Illustration.

Oil Price Drops by Over $2 per Barrel

Oil prices fell by more than $2 per barrel after reports that Israel and Lebanon had agreed to the terms of a deal to end the Israel-Hizbullah conflict, citing senior U.S. officials. Brent crude oil traded at $73.01 per barrel, a decrease of $2.16 or 2.87%. West Texas Intermediate (WTI) crude oil in the U.S. ended at $68.94 per barrel, a decline of $2.30 or 3.23%. Phil Flynn, senior analyst at Price Futures Group, noted that oil markets fluctuated due to concerns about supply disruptions.

Brent and WTI crude oils both recorded their largest weekly increases since late September 2024 and reached their highest closing prices since November 7, following Russia’s launch of supersonic missiles into Ukraine as a warning to the West. The Energy Minister of Azerbaijan, Parviz Shahbazov, stated in an interview with Reuters that the Organization of the Petroleum Exporting Countries and its allies (OPEC+) may consider maintaining current production cuts during their upcoming meeting on Sunday.

The group, which includes OPEC and allies such as Russia, has delayed increasing production this year due to demand concerns.

Gold Price Drops by Over 3%

Gold prices fell by over 3%, breaking a five-day streak of gains and reaching a near three-week high, as reports from Israel and the U.S. indicated that Israel and Hezbollah forces in Lebanon were moving closer to a ceasefire agreement. Additionally, U.S. President Donald Trump nominated Scott Bessent as the U.S. Treasury Secretary.

Spot gold prices dropped by 3.4% to $2,619.66 per ounce, marking the biggest daily decline since June 7, 2024. Gold futures in the U.S. fell by 3.5% to $2,618.50 per ounce. The gold market was poised for a sell-off due to a lack of buying momentum after last week’s price surge. Daniel Ghali, a commodity strategist at TD Securities, noted that the appointment of Scott Bessent eased some of the risks associated with the U.S.

The precious metal had reached its highest level since November 6 during early trading in Asia after climbing nearly 6% last week, its best performance since March 2023, driven by escalating tensions in the Russia-Ukraine conflict. Silver fell by 3.3% to $30.28 per ounce, platinum decreased by 2.6% to $938.57, and palladium dropped by 3.1% to $977.94.

Copper Prices Rise on Bargain Hunting and Improved Risk Sentiment

Copper prices rebounded after two consecutive sessions of losses, supported by bargain hunting and improved risk sentiment following the nomination of Scott Bessent as the U.S. Treasury Secretary. Three-month copper on the London Metal Exchange (LME) rose by 0.9% to $9,046 per ton. Copper futures on the Comex in the U.S. increased by 0.6% to $4.11 per lb.

LME copper had declined by 11% since reaching a four-month peak on September 30, as speculators unwound long positions due to disappointment over the pace of economic stimulus in top consumer China and concerns about potential tariffs on China by the U.S. president-elect. Inventories of copper in warehouses of the Shanghai Futures Exchange (SHFE) started to decline during China’s peak consumption season, which typically lasts from November to December.

LME aluminum rose by 1.1% to $2,652.50 per ton after Russia, the world’s largest aluminum producer outside of China, announced a production cut of over 6%. On the LME, nickel prices climbed by 1.5% to $16,205 per ton, zinc increased by 1.8% to $3,019.50, lead rose by 0.5% to $2,032, and tin remained unchanged at $28,915.

Iron Ore Prices Rise on Strong Global Steel Output

Iron ore futures prices advanced, supported by robust global steel production, despite escalating trade tensions involving top consumer China, which limited the upside. The most-traded January 2025 iron ore contract on the Dalian Commodity Exchange (DCE) in China closed the session 0.84% higher at 781.5 yuan ($107.88) per ton, after earlier rising to 791 yuan, the highest since November 8, 2024. December 2024 iron ore on the Singapore Exchange climbed by 1.61% to $102.20 per ton.

Global crude steel output in October 2024 increased by 0.4% year-over-year to 151.2 million tons, according to data released by the World Steel Association on Friday. In China, the world’s largest producer and consumer of metals, crude steel production rose by 2.9% to 81.9 million tons during the same period. Analysts at Westpac noted that declining inventories of steel products in China due to robust exports also supported iron ore prices above the $100 per ton level.

In Shanghai, rebar prices fell by approximately 0.2%, hot-rolled coil decreased by around 0.3%, stainless steel dropped by 0.04%, while wire rod prices climbed by about 0.3%.

Arabica Coffee Reaches 47-Year High

Arabica coffee futures rose to their highest level since 1997, supported by tight supply concerns, while cocoa and sugar prices declined slightly. March 2025 Arabica coffee closed up 2.7 cents, or 0.9%, at $3.048 per lb after peaking at $3.1125, the highest since the early days of coffee futures trading in the 1970s. January 2025 Robusta coffee climbed by 2.5% to $5,110 per ton.

Traders noted that supply was tightening as some farmers in Brazil were withholding sales for tax reasons and in hopes of higher prices. They also pointed out that next year’s Arabica crop in Brazil was not developing as well as many had predicted, and recent rains were not enough to reverse the damage caused by earlier dry weather. Heavy rains in Costa Rica triggered a national state of emergency and destroyed nearly 15% of the country’s annual coffee production, resulting in losses of around $45 million for coffee growers, according to the coffee institute ICAFE. Speculators increased their net long positions in both Arabica and Robusta coffee during the recent price rally.

Cocoa Prices Decline

March 2025 cocoa on the London market closed down £87, or 1.2%, at £7,405 per ton, extending the market’s decline from a five-month high of £7,654 reached on Friday. Below-average rainfall combined with extended sunny spells in most of the main cocoa-growing regions of Ivory Coast had boosted the main crop, which runs from October to March, while the light Harmattan wind started blowing in some areas. March 2024 cocoa on the New York market fell by 1.2% to $8,972 per ton.

Sugar Prices Ease

March 2025 raw sugar declined by 1% to 21.15 cents per lb. March 2025 white sugar fell by 1.4% to $545.60 per ton. Traders noted that the market was searching for direction while continuing to improve for the upcoming Brazilian crop.

Wheat Prices Decline on Increased Supply and Reduced Conflict Concerns

Chicago wheat futures dropped due to ample supplies and eased concerns about an escalating conflict between Russia and Ukraine, which could have disrupted Black Sea exports. Soybean prices rose on improved demand after touching contract lows last week, while corn prices fell amid weakness spilling over from wheat and favorable weather forecasts in South America.

At the Chicago Board of Trade, the most active wheat contract fell by 9 cents to $5.55-3/4 per bushel, and corn dropped by 2-1/4 cents to $4.33 per bushel. Soybeans gained 2-1/4 cents to $9.83-1/2 per bushel after falling to their lowest since October 21. Negotiations for a ceasefire between Israel and Hezbollah also put pressure on wheat prices.

The Russian agricultural consultancy IKAR stated that they had increased their forecast for Russia’s 2024 grain crop to 125 million tons from 124.5 million tons previously. Conditions for the U.S. winter wheat crop were likely to improve for the fourth consecutive week after timely rainfall in most of the agricultural belt in the Plains earlier in the month, according to analysts polled by Reuters.

Soybean planting in Brazil for the 2024/25 season had reached 86% of the expected total area as of last Thursday, significantly higher than the 74% recorded a year earlier. While drought conditions in some South American corn and soybean areas remained a concern, forecast rains in the region were expected to ease worries.

Japanese Rubber Prices Rise on Stronger Oil and Improved Market Sentiment

Japanese rubber prices increased due to stronger global oil prices, which boosted market sentiment, although a firmer yen limited further gains. The April 2025 rubber contract on the Osaka Exchange (OSE) rose by 6.4 yen, or 1.8%, to 362.9 yen ($2.36) per kg. January 2025 rubber on the Shanghai Futures Exchange (SHFE) gained 55 yuan, or 0.32%, to 17,505 yuan ($2,416.88) per ton. January 2025 butadiene rubber on the SHFE fell by 120 yuan, or 0.93%, to 12,805 yuan ($1,767.96) per ton. The front-month rubber contract on the Singapore Exchange was last traded near $1.87 per kg, up nearly 1%.

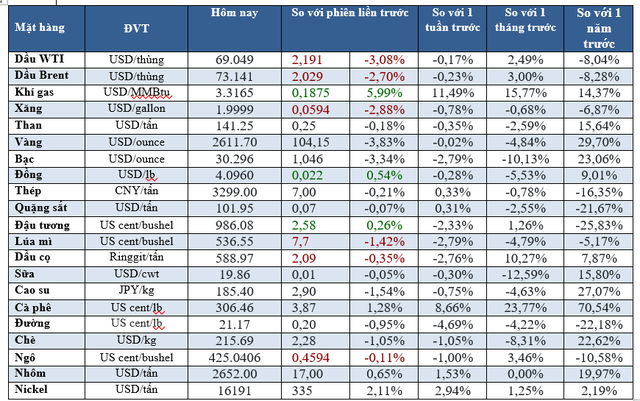

Prices of Key Commodities on November 26, 2024

“Gold’s Turbulent Week: Market Update for November 16th”

Oil prices fell more than 2% on November 15 as weak Chinese data stoked demand concerns, while gold posted its biggest weekly fall in three years and aluminum surged after China scrapped export rebates.

The Curious Case of Vietnam’s Coffee Export Market: What Do Experts Make of It?

Robusta coffee bean prices have recently soared to unprecedented heights, reaching almost 1000 USD per ton above Arabica. This is a remarkable event, as such a price difference has never been witnessed before.