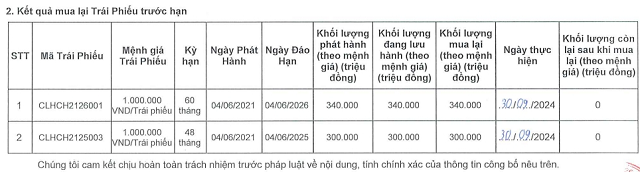

Cat Lien Hoa has consecutively spent 340 billion VND and 300 billion VND (at par value) to repurchase the entire principal amounts of bonds CLHCH2126001 and CLHCH2125003, respectively, thereby prepaying the debts that were due in 1-2 years from 2021.

Cat Lien Hoa announced the repurchase of two bond principal amounts totaling 640 billion VND. Source: Cat Lien Hoa

|

The real estate enterprise still has the CLHCH2124002 bond issue, which has already passed its maturity date since June 4. In a report sent to the Stock Exchange (HNX) earlier this year, Cat Lien Hoa attributed the delay in paying the interest of 8.6 billion VND for this issue (due on June 4, 2024) to a lack of timely arrangement, while the principal amount of 310 billion VND is under negotiation with bondholders for extension, but no new information has been recorded so far.

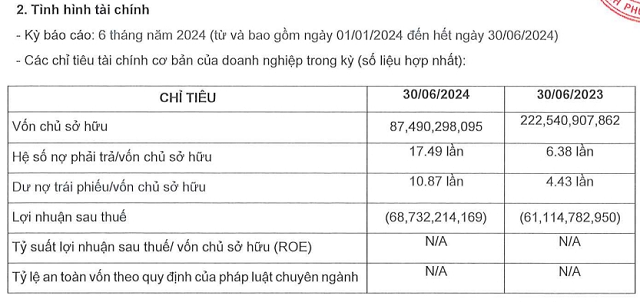

Cat Lien Hoa’s business performance in the first half of 2024 was not optimistic, with a post-tax loss of nearly 69 billion VND. As of Q2/2024, its owner’s equity stood at over 87 billion VND, significantly declining from 222 billion VND a year ago. The company’s total liabilities at the end of the period exceeded 1,500 billion VND, approximately 17.5 times the owner’s equity, while the outstanding bond debt was about 950 billion VND.

Formerly known as No Va Real Estate Limited Company, established in 2020, Cat Lien Hoa had VPS Securities arrange the issuance of six bond batches totaling nearly 2,000 billion VND in 2021. The real estate company used to share the same address as Novaland Group at 65 Nguyen Du, Ben Nghe Ward, District 1, but has now moved to 104 Mai Thi Luu, Da Kao Ward, District 1, Ho Chi Minh City, with Ms. Cao Ngoc Kieu Trinh still serving as the Chairwoman of the Members’ Council.

Cat Lien Hoa once had a charter capital of 500 billion VND, but due to continuous losses, its owner’s equity has dwindled to the aforementioned amount. According to the audited financial statements for 2022, the company had zero revenue from sales and services in 2021 and 2022, recording only financial income of about 72 billion VND and 20 billion VND, respectively, while interest expenses soared to 164 billion VND and 71 billion VND, resulting in significant losses.

Cat Lien Hoa owns 99.99% of a subsidiary, Phuoc Thien Urban Area Joint Stock Company. As of the end of 2022, the investment value in this subsidiary exceeded 1,400 billion VND.

Source: Cat Lien Hoa

|

The Tax Evasion Crackdown: Unraveling the Web of Corporate Deceit

Many businesses have recently disclosed regulatory decisions regarding penalty charges and tax arrears.

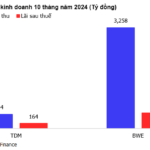

The Soaring Profits of the Two Water Industry Giants

TDM is a prominent private water company in Binh Duong Province and a strategic shareholder, owning over 37% of Biwase – the largest water company with a complete water value chain in the province. These two enterprises have recently reported a decline in profits for the first ten months of 2024.