Vietnam Report Unveils the Top 10 Reputable Companies in the Pharmaceutical, Medical Equipment, and Healthcare Industries for 2024

Thanh Thanh • 11/23/2024 10:35

On November 22, 2024, Vietnam Report JSC officially announced the Top 10 Reputable Companies in the Pharmaceutical, Medical Equipment, and Healthcare Industries for 2024, along with the survey results of enterprises in the industry.

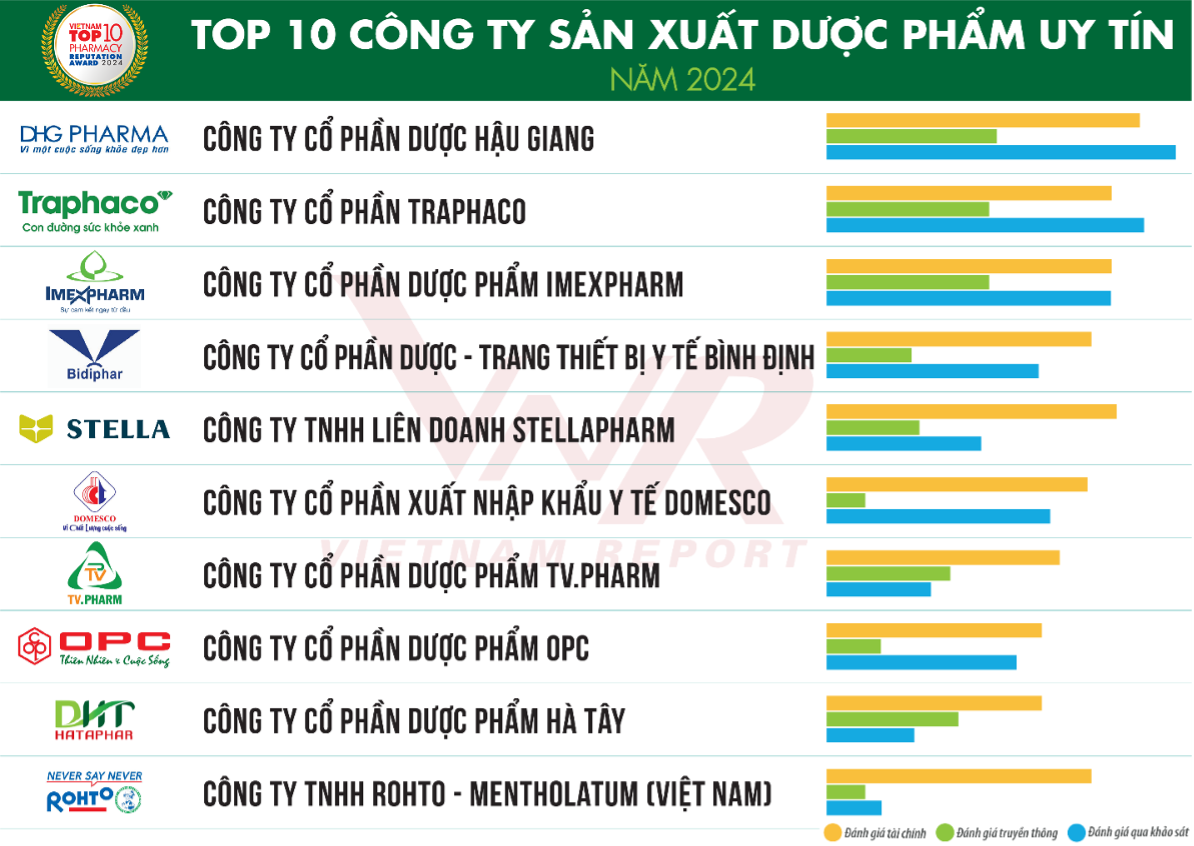

Accordingly, the Top 10 Reputable Pharmaceutical Manufacturers for 2024 include: JSC for Pharmaceutical Import and Export (Pharma JSC); Traphaco JSC; Imexpharm Pharmaceutical JSC; Binh Dinh Pharmaceutical and Medical Equipment JSC; Stellapharm Limited Company; Domesco Medical Import Export JSC; TV.Pharm Pharmaceutical JSC; OPC Pharmaceutical JSC; Ha Tay Pharmaceutical JSC; Rohto-Mentholatum (Vietnam) Co., Ltd.

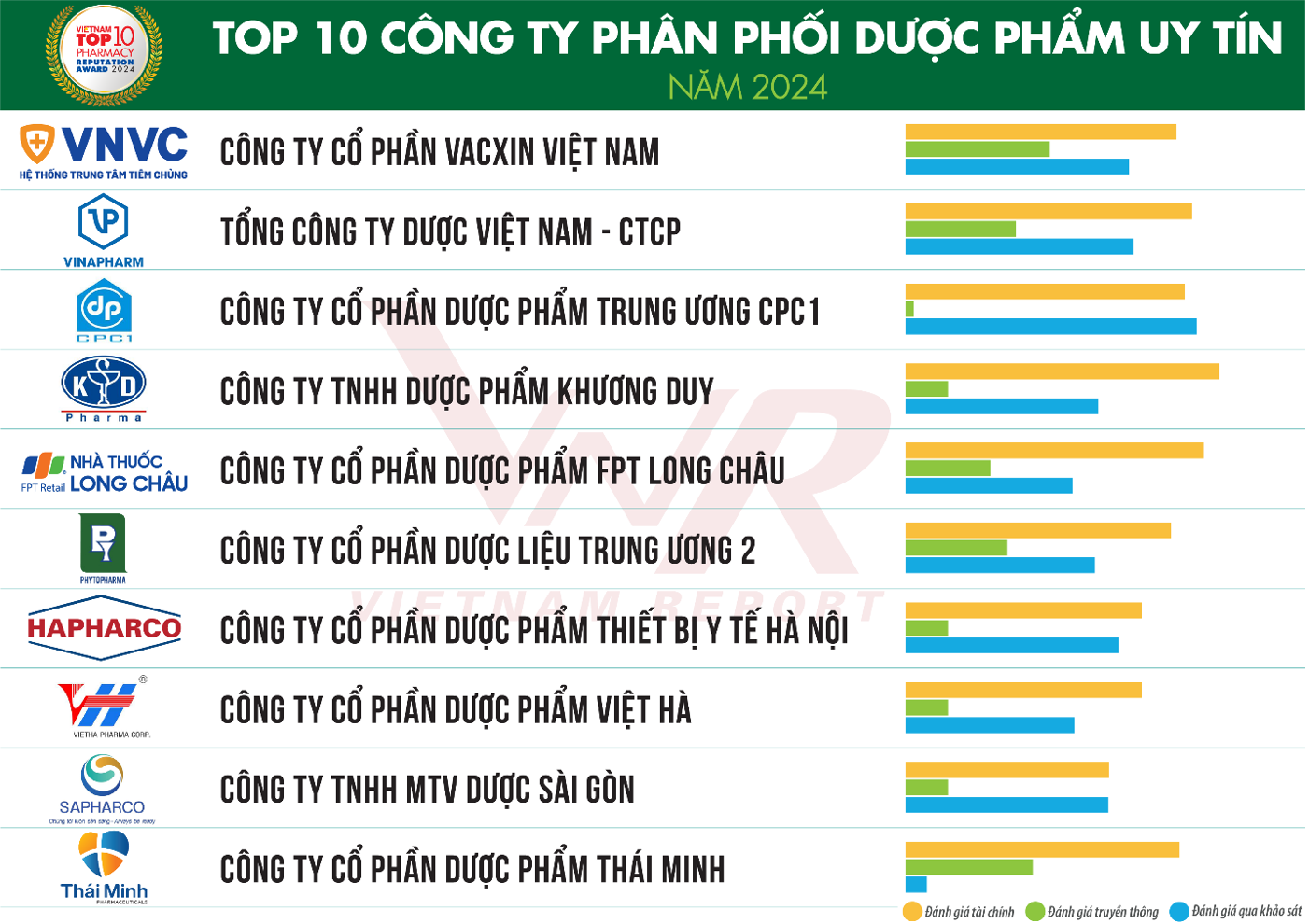

The Top 10 Reputable Pharmaceutical Distributors for 2024 are: Vietnam Vaccine JSC; Vietnam Pharmaceutical Corporation – JSC; Central Pharmaceutical Joint Stock Company 1; Khuong Duy Pharmaceutical Co., Ltd.; FPT Long Chau Pharmaceutical JSC; Central Pharmaceutical Material 2 JSC; Hanoi Pharmaceutical and Medical Equipment JSC; Vietnam Pharmaceutical Joint Stock Company; Saigon Pharmaceutical One-Member Limited Liability Company; Thai Minh Pharmaceutical JSC.

The Top 10 Reputable Medical Equipment and Healthcare Companies for 2024 comprise: B. Braun Vietnam Co., Ltd.; Phuong Medical Equipment Co., Ltd.; Minh Tam Equipment Co., Ltd.; Medicon Co., Ltd.; Medtronic Vietnam Co., Ltd.; Indo Trans Development Import Export Co., Ltd.; USM Healthcare Medical Equipment Factory JSC; ICT Vina Co., Ltd.; Danang Pharmaceutical and Medical Equipment JSC; Meditronic JSC.

The Top 5 Reputable Traditional Medicine Companies for 2024 are: Traphaco JSC; OPC Pharmaceutical JSC; Nam Duoc JSC; Hoa Linh Pharmaceutical Co., Ltd.; and Nam Ha Pharmaceutical JSC.

In the field of medical equipment and healthcare, the 5 most reputable companies in 2024 are: B. Braun Vietnam Co., Ltd.; Phuong Medical Equipment Co., Ltd.; Minh Tam Equipment Co., Ltd.; Medicon Co., Ltd.; and Medtronic Vietnam Co., Ltd.

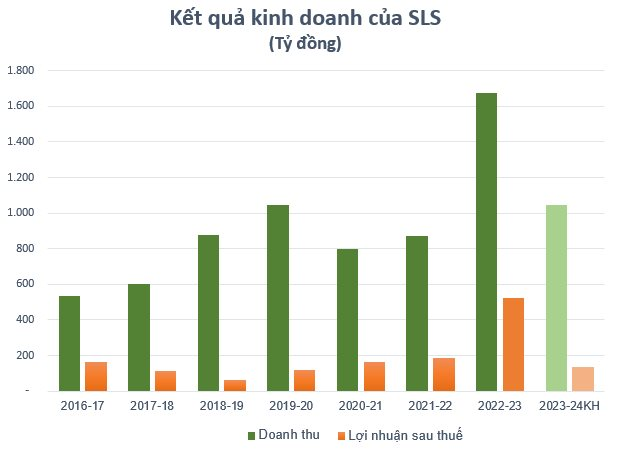

According to Vietnam Report’s survey, after a prosperous 2023, the growth of the pharmaceutical and medical equipment and healthcare industries slowed down in the first 10 months of 2024, especially in the first and second quarters. The survey results show an increase in the percentage of businesses experiencing a decline compared to the high base of the previous year.

Revenue remained relatively stable compared to the same period in 2023, but the proportion of businesses with profit decreases increased significantly (from 21.1% to 37.5%). Fluctuations in raw material prices, reduced purchasing power due to consumers’ tight spending trends, slower circulation of some epidemic prevention products, and intensifying market competition made the market generally less favorable in the early months of this year.

Despite facing significant challenges, the last months of the year are expected to witness a more positive performance for businesses in the industry. As the Vietnamese economy transitions to a recovery phase with marked improvements in many indicators, this will provide a solid foundation to support the industry’s growth momentum.

In addition, according to business leaders, the fourth quarter is usually the busiest period of the year, especially in the healthcare sector, as demand for products typically increases due to seasonal weather changes and certain diseases that often occur during this period, such as dengue fever, flu, and colds.

This optimism is also reflected in businesses’ outlook for 2025. Vietnam Report’s survey results show that 66.6% of businesses are confident about market development, only 13.4% predict more challenges, and 20.0% believe the market will remain stable without much change from 2024.

The hospital distribution channel (ETC), which accounts for a large proportion of the industry’s revenue, is expected to continue its growth trajectory thanks to the universal health insurance policy and more relaxed regulations for drug bidding in hospitals. Additionally, there is an increasing demand for specialized pharmaceutical products, particularly rare medicines, biologics, and drugs for treating critical illnesses. Meanwhile, the over-the-counter (OTC) distribution channel, despite modest revenue growth in the past ten months, is also anticipated to witness positive changes in 2025 by the majority of businesses.

In the long term, the pharmaceutical and medical equipment and healthcare market is assessed to have high growth potential and ample room for development. Vietnam is among the fastest-growing pharmaceutical markets globally, with a projected compound annual growth rate (CAGR) of 6-8% during 2023-2028 (according to IQVIA).

Moreover, according to Statista, the revenue of Vietnam’s medical equipment market has been steadily increasing over the years, from $922 million in 2016 to $1.6 billion in 2024, and is expected to reach $2.5 billion by 2029.

Alongside these advantages, the pharmaceutical and medical equipment and healthcare industries in Vietnam still face considerable challenges in their journey to greater heights.

Currently, infrastructure, technical expertise, and technology remain limited, and there is a lack of concentrated pharmaceutical and biotechnology industrial parks. Domestic pharmaceutical companies are mostly small-scale, with modest revenue and investment, and there is an absence of large-scale corporations with national prominence. This context is further challenged by the financial constraints and limited scale of many enterprises.

Additionally, the shift from chemical drugs to biological or biosimilar drugs requires significant technological advancements and enhanced capacity for technology acquisition and transfer. The digital transformation process in the industry is also slow, necessitating synchronized policy solutions and determination from businesses.

To truly achieve a breakthrough, the pharmaceutical and medical equipment and healthcare industries require comprehensive efforts, not only to strengthen their domestic position but also to deepen their participation in the global value chain. These endeavors will contribute to enhancing their international reputation and competitiveness and positioning Vietnam on the world map of healthcare.

SHB Ranks in the Top 10 Most Profitable Private Enterprises in 2024

Effective operations, sustainable growth, and positive contributions to the economy have earned SHB a place in the “Top 50 Most Profitable Enterprises in Vietnam.” This prestigious recognition highlights SHB’s remarkable performance and positions it among the top 10 most profitable private enterprises in the country.

C69 Sustains Top Spot on FAST500 for Fourth Consecutive Year

On 24th April, 2024, at the National Convention Center – Hanoi, Construction Joint Stock Company 1369 (HNX:C69) was honored to receive the award Top 500 Fastest Growing Enterprises in Vietnam (FAST500), and also continued to be listed in the Top 50 Vietnam Best Growth Enterprises (Top 50 Vietnam Best Growth).