In a press release issued this morning, Eximbank (stock code: EIB) announced that it has officially been approved by the State Bank of Vietnam to amend its charter capital in the Operating License under Decision No. 2570/QD-NHNN. As a result, Eximbank’s current charter capital stands at 18,688 billion VND.

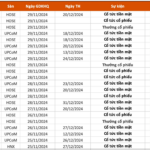

The increase in Eximbank’s charter capital by 1,218 billion VND was made through the issuance of shares to pay dividends from undistributed profits accumulated up to 2023, after allocating funds to reserves, according to the plan for capital increase approved by the bank’s 2024 Annual General Meeting of Shareholders. Specifically, on September 20, Eximbank finalized the list of shareholders entitled to receive a 7% dividend payout in the form of shares.

Previously, in 2023, Eximbank shareholders received dividend payouts twice, with rates of 20% and 18%, respectively.

Regarding its financial performance, in the first nine months of 2024, Eximbank’s total assets grew by 11% year-to-date and 16.9% year-over-year. Total capital mobilization increased by 9.1% compared to the beginning of the year and 12.2% compared to the same period last year. Meanwhile, loan balances rose by 15.1% year-to-date and 18.9% year-over-year.

The bank’s pre-tax profit for the first nine months of 2024 increased by 39% compared to the same period in 2023. The Capital Adequacy Ratio (CAR) has been consistently maintained at a healthy level of 12-14%.

Eximbank is expected to hold an Extraordinary General Meeting of Shareholders on November 28, 2024, to discuss several important matters, including the relocation of its head office from Ho Chi Minh City to Hanoi and the dismissal of personnel as proposed by a major shareholder group.

The Race to Raise Deposit Rates: Why Banks Are Competing to Offer Higher Returns

As we approach the year-end, there has been a significant surge in demand for capital, especially medium and long-term funds. In response, banks have engaged in a fierce competition to raise deposit interest rates, with the highest rate reaching an impressive 6.4% per annum for terms of 18 months and beyond.

The Thai-Owned Vietnamese Packaging Company to Spend $50 Million on Factory Relocation from Vietnam’s First Industrial Park

SVI is renowned for being one of the top five packaging suppliers in the Southern region, catering to prominent brands such as Unilever, Pepsico, Nestle, and Vinacafe. With a strong reputation for delivering high-quality packaging solutions, SVI has established itself as a trusted partner for industry leaders, ensuring their products are presented with excellence.