Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 452 million shares, equivalent to a value of more than 10.5 trillion VND; HNX-Index reached over 38.3 million shares, equivalent to a value of more than 613 billion VND.

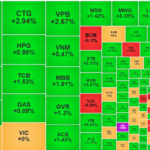

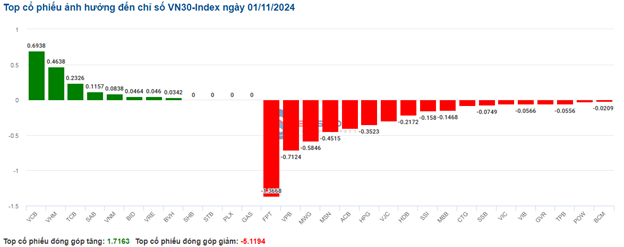

The afternoon session opened with a pessimistic sentiment and sellers gradually gained the upper hand, causing the VN-Index to plunge despite buying pressure appearing towards the end of the session. In terms of impact, MSN, GVR, VPB, and MBB were the most negative stocks, taking away more than 2.4 points from the index. On the other hand, stocks such as SSB, BVH, NLG, and BCG had the most positive impact on the index, but not significantly.

| Top 10 stocks with the strongest impact on VN-Index |

Similarly, the HNX-Index also had a lackluster performance, with the index negatively impacted by MBS (-1.78%), SHS (-1.41%), NTP (-2.03%), and BAB (-0.83%)…

|

Source: VietstockFinance

|

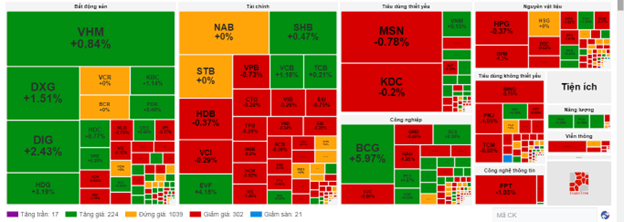

The telecommunications sector recorded the largest decline in the market, falling by -3.69%, mainly due to losses in VGI (-4.54%), CTR (-2.05%), FOX (-2.09%), and TTN (-3.23%). This was followed by the materials sector and the non-essential consumer sector, which decreased by 1.05% and 1.01%, respectively.

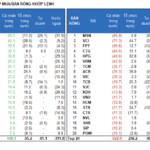

In terms of foreign trading, foreigners continued to net sell over 554 billion VND on the HOSE exchange, focusing on MSN (248.88 billion), VHM (165.71 billion), KDC (101.42 billion), and FPT (67.63 billion). On the HNX exchange, foreigners net bought over 4 billion VND, mainly investing in IDC (8.2 billion), PVS (7.27 billion), TNG (2.63 billion), and PVI (400 million).

| Foreign trading net buy-sell activity |

Morning session: Continued subdued sentiment

Positive signals in terms of liquidity were still absent, and weak demand allowed sellers to easily increase pressure, pushing the indices deeper into negative territory towards the end of the morning session. At the midday break, the VN-Index lost 3.86 points, or 0.31%, to 1,260.62 points; the HNX-Index fell by 0.28% to 225.74 points. Sellers dominated with 402 declining stocks versus 200 advancing stocks.

The matching volume of the VN-Index in the morning reached nearly 195 million units, equivalent to a value of almost 4.5 trillion VND. The HNX-Index recorded a matching volume of nearly 15 million units, with a value of over 224 billion VND.

Despite VCB‘s efforts to support the VN-Index with a contribution of more than 1.5 points, the index still slid due to overwhelming selling pressure. The most negative impact on the VN-Index in the morning was from stocks such as GVR, FPT, MSN, and VPB, which dragged the index down by 2 points.

Red dominated across most sectors. In particular, the telecommunications and information technology groups were at the bottom of the table with decreases of 2.47% and 1.11%, respectively. This was mainly due to losses in VGI (-3%), FOX (-1.1%), CTR (-0.71%), SGT (-2.65%); FPT (-1.1%), and CMG (-1.73%).

The two largest sectors by market capitalization, financials and real estate, were mixed. Most stocks fluctuated slightly, with movements below 1%, except for a few notable gainers such as VCB (+1.18%), PGB (+1.86%), EVF (+2.3%); DIG (+2.19%), HDG (+2.63%), and QCG (+2.52%). On the downside, PTI (-3.53%), VBB (-1.98%), SGB (-1.57%), OCB (-1.31%), MSB (-1.21%), TPB (-1.16%); SZC (-2.05%), NLG (-1.25%), NTL (-1.2%), and others declined.

On the other hand, energy and industrials were the only two sectors that managed to stay in positive territory, supported by gains in BSR (+0.48%), PVS (+0.26%), and PVD (+0.78%); ACV (+0.61%), MVN (+0.92%), SCS (+2.39%), and STG (+4.52%).

Foreigners net sold nearly 278 billion VND on the HOSE exchange in the morning session. Notably, MSN continued to be a major target for offloading, with foreigners net selling over 120 billion VND in the morning session. VHM also faced significant selling pressure, with net selling value reaching nearly 94 billion VND. On the HNX exchange, foreigners net sold over 10 billion VND at the end of the morning session.

10:35 am: Liquidity declines

Investors remained cautious, and trading volume failed to improve, resulting in a decline for the main indices, which fluctuated around the reference level. As of 10:30 am, the VN-Index was down 0.37 points, trading around 1,264 points. The HNX-Index fell 0.32 points, trading around 226 points.

Stocks in the VN30 basket showed mixed performance, but sellers had a slight edge. Specifically, VCB, VHM, TCB, and SAB contributed 0.69 points, 0.46 points, 0.23 points, and 0.12 points to the index, respectively. Conversely, FPT, VPB, MWG, and MSN faced strong selling pressure and dragged the index down by more than 3 points.

Source: VietstockFinance

|

The telecommunications services sector continued to lead the groups with the most negative impact on the market in the morning, with stocks such as VGI falling nearly 2%, YEG down 1.44%, TTN losing 1.29%, FOX declining 0.88%, ELC down 0.2%, and VTK falling 2.26%, among others. The remaining stocks in this sector were mostly unchanged or slightly lower.

From a technical perspective, BCG stock witnessed a strong increase and formed a White Marubozu candlestick pattern, accompanied by above-average trading volume. This indicates active participation from investors. Moreover, the stock price has risen above the SMA 50-day moving average, while the Stochastic Oscillator indicator is trending upwards after generating a buy signal earlier, suggesting a return to a positive mid-term outlook.

Source: https://stockchart.vietstock.vn/

|

Following closely were stocks in the information technology sector. Specifically, several stocks opened in negative territory, including FPT (-0.96%), CMG (-0.96%), CMT (-0.77%), and PIA (-1.47%), among others. The remaining stocks in this sector were mostly unchanged or slightly higher.

On the positive side, the energy sector rose nearly 1%, led by gains in BSR (+0.95%), PVS (+0.79%), PVD (+1.36%), and TVD (+0.83%).

Compared to the opening, the number of stocks trading around the reference price remained high at nearly 1,040, indicating a persistent tug-of-war between buyers and sellers. However, sellers held a stronger position, with 302 declining stocks versus 224 advancing stocks.

Source: VietstockFinance

|

Opening: Caution from the start

At the start of the November 1 session, as of 9:30 am, the VN-Index fluctuated around the reference level, reaching 1,263.5 points. Meanwhile, the HNX-Index also edged lower, falling to 226.23 points.

Oil prices rose on Thursday (October 31) as investors priced in stronger fuel demand in the US and the possibility of OPEC+ delaying its planned production increase in December, just five days before the US presidential election.

At the close of the trading session on October 31, Brent crude oil futures rose 61 cents (or 0.84%) to $73.16 per barrel. WTI crude oil futures gained 65 cents (or 0.95%) to $69.26 per barrel.

As of 9:30 am, large-cap stocks such as VCB, BID, and VHM led the market higher, contributing more than 1.5 points to the index. On the other hand, stocks such as FPT, GVR, and VPB weighed on the market, dragging the index down by less than 1 point.

Red dominated the market in the morning session, with several stocks in the telecommunications services sector declining from the start, including VGI (-1.65%), CTR (-0.32%), YEG (-0.96%), ELC (-0.4%), FOX (-0.77%), and MFS (-1.67%), among others. The remaining stocks in this sector were mostly unchanged.

In contrast, the energy sector led the groups with the most positive impact on the market in the morning. Notable gainers included BSR (+0.48%), PVS (+0.53%), PVD (+0.97%), and PVB (+0.36%), among others.

Is a V-Shaped Recovery in the Cards for the Market Post-Deep Pullback?

The afternoon session witnessed a surge in trading activities, with momentum picking up towards the end. The depletion of selling pressure from the morning session triggered a rapid upward swing in prices. As buying momentum improved, sellers became imbalanced, leading to a dominant wave of rising prices across the board. The HoSE trading volume soared by 130% in the afternoon session compared to the morning.

The Foreign Block: Ending the Sell-Off, Going Long on Retail and Bank Stocks

Foreign investors bought a net amount of 116.2 billion VND, and for matched orders, they bought a net amount of 189.1 billion VND.

The Market Beat: Low-End Buyers Return, but VN-Index Stays in the Red

The market ended the session on a negative note, with the VN-Index shedding 2.24 points (-0.18%) to close at 1,250.32. The HNX-Index also dipped, losing 0.02 points (-0.01%) to finish at 226.86. The market breadth was relatively balanced, with 321 decliners against 343 advancers. The large-cap VN30-Index painted a similar picture, as 19 stocks fell, 10 rose, and 1 remained unchanged, tilting the index towards the red.