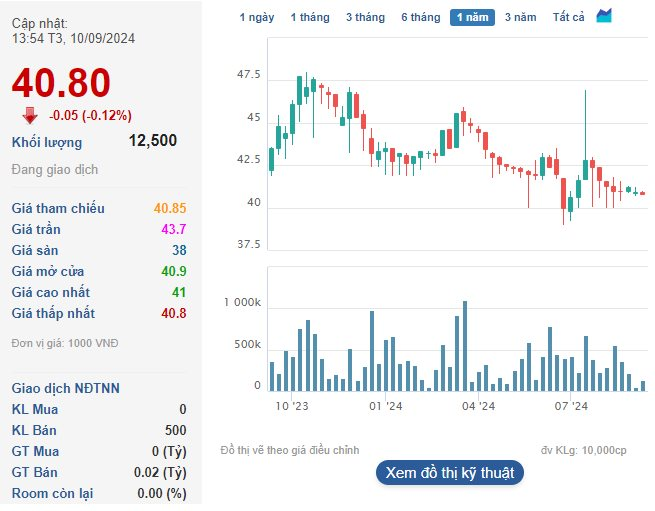

Profit-taking pressure remained present on the first trading day of the week, but it didn’t pose a significant challenge to the market. The slow upward trend, coupled with low liquidity and gradually improving breadth, reflected investors’ cautious sentiment. However, there was capital inflow into the market, indicating acceptance of higher prices.

The VN-Index stayed above the reference level throughout the morning session, with the lowest point being just a 1% increase. The breadth was positive throughout, and the index closed with a gain of 5.56 points (+0.45%), with 243 gainers and 116 losers.

Liquidity on the HoSE decreased slightly by 3% compared to the previous session, reaching 4,145 billion VND excluding matching transactions. At the lowest point of the index, the breadth was 166 gainers to 140 losers, with only a few stocks declining by more than 1%. Only 76 stocks on the exchange experienced maximum declines of 1% or more, accounting for about 22.3% of the total traded stocks. By the end of the session, this number had dwindled to 35, with only two stocks, CMG and TCH, achieving notable liquidity: CMG fell 2.44% with a matching volume of 66.8 billion, and TCH decreased by 1.29% with a matching volume of 23 billion. The next best-performing stock in terms of liquidity was EVG, with a modest 2.8 billion VND.

The picture was much brighter for stocks on the rise: out of 243 gainers, 76 saw increases of more than 1%, and this group attracted 41.1% of the HoSE’s total matching value. The stocks that witnessed excellent capital inflows and price increases were POW, which hit the ceiling price with a 6.58% increase and a liquidity of 209.8 billion; MSN, which rose 1.69% with 193.4 billion; DHG, up 2.83% with 175.3 billion; DXG, climbing 1.49% with 157.8 billion; and TCM, increasing 2.49% with 108.6 billion. A long list of stocks with average liquidity, including GEX, REE, HAH, PVD, GIL, and VSC, also saw significant price increases.

Although the rising stocks outperformed the declining ones in terms of both margin and liquidity, most stocks, in reality, experienced narrow margins of increase and low liquidity. When the overall market liquidity is low, even a few standout stocks with significant capital inflows are exceptions. For instance, only nine stocks on the HoSE reached transaction values of 100 billion VND or higher during this session. The positive sign is that even with low liquidity, prices are rising, indicating limited selling pressure.

The blue-chip stocks also didn’t witness any notable transactions, especially considering their poor liquidity. The VN30 basket saw a 12% decrease in liquidity compared to the previous session, with matching orders totaling a little over 1,768 billion VND. The VnN30-Index rose slightly by 0.4%, with 19 gainers and 6 losers. Among the top 10 stocks by market capitalization, VCB increased by 1.21%, VHM by 1.32%, and GAS by 1.3%. On the other hand, BID, FPT, CTG, and TCB closed in the red.

The highlight of today’s foreign exchange trading was the continued weakening of selling pressure. Total selling on the HoSE fell to 522.2 billion VND, a 21% decrease compared to the previous morning session and the lowest level in 13 sessions. After a series of morning sessions with massive sell-offs of thousands of billions of VND, this decline is a positive sign. Buying power also remained weak, reaching 419.1 billion VND, resulting in a net sell-off of 103.1 billion VND—the lowest level in 20 sessions. MWG (-39.6 billion), HPG (-32.3 billion), and DXG (-24.9 billion) were the stocks that experienced the most substantial net selling. On the other hand, MSN (+46.7 billion) and TCM (+24.8 billion) saw net buying.

The market is witnessing a recovery streak with extremely low liquidity, raising doubts among investors. This upward trend resembles a technical rebound, making it challenging for investors to make decisions. Typically, low liquidity indicates that few people are willing to buy, and the prevalent sentiment is to wait for a market correction before investing. This “increasing doubt” state is common during any bottom-forming process.