB, and MWG weighed on the market, with a total negative impact of more than 1 point. On the other hand, VCB, FPT, and GAS led the gainers but contributed less than 1 point to the index.

As of 9:30 am, a number of large-cap stocks in the telecommunications services sector witnessed positive performance from the beginning

Vietstock Daily: Can the Bulls Keep the Momentum Going?

The VN-Index extended its upward momentum following a strong previous session. To solidify this upward trend, trading volume needs to surpass the 20-day average. Notably, the Stochastic Oscillator has already signaled a buy in the oversold region. If the MACD indicator also flashes a similar signal, the short-term outlook will turn even more optimistic.

The Perfect Headline: “The Looming Correction”

The VN-Index witnessed a significant decline, closely hugging the lower boundary of the expanding Bollinger Bands, painting a rather pessimistic picture. Accompanying this downturn was a dip in trading volume, falling below the 20-day average, indicative of investors’ cautious sentiment. As the Stochastic Oscillator continues its southward journey, foreign investors’ net selling reinforces the ongoing corrective pressure in the foreseeable future.

The Market Beat, November 18th: A Tug of War Persists, VN-Index Stuck in the Red

The market closed with the VN-Index down 1.45 points (-0.12%) to 1,217.12, while the HNX-Index climbed 0.26 points (+0.12%) to 221.79. The market breadth tilted in favor of gainers with 368 advancing stocks against 340 declining ones. Meanwhile, the VN30-Index presented a relatively balanced picture, with 14 decliners, 12 advancers, and 4 unchanged stocks.

Market Beat 25/11: Indecisive Sentiment Prevails, VN-Index Struggles to Break Out

The market ended the session on a positive note, with the VN-Index climbing 6.6 points (0.54%) to reach 1,234.7; while the HNX-Index gained 0.96 points (0.43%), closing at 222.25. The market breadth tilted in favor of gainers, with 423 advancing stocks against 288 declining ones. The large-cap stocks in the VN30 basket painted a similar picture, as 18 stocks added value, 5 declined, and 7 remained unchanged, resulting in a predominantly green sentiment.

“Unleashing the Power of Words: Vietstock Weekly 25-29/11/2024: Navigating Through Hidden Risks”

The VN-Index has staged a strong recovery since last week’s sharp decline. However, trading volume remains below the 20-week average, indicating that investors are still cautious. At present, the MACD indicator is signaling a sell, and it could potentially drop to the zero threshold. If it does breach this level, the risk of a short-term correction increases.