Silver Trading and Investment Opportunities: A Shining Outlook

Silver, traded on stock exchanges by the Troy Ounce (abbreviated as Ozt) with one ounce being approximately 31.1 grams, is a precious metal with a range of investment opportunities. The largest producers of silver are Mexico (around 6,000 tons/year), Peru (4,300 tons/year), and China (3,500 tons/year), accounting for over 50% of global production.

In 2022-2023, global demand for silver increased by 11%, partly due to its crucial role in the manufacturing of solar photovoltaic panels. The demand for silver in this industry surged by 64% during these two years. However, global silver production in 2023 experienced a 1% decline compared to the previous year due to decreased usage in jewelry and household goods.

Silver investment is considered a prudent strategy.

The largest companies in the silver market, such as Industrias Penoles SAB de CV, Polymetal International PLC, Fresnillo PLC, and Pan American Silver Corp., boast revenues and market capitalizations in the billions of USD.

Silver offers a reliable investment avenue with diverse options. According to a recent report by the Silver Institute, a non-profit international organization, investing in silver is ideal during periods of challenges in other investment sectors.

The Silver Institute’s report states, “Silver offers a unique combination of stability and growth potential, making it a highly attractive asset as a safe haven for money and its increasing industrial applications. This makes silver an excellent tool for ensuring a balanced, flexible, and risk-mitigated investment portfolio.”

The report also predicts that global silver demand is expected to surpass 1.2 billion ounces by the end of this year. Additionally, silver plays a crucial role in the rapidly growing renewable energy sector, particularly in the production of solar panels and electronic devices.

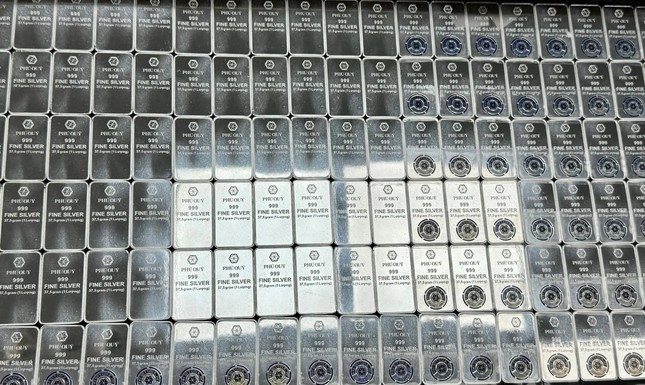

Compared to other precious metals like platinum and gold, silver has the lowest price per ounce, making it appealing and accessible to a wide range of investors, including beginners and those with modest capital. Physical silver is available in weights as low as 37.5 grams (equivalent to 1 tael), currently valued at over 1 million VND.

During economic downturns, investors often shift their focus from other assets to buying silver and gold. Silver is widely used in industrial applications, while gold is more popular among individual buyers. Silver price hikes often coincide with inflationary pressures.

Effective silver investment strategies include investing in physical silver (bars, bullion, and jewelry), silver ETFs, and stocks of silver mining companies. Among these options, investing in physical silver is considered the safest choice.