Royal Invest is a leading manufacturer and trader of tiles, artificial quartz stone

|

On its debut (December 12), RYG’s reference price was VND 15,000 per share, with a trading band of +/- 20% compared to the reference price. With 45 million shares listed, the market capitalization on the first trading day was equivalent to VND 675 billion. The listing took effect from October 31, 2024.

On May 21, HOSE announced that it had received a listing registration application for 45 million RYG shares, equivalent to a charter capital of VND 450 billion. Starting November 20, 2023, the Vietnam Securities Depository (VSDC) began custody of these shares.

Previously, on October 20, 2023, the State Securities Commission of Vietnam (SSC) announced that RYG successfully sold 9 million shares in its initial public offering (IPO) at VND 15,000 per share, raising VND 135 billion. With this IPO, RYG became a public company.

Post-IPO, RYG’s charter capital increased from VND 360 billion to VND 450 billion, equivalent to 45 million shares with 137 domestic shareholders. Based on the IPO results, the company’s Board of Directors approved the listing application on HOSE and set the expected reference price for RYG shares on the first trading day at VND 15,000 per share.

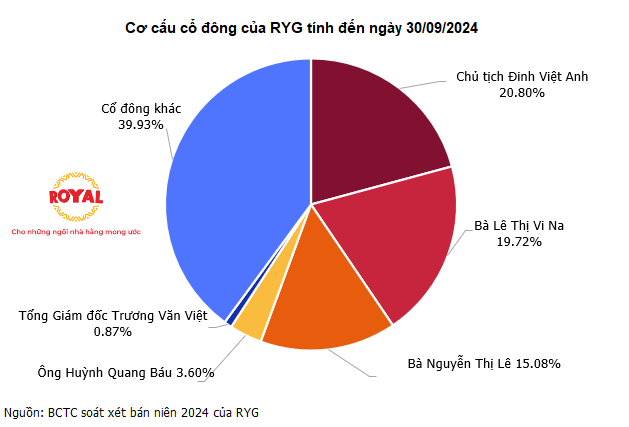

Currently, the largest shareholder of RYG is Mr. Dinh Viet Anh, Chairman of the Board of Directors, holding 20.8% of the capital. Following are Ms. Le Thi Vi Na (19.72%), Ms. Nguyen Thi Le (15.08%), Mr. Huynh Van Bau (3.6%), and Mr. Truong Van Viet – CEO (0.87%).

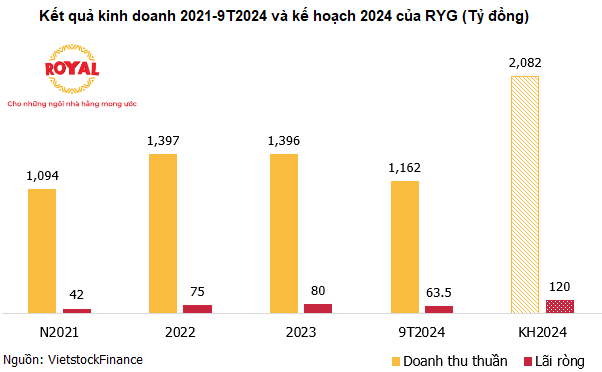

In terms of business performance, in Q3 2024, RYG recorded a net profit of nearly VND 18 billion, down 25% over the same period in 2023, due to lower revenue and higher expenses. Thanks to efficient operations in the first half, net profit for the first nine months was still 28% higher than the previous year, reaching VND 63.5 billion, achieving 53% of the annual profit target.

In a related development, on November 7, RYG’s Board of Directors approved a short-term loan of VND 80 billion from Wooribank Vietnam – Bac Ninh Branch to supplement working capital for business activities.

The loan has a term of 364 days and is secured by a VND 32 billion term deposit of the Company/third party; a VND 60 billion guarantee letter from the Chairman of the Board of Directors, Mr. Dinh Viet Anh; and inventory valued at VND 48 billion belonging to the Company.

By The Manh

The Rising Exchange Rate: A Boon for Banks

The volatile exchange rates in the first half of the year have resulted in a windfall for many banks’ foreign exchange business.

The Dynamic Duo: Unveiling the Power of Nhất Việt Securities’ New Board

On November 11th, the Board of Directors of VFS Joint Stock Company (HNX: VFS) passed two resolutions to establish the Procurement and Expenses Council and the Investment and Capital Council for the term 2024-2029. Key roles within these councils are held predominantly by the newly appointed members of the Board of Directors, who joined in April 2024.

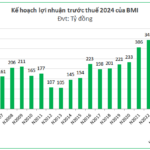

Profits Plummet: Bảo Minh Insurance Projects a 29% Drop in 2024 Profit Plans

The Board of Directors of Baominh Insurance Joint Stock Corporation (HOSE: BMI) has proposed to adjust and reduce the profit plan for 2024, following a significant drop in interest rates in the third quarter due to Storm Yagi.