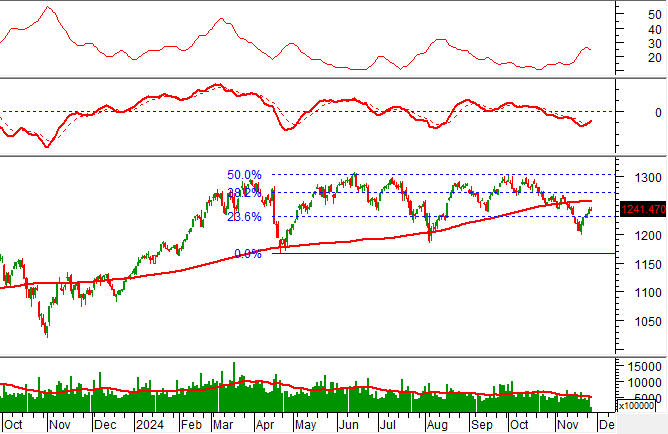

Technical Signals for the VN-Index

During the trading session on the morning of November 27, 2024, the VN-Index witnessed a decline and formed a Doji-like pattern, while trading volume decreased, indicating investors’ cautious sentiment.

Additionally, the VN-Index is testing the Fibonacci Projection 23.6% threshold (equivalent to the 1,225-1,240 point region) as the MACD indicator flashes a buy signal. A successful breakthrough above this resistance level would further strengthen the recovery momentum.

However, the ADX indicator is currently moving within the gray zone (20 < adx < 25), suggesting a period of consolidation.

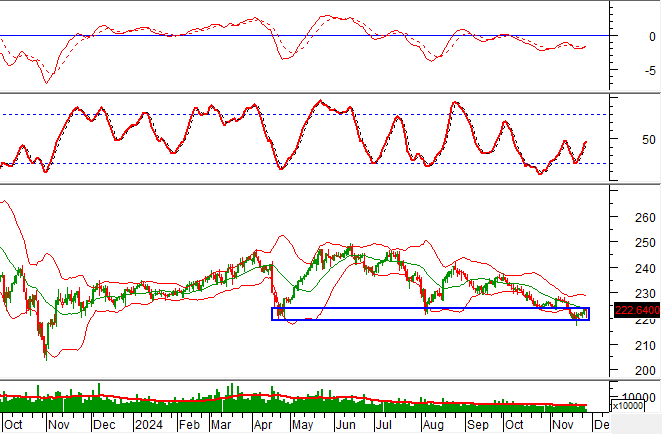

Technical Signals for the HNX-Index

On November 27, 2024, the HNX-Index declined, accompanied by a significant drop in trading volume during the morning session, reflecting investors’ cautious approach.

At present, the HNX-Index is retesting the April 2024 low (around 220-225 points) while the MACD indicator continues to narrow the gap with the signal line after previously giving a sell signal. If a buy signal reappears, the short-term outlook is likely to improve in the upcoming sessions.

CSV – Southern Basic Chemicals JSC

On the morning of November 27, 2024, CSV witnessed a slight increase in price, but trading volume remained unchanged, indicating investors’ indecision.

Currently, the stock price is retesting the Middle line of the Bollinger Bands, and the MACD indicator has turned bullish. In a positive scenario, if the stock price rebounds, a short-term upward trend may emerge in the coming sessions.

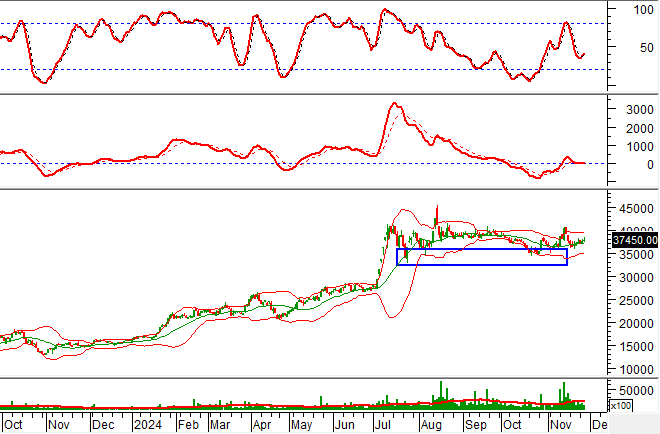

KDH – Khang Dien House Trading and Investment Joint Stock Company

During the morning session of November 27, 2024, KDH experienced a price decline, along with a significant drop in trading volume, suggesting investors’ cautious sentiment.

Additionally, the stock price is testing the SMA 200-day moving average, while the Stochastic Oscillator continues its upward trajectory after providing a buy signal. If the stock price successfully surpasses this resistance level, the long-term optimistic outlook may return in the upcoming sessions.

Technical Analysis Team, Vietstock Consulting Department

The Power of Persuasive Words: Crafting a Compelling Headline

“Sustaining the Uptrend: A Comprehensive Guide to Navigating the Volatile Market”

The VN-Index continued its upward trajectory, surging above the Middle Band of the Bollinger Bands. If, in the upcoming sessions, the index sustains its position above this threshold, coupled with trading volumes surpassing the 20-day average, the upward momentum will be reinforced. Moreover, the MACD indicator has flashed a buy signal, crossing above the signal line, boding well for the short-term outlook.

The Market Tug-of-War Continues

The VN-Index witnessed a slight dip with a tug-of-war session, coupled with below-average trading volume. This cautious investor sentiment persists, as reflected by the MACD indicator, which has given a buy signal after crossing above the signal line. In tandem, the Stochastic Oscillator echoes a similar message. Should this momentum be sustained in the upcoming sessions, the outlook may not be as pessimistic as it seems.

Market Beat Nov 1: Sharp Drop, VN-Index Nears 1,250 Points

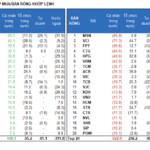

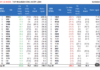

The market closed with the VN-Index down 9.59 points (-0.76%) to 1,254.89, while the HNX-Index fell 0.95 points (-0.42%) to 225.41. The market breadth tilted towards decliners with 480 stocks decreasing and 251 advancing. The VN30-Index basket witnessed a similar trend, with 25 losers, 3 gainers, and 2 stocks referenced.

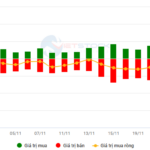

The Foreign Block: Ending the Sell-Off, Going Long on Retail and Bank Stocks

Foreign investors bought a net amount of 116.2 billion VND, and for matched orders, they bought a net amount of 189.1 billion VND.

The Market Beat: Low-End Buyers Return, but VN-Index Stays in the Red

The market ended the session on a negative note, with the VN-Index shedding 2.24 points (-0.18%) to close at 1,250.32. The HNX-Index also dipped, losing 0.02 points (-0.01%) to finish at 226.86. The market breadth was relatively balanced, with 321 decliners against 343 advancers. The large-cap VN30-Index painted a similar picture, as 19 stocks fell, 10 rose, and 1 remained unchanged, tilting the index towards the red.