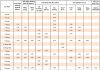

On November 25, NLD reporters observed that several commercial banks had adjusted their deposit interest rates upwards for various terms.

CBBank has also joined this heated race. Accordingly, in today’s applied interest rate table, CBBank increased deposit interest rates for the long-term 12-month term to 5.55% per year, an increase of 1.15 percentage points compared to before. The highest savings interest rate at this bank is 5.7% per year when customers deposit for long-term periods of 13 months or more.

Previously, ABBANK, Bac A Bank, Saigonbank, Nam A Bank, VIB, and Agribank had also adjusted their deposit interest rates upwards for various terms.

Deposit interest rates have been inching up since the beginning of November at many banks

On the other hand, an unexpected “change in the wind” occurred as Quoc Bank (NCB) unexpectedly adjusted its interest rates downwards for a few terms. In the latest interest rate table, customers depositing for 6-9 month terms will receive interest rates of 5.15% and 5.25%, respectively, a decrease of 0.1 percentage points compared to before.

Ms. Tran Thi Ha My, Senior Analyst at Rong Viet Securities Company, opined that the liquidity of the banking system has shown signs of widespread tension recently, as reflected in the overnight lending interest rate developments in the interbank market in the first 20 days of November, which stood at 5.17% per year, 1.55 percentage points higher than the previous month’s average. At the same time, the average lending interest rates for terms of less than one month also increased from 1.03 to 1.45 percentage points.

“The lower change in the 3-month term indicates that the system’s liquidity difficulties are short-term and occur during the peak season for credit growth in the last months of the year,” said Ms. Ha My.

At the same time, deposit interest rates of banks have also been adjusted upwards more strongly than in the previous month, with more adjustments in the short-term rates from 1 to 3 months at joint-stock banks such as VIB and Nam A Bank.

In the state-owned commercial bank group, Agribank has consecutively increased deposit interest rates for the past four months, becoming the state-owned commercial bank with the highest deposit interest rates, with the 12-month term rate at 4.8% per year, higher than Vietcombank, BIDV, and VietinBank. However, Agribank’s deposit interest rates are still significantly lower than the average deposit interest rates of the joint-stock bank group.

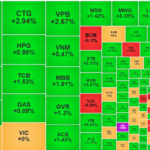

The Flow of Funds: Is It Time to Buy Big?

The market’s initial response to the psychological support level of 1200 points was positive last week. However, liquidity concerns have experts uncertain about a significant bottom formation around this level.

The Race to Raise Deposit Rates: Why Banks Are Competing to Offer Higher Returns

As we approach the year-end, there has been a significant surge in demand for capital, especially medium and long-term funds. In response, banks have engaged in a fierce competition to raise deposit interest rates, with the highest rate reaching an impressive 6.4% per annum for terms of 18 months and beyond.

Is a V-Shaped Recovery in the Cards for the Market Post-Deep Pullback?

The afternoon session witnessed a surge in trading activities, with momentum picking up towards the end. The depletion of selling pressure from the morning session triggered a rapid upward swing in prices. As buying momentum improved, sellers became imbalanced, leading to a dominant wave of rising prices across the board. The HoSE trading volume soared by 130% in the afternoon session compared to the morning.