MARKET REVIEW FOR THE WEEK OF 18-22/11/2024

During the week of 18-22/11/2024, the VN-Index saw a strong recovery following the previous week’s sharp decline. However, trading volume remained below the 20-week average, indicating that participating funds were still cautious.

Currently, the MACD indicator is giving a sell signal and is likely to fall to the 0 threshold. If the indicator cuts down to this level, the risk of a short-term adjustment will increase.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – ADX moving within the gray area (20<>

In the trading session on 22/11/2024, the VN-Index fell slightly and formed a candle pattern similar to a High Wave Candle, while trading volume fluctuated erratically in recent sessions, indicating investors’ uncertainty.

Currently, the index remains below the Middle line of the Bollinger Bands, while the ADX indicator is moving within the gray area (20

However, the Stochastic Oscillator has risen out of the oversold region and continues to head higher after a buy signal appeared there. This indicates that the short-term outlook is less pessimistic.

HNX-Index – Stochastic Oscillator forms bullish divergence

In the trading session on 22/11/2024, the HNX-Index fell and formed a Spinning Top candle pattern, while trading volume increased and exceeded the 20-session average, reflecting investors’ uncertainty.

Additionally, the HNX-Index is testing the April 2024 low (corresponding to the 217-222 point region) while the Stochastic Oscillator has given a buy signal after forming a bullish divergence in the oversold region. Therefore, a short-term recovery is likely to emerge soon.

Money Flow Analysis

Changes in Smart Money Flow: The Negative Volume Index of the VN-Index cut below the 20-day EMA. If this condition continues in the next session, the risk of a sudden drop (thrust down) will increase.

Changes in Foreign Money Flow: Foreign investors returned to net buying in the session on 22/11/2024. If foreign investors maintain this action in the coming sessions, the situation will be less pessimistic.

Technical Analysis Department, Vietstock Consulting

The Market Pulse: Adjustment Pressures Linger

The VN-Index closed with a slight decline amid a volatile session that saw significant fluctuations. The index also formed a High Wave Candle pattern, indicating investor indecision. The Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that the short-term outlook remains bearish.

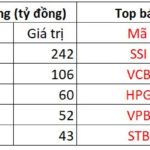

What Stocks are Propping Up the Stock Market?

Yesterday’s trading session (November 20) saw a boost in investor confidence with bottom-fishing funds pushing the VN-Index up by 11 points, leading to a market recovery with improved liquidity. However, many securities firms remain cautious about the market’s outlook for short-term investors and advise a prudent approach to trading.

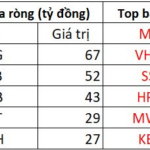

The Foreign Sell-Off Continues: Vietnam’s Real Estate Stock Takes a 600 Billion Hit

Foreign investors continued their net-selling streak, offloading Vietnamese shares worth over 921 billion VND today.