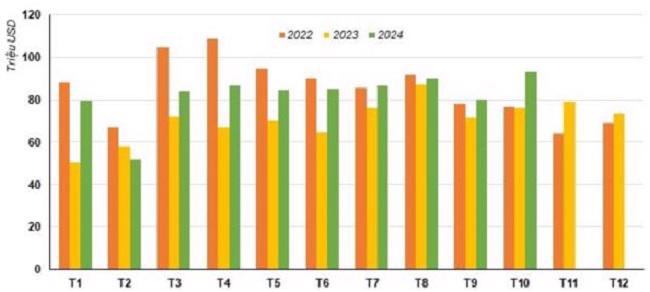

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), the seafood export turnover in October 2024 reached $1.1 billion, a nearly 31% increase compared to the same period last year. This is the first time in 27 months (since June 2022) that seafood exports have returned to the $1 billion mark – a milestone for Vietnam’s seafood businesses. The United States, China, and Japan are the three largest consumers of Vietnam’s seafood products.

In the first ten months of 2024, the total seafood export turnover reached $8.33 billion, a 12% increase compared to the same period in 2023; shrimp exports increased by 13%, pangasius by 9%, and tuna by 18%…

SHRIMP EXPORTS TO MAJOR MARKETS ARE GROWING

Specifically, shrimp exports in October 2024 reached $394 million, a 24% increase compared to the same period last year. In the first ten months of 2024, shrimp exports brought in $3.2 billion, a 13% increase compared to the previous year. The significant growth in all major markets indicates a strong recovery in demand.

Notably, Vietnam’s shrimp exports to China and Hong Kong in October 2024 reached $91 million, a 44% increase compared to October 2023. In the first ten months of 2024, shrimp exports to these markets reached $676 million, a 31% increase compared to the same period; of which, lobster exports surged by 157% to $298 million.

In the US market, Vietnam’s shrimp exports in October 2024 exceeded $80 million, a 17% increase compared to October 2023. In the first ten months of 2024, shrimp exports to this market reached $646 million, a 10% increase compared to the same period.

VASEP believes that Mr. Trump’s proposal to increase import taxes on goods entering the US after his re-election is causing US businesses to tend to speed up imports to stockpile goods before the tax increase. Therefore, in the short term, the demand for shrimp imports into the US will increase.

In the first ten months of 2024, shrimp exports to Japan and South Korea also recorded growth of 18% and 28%, respectively, after fluctuating in the previous months.

In the EU, shrimp exports in October increased by 32%. In the first ten months of 2024, the total shrimp export turnover to this market reached $408 million, a 17% increase compared to the same period last year.

According to VASEP, the export data for the first ten months of 2024 shows optimistic prospects in each major market. Exports to the US and the EU have recorded stable growth. China is implementing policies to promote consumption, which could help increase the demand for shrimp imports from Vietnam. Export prices for shrimp, especially whiteleg shrimp, are showing signs of increase, improving profit margins for businesses. Raw material prices for shrimp are also at a positive level, which will support production and exports. With the results of the first ten months, the goal of achieving a shrimp export turnover of $4 billion in 2024 is entirely feasible.

PANGASIUS EXPORTS ARE EXPECTED TO SURPASS $2 BILLION

Regarding pangasius, VASEP reported that export turnover in October 2024 reached nearly $202 million, a 17% increase compared to October 2023. In the first ten months of 2024, pangasius exports reached $1.7 billion, a 9% increase compared to the same period last year.

In terms of consumption markets, China and Hong Kong remain the largest destinations for Vietnam’s pangasius exports. In October 2024, these markets consumed $61 million worth of pangasius, a 9% increase compared to the same period. However, total pangasius exports to China and Hong Kong in the first ten months of 2024 reached only $479 million, a 2% decrease compared to the previous year.

The second-largest market is the US. In October 2024, Vietnam’s pangasius exports to this market reached over $35 million, a 65% increase compared to the same period last year. In the first ten months of 2024, the total value of pangasius exports to the US reached over $291 million, a 28% increase compared to the same period last year.

With Donald Trump’s re-election as president, there are predictions of new tax policies for imported goods, including pangasius. However, the situation is expected to improve, and orders will increase as Vietnam and the US are comprehensive strategic partners, not to mention the existence of separate tax policies.

The CPTPP market is the third-largest consumer of Vietnam’s pangasius. In the first ten months of 2024, pangasius exports to CPTPP countries reached over $224 million, an 11% increase compared to the same period last year.

Regarding the EU, Vietnam’s pangasius exports to this market in the first ten months of 2024 reached nearly $144 million, a slight increase of 0.04% compared to the same period last year. Nevertheless, some EU markets recorded double-digit growth in pangasius imports from Vietnam, including Lithuania, Ireland, Italy, Belgium, Spain, Poland, and Portugal…

With the results of the first ten months, VASEP forecasts that in 2024, Vietnam’s pangasius exports are likely to surpass $2 billion due to the expected increase in year-end orders to serve the holiday season.

TUNA EXPORTS RECOVER WITH STRONG GROWTH

For tuna, the export turnover in October 2024 reached nearly $93 million, a 22% increase compared to the same period in 2023. This is the first time in 25 months that the monthly tuna export value has exceeded $90 million.

In the first ten months of 2024, the total tuna export turnover exceeded $821 million, an 18% increase compared to 2023. According to VASEP, if this growth momentum is maintained, Vietnam’s tuna exports are expected to reach a total turnover of about $1 billion in 2024, an 18% increase compared to 2023.

Analyzing in more detail, VASEP stated that exports of various tuna products from Vietnam in October 2024 all increased compared to the same period. Notably, exports of frozen tuna meat/loin products with HS code 0304 tend to grow rapidly in the last months of this year.

The utilization of preferential tariff quotas and the challenges in implementing regulations related to the IUU fishing fight have hindered tuna exports to the EU in the last months of the year. Exports to this market decreased by 15% in October 2024, but due to the good growth in the previous months, the cumulative exports in the first ten months still increased by 17%.

In contrast, tuna exports to the US, after slowing down in the third quarter, tend to accelerate again in the last months of the year. The demand for seafood consumption during the year-end holidays, along with the impact of the presidential election, has boosted the demand for tuna imports into this market. Tuna exports to the US in October 2024 increased by 30% compared to October 2023.

Along with the US, the Middle East market is also increasing its imports of Vietnamese tuna. Exports to this market are growing rapidly, with significant increases in countries like Israel (55%), Egypt (70%), and Saudi Arabia (72%)…

Notably, the recovery of tuna exports to Japan in October 2024 increased by nearly 31% compared to the same period last year. Japan’s economic picture has brightened considerably after a long period of gloom. Along with the economic recovery, the strengthening of the Japanese yen since September has increased the demand for seafood imports, including tuna.

Vietnam Prepares for EU Inspection Delegation in Aquaculture

The European Union (EU) inspection team is set to visit Vietnam to audit its aquaculture industry. The team is expected to evaluate the country’s residue control program for products destined for the EU market and verify the reliability of ensuring that farmed seafood complies with residue regulations.