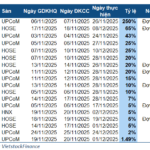

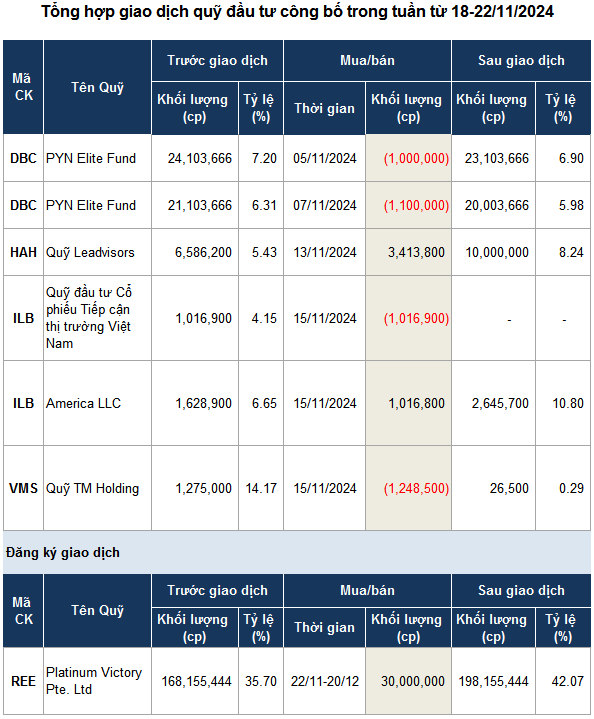

In a series of transactions announced by investment funds last week (Nov 11-15, 2024), selling pressure dominated the market.

Specifically, on Nov 15, TM Holding Fund offloaded more than 1.2 million VMS shares (of Marine Development Joint Stock Company) through a negotiated deal. The transaction value amounted to nearly VND 21 billion, corresponding to VND 16,600 per share, which was 17% lower than the closing price of that session.

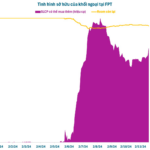

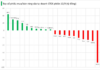

| Price movement of VMS shares from the beginning of 2024 to Nov 22 |

Following this transaction, the TM Holding Fund is no longer a major shareholder of VMS, as its ownership ratio decreased from 14.17% (1.28 million shares) to 0.29% (26,500 shares). The investment fund’s move to reduce its stake could be attributed to the fact that VMS share price has declined by over 40% since the beginning of the year, closing at VND 21,300 per share on Nov 22.

| Price movement of ILB shares from the beginning of 2024 to Nov 22 |

Also, on Nov 15, the Vietnam Market Access Stock Fund (under VinaCapital) sold over 1 million ILB shares (of ICD Tan Cang – Long Binh Joint Stock Company), in addition to the 115,000 ILB shares it offloaded on Nov 11. With this transaction, the VinaCapital-affiliated fund is no longer a shareholder of ILB.

Meanwhile, foreign fund America LLC reported the purchase of more than 1 million ILB shares on Nov 15, just 100 shares short of the number sold by the Vietnam Market Access Stock Fund. As a result, America LLC increased its ownership stake in ILB to 10.8%, equivalent to 2.65 million shares.

On Nov 15, ILB shares witnessed a negotiated transaction with a volume matching the number of shares sold by the VinaCapital-affiliated fund. The transaction value exceeded VND 33 billion, corresponding to VND 32,500 per share, nearly identical to the closing price.

Source: VietstockFinance

|

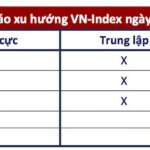

The Ultimate Guide to Captivating Copy: “VN-Index: Unveiling the Mystery of its Potential Retreat Below 1,240 Points”

Agriseco recommends maintaining a high cash balance for the time being, awaiting opportunities to invest when the market confirms a short-term bottom at support levels.