I. MARKET ANALYSIS OF THE STOCK MARKET ON 11/27/2024

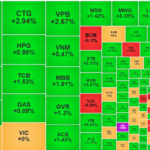

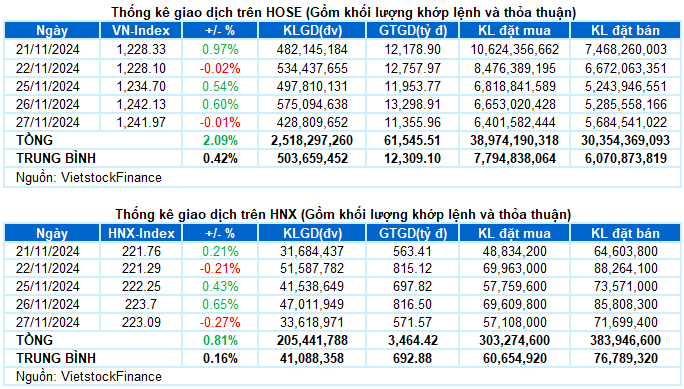

– The main indices edged lower in the trading session on November 27. The VN-Index closed just below the reference mark, reaching 1,241.97 points; HNX-Index closed at 223.09 points, down 0.27% from the previous session.

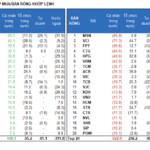

– Matching volume on the HOSE reached just over 366 million units, down 27.4% from the previous session. Matching volume on the HNX decreased by 29.6%, reaching nearly 31 million units.

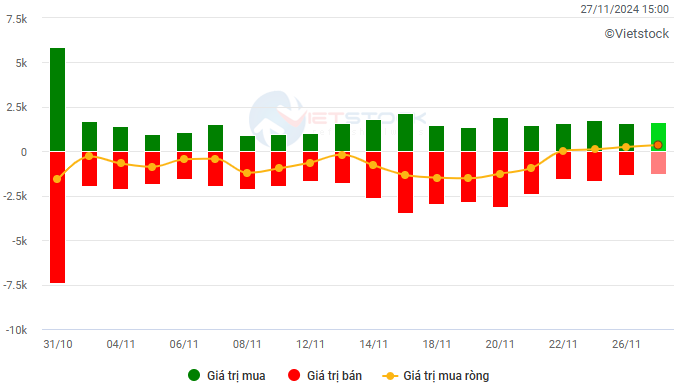

– Foreign investors net bought on the HOSE with a value of more than VND 354 billion and net bought more than VND 13 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

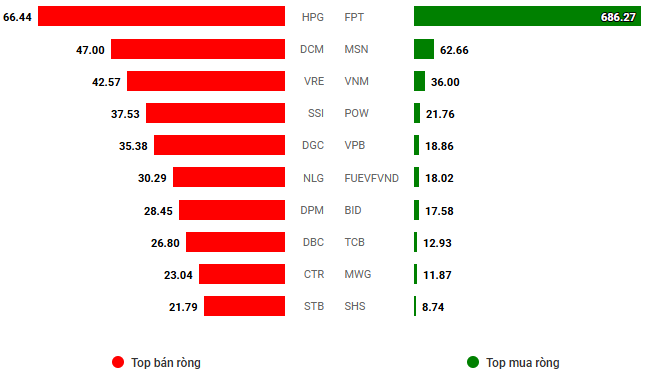

Net trading value by stock code. Unit: VND billion

– The stock market today returned to a cautious trading state as buyers became more cautious and no longer accepted buying in an uptrend. The tug-of-war situation persisted throughout the trading session amid low liquidity. At the close, the VN-Index stood at 1,241.97 points, down 0.01%.

– In terms of impact, FPT was the most prominent bright spot in today’s gloomy context, with this stock alone contributing more than 1.3 points to the VN-Index. This was followed by VCB, which also contributed nearly half a point to the overall index despite a slight increase in share price. On the contrary, the most notable negative influence was VHM, which took away about half a point from the VN-Index, while the remaining stocks had a negligible impact.

– The VN30-Index rose 0.14% to 1,301.06 points. The breadth was relatively balanced with 9 gainers, 14 losers, and 7 stocks standing at the reference price. Among them, FPT and POW led the gains with increases of 2.7% and 1.6%, respectively. On the other hand, VHM, SSI, and VRE were the top losers, falling more than 1%. The remaining stocks fluctuated slightly around the reference price.

Considering sector performance, information technology and telecommunications were the two sectors that witnessed outstanding gains today, thanks to the positive contributions of FPT (+2.74%), CMG (+1.31%); VGI (+1.44%), FOX (+3.06%), and FOC (+1.95%).

Most other sectors exhibited mixed performances, resulting in limited fluctuations. Notably, within the financial group, most stocks experienced slight increases or decreases around the reference price, except for a few standouts such as LPB (+1.25%), EIB (+2.19%), SSI (-1.22%), VND (-1.07%), BVS (-2.1%), and BIC (-1.96%).

The healthcare sector lagged today as strong selling pressure was observed in several large-cap stocks, including IMP (-1.14%), DVN (-7.22%), TNH (-1.23%), DTP (-3.02%), and DCL (-3.14%).

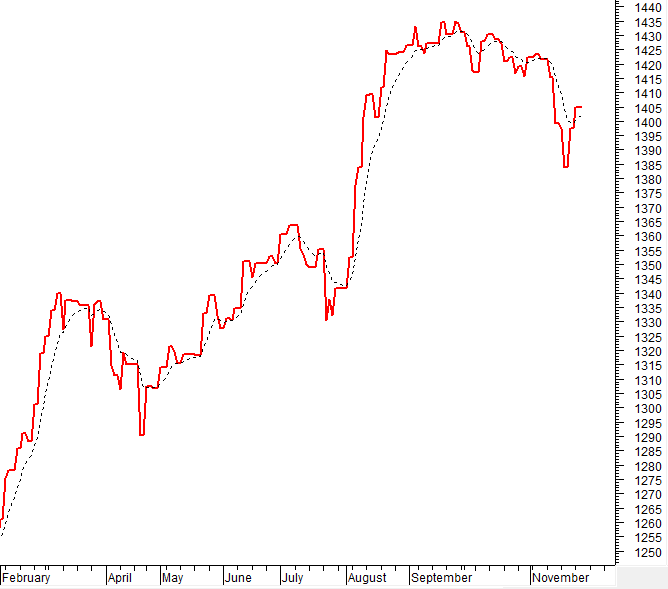

The VN-Index edged lower amid a tug-of-war situation, accompanied by trading volume below the 20-day average. This reflects the continued cautious sentiment among investors. At present, the MACD indicator has given a buy signal after crossing above the Signal Line. Additionally, the Stochastic Oscillator indicator is also providing a similar signal. If this persists in the coming sessions, the outlook may not be overly pessimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – The MACD indicator has given a buy signal again

The VN-Index edged lower amid a tug-of-war situation, accompanied by trading volume below the 20-day average. This reflects the continued cautious sentiment among investors.

Currently, the MACD indicator has given a buy signal after crossing above the Signal Line. Additionally, the Stochastic Oscillator indicator is also providing a similar signal. If this persists in the upcoming sessions, the outlook may not be overly pessimistic.

HNX-Index – Trading volume fluctuates erratically

The HNX-Index declined amid trading volume below the 20-day average and erratic fluctuations in recent sessions. This indicates a lack of stability in investor sentiment.

However, the Stochastic Oscillator indicator continues to trend upward after leaving the oversold region. Moreover, the MACD indicator has given a buy signal again after crossing above the Signal Line. If this persists, the short-term outlook may not be overly negative.

Analysis of Money Flow

Fluctuation of Smart Money Flow: The Negative Volume Index indicator of the VN-Index has risen above the 20-day EMA line. If this state continues in the next session, the risk of an unexpected downturn (thrust down) will be mitigated.

Fluctuation of Foreign Investment Flow: Foreign investors continued to net buy in the trading session on November 27, 2024. If foreign investors maintain this behavior in the coming sessions, the outlook will be more optimistic.

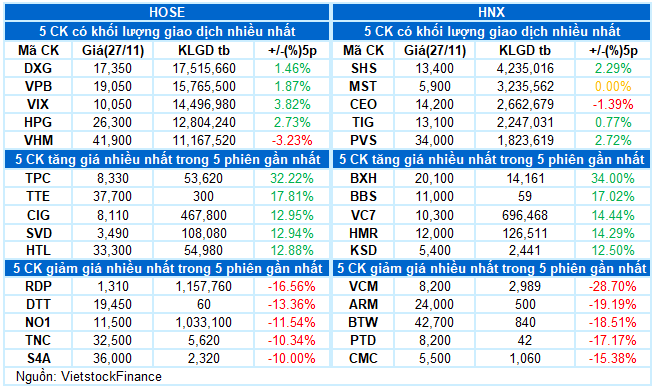

III. MARKET STATISTICS ON 11/27/2024

Economic Analysis and Market Strategy Department, Vietstock Consulting

Market Beat Nov 1: Sharp Drop, VN-Index Nears 1,250 Points

The market closed with the VN-Index down 9.59 points (-0.76%) to 1,254.89, while the HNX-Index fell 0.95 points (-0.42%) to 225.41. The market breadth tilted towards decliners with 480 stocks decreasing and 251 advancing. The VN30-Index basket witnessed a similar trend, with 25 losers, 3 gainers, and 2 stocks referenced.

Is a V-Shaped Recovery in the Cards for the Market Post-Deep Pullback?

The afternoon session witnessed a surge in trading activities, with momentum picking up towards the end. The depletion of selling pressure from the morning session triggered a rapid upward swing in prices. As buying momentum improved, sellers became imbalanced, leading to a dominant wave of rising prices across the board. The HoSE trading volume soared by 130% in the afternoon session compared to the morning.

The Foreign Block: Ending the Sell-Off, Going Long on Retail and Bank Stocks

Foreign investors bought a net amount of 116.2 billion VND, and for matched orders, they bought a net amount of 189.1 billion VND.