I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 11/19/2024

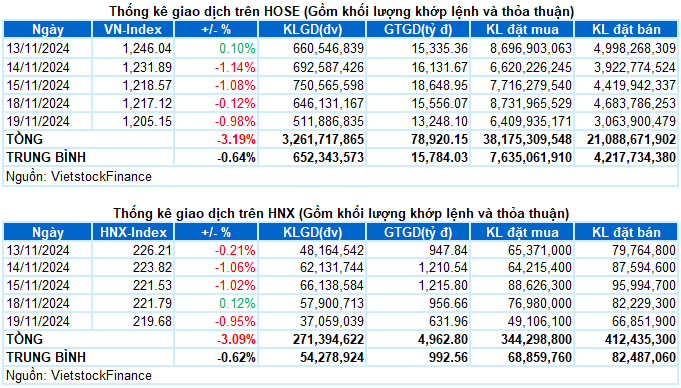

– The main indices decreased in the trading session on November 19. VN-Index closed the session down 0.98%, at 1,205.15 points; HNX-Index stopped at 219.68 points, down 0.95% compared to the previous session.

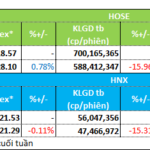

– The matching volume on HOSE reached just over 437 million units, down 21.3% from the previous session. The matching volume on HNX decreased by 39%, reaching more than 32 million units.

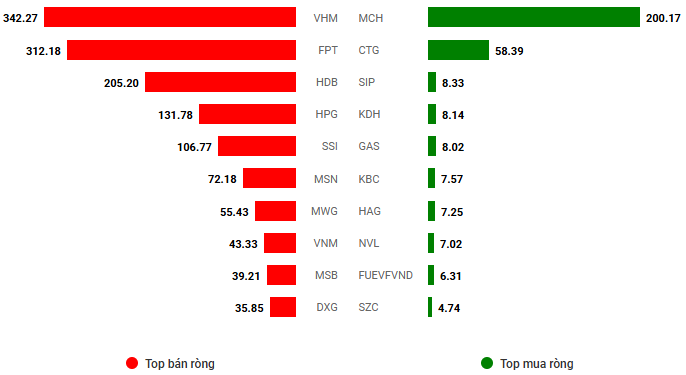

– Foreigners continued to sell on the HOSE with a value of more than 1,600 billion VND and net sold nearly 38 billion VND on the HNX.

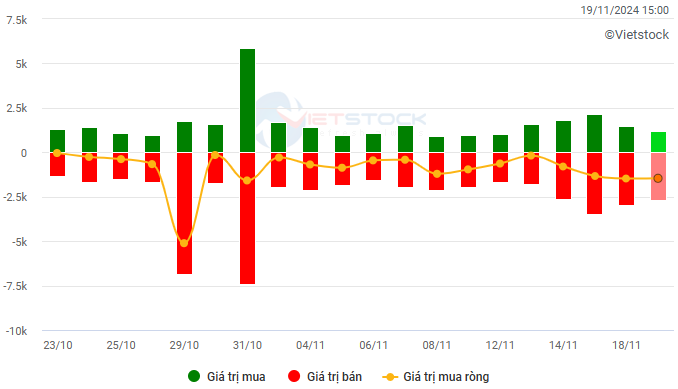

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

– The market started the session on November 19 with a slight green color, but the weak demand was quickly overtaken by the sellers. Liquidity became more and more gloomy, and the VN-Index then fluctuated slightly below the reference level for most of the remaining time. A surprise occurred in the last 30 minutes of the session, as sudden selling pressure pushed the index down sharply. The VN-Index closed down nearly 12 points, falling to 1,205.15 points.

– In terms of impact, FPT, VCB and BCM were the most negative stocks today, taking away 3.5 points from the VN-Index. In contrast, VHM “shouldered” to hold the general index, helping the VN-Index to increase by more than 1.5 points, while the remaining positively impacting stocks had an insignificant impact.

– VN30-Index closed the session down 0.88%, at 1,259.08 points. Sellers dominated with 23 decreasing codes, 6 increasing codes, and 1 stable code. Of which, BCM and FPT ranked at the bottom with a decrease of 4.5% and 3%, respectively. Following were MWG, GVR and STB, also down more than 2%. On the opposite side, VHM and PLX attracted positive demand, topping the list with gains of 3.4% and 1.6%, respectively. The remaining green-holding stocks were HDB, BID, SSB and CTG, but the gains were modest at less than 0.5%.

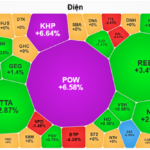

Most sectors were immersed in red. Telecommunications was the “bottom” group today when it plunged nearly 6%, with large-cap stocks in the industry all falling sharply, including VGI (-6.23%), FOX (-5.53%), CTR (-6.32%), ELC (-4.07%) and YEG (-2.22%). Following was the information technology group, which also fell by more than 3% when the two “giants” in the industry faced heavy selling pressure, namely CMG hitting the floor and FPT (-2.99%).

Large-cap groups such as finance and real estate, although the industry index did not decrease too much compared to the remaining industries, also put significant pressure on stocks such as VCB (-1.1%), VPB (-1.07%), MBB (-1.07%), STB (-1.99%), TPB (-1.25%), SSI (-1.85%), VCI (-2.27%); VRE (-1.1%), KDH (-1.84%), DXG (-2.13%), BCM (-4.48%), KBC (-3.62%), IDC (-3.07%), SIP (-4.36%), SZC (-6.01%) and QCG hitting the floor.

On the upside, energy and healthcare were the only two industries to maintain a slight gain. But this positivity was only maintained thanks to large-cap stocks such as BSR (+1.06%); DHT (+2.75%), PMC (+8.1%) and PBC (+1.54%), while the remaining stocks mostly failed to escape the downward trend, typically PVS (-1.47%), PVD (-1.28%); DBD (-1.47%), TNH (-1.24%), DTP (-1.76%) and DVN (-0.88%).

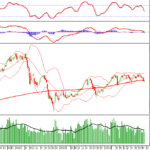

The sharp decline of the VN-Index and its continuous proximity to the Lower Bollinger Band, which is currently widening, indicate a rather pessimistic situation. In addition, the trading volume has decreased and is below the 20-day average, reflecting the cautious sentiment of investors. At present, the Stochastic Oscillator indicator continues to decline as foreign investors maintain net selling, indicating that the adjustment pressure remains high in the near future.

II. ANALYSIS OF TRENDS AND PRICE MOVEMENTS

VN-Index – Continuously tracking the Lower Bollinger Band

The sharp decline of the VN-Index and its continuous proximity to the Lower Bollinger Band, which is currently widening, indicate a rather pessimistic situation. In addition, the trading volume has decreased and is below the 20-day average, reflecting the cautious sentiment of investors.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the risk of short-term adjustments remains.

HNX-Index – The MACD indicator has given a sell signal again

The HNX-Index declined quite negatively as the trading volume was below the 20-day average, indicating investors’ cautious sentiment.

At present, the MACD indicator has given a sell signal again after cutting down the Signal Line. At the same time, the Stochastic Oscillator indicator is also giving a similar signal, reflecting that the short-term outlook remains pessimistic.

Analysis of Capital Flows

Fluctuations in smart money flow: The Negative Volume Index indicator of the VN-Index cut down below the EMA 20 day. If this state continues in the next session, the risk of an unexpected drop (thrust down) will increase.

Fluctuations in foreign capital flow: Foreigners continued to sell in the trading session on November 19, 2024. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

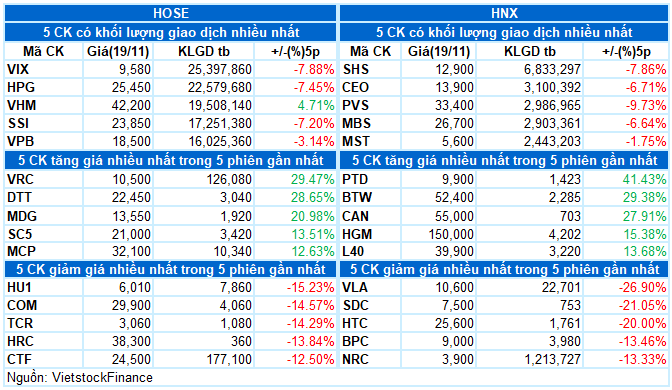

III. MARKET STATISTICS ON 11/19/2024

Economic Analysis and Market Strategy Department, Vietstock Consulting

The Market Beat, November 18th: A Tug of War Persists, VN-Index Stuck in the Red

The market closed with the VN-Index down 1.45 points (-0.12%) to 1,217.12, while the HNX-Index climbed 0.26 points (+0.12%) to 221.79. The market breadth tilted in favor of gainers with 368 advancing stocks against 340 declining ones. Meanwhile, the VN30-Index presented a relatively balanced picture, with 14 decliners, 12 advancers, and 4 unchanged stocks.

Market Beat 25/11: Indecisive Sentiment Prevails, VN-Index Struggles to Break Out

The market ended the session on a positive note, with the VN-Index climbing 6.6 points (0.54%) to reach 1,234.7; while the HNX-Index gained 0.96 points (0.43%), closing at 222.25. The market breadth tilted in favor of gainers, with 423 advancing stocks against 288 declining ones. The large-cap stocks in the VN30 basket painted a similar picture, as 18 stocks added value, 5 declined, and 7 remained unchanged, resulting in a predominantly green sentiment.

“Unleashing the Power of Words: Vietstock Weekly 25-29/11/2024: Navigating Through Hidden Risks”

The VN-Index has staged a strong recovery since last week’s sharp decline. However, trading volume remains below the 20-week average, indicating that investors are still cautious. At present, the MACD indicator is signaling a sell, and it could potentially drop to the zero threshold. If it does breach this level, the risk of a short-term correction increases.

The Liquidity Crunch: Capital Flow Conundrum for Real Estate Players

After a week of recovery, fueled by bottom-fishing funds, the market’s liquidity took a turn for the worse. Many groups witnessed a decline in their trading volumes. Amidst this downturn, real estate emerged as a sector with a distinct divergence in fund flows.

The Market Pulse: Adjustment Pressures Linger

The VN-Index closed with a slight decline amid a volatile session that saw significant fluctuations. The index also formed a High Wave Candle pattern, indicating investor indecision. The Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that the short-term outlook remains bearish.