I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON NOVEMBER 26, 2024

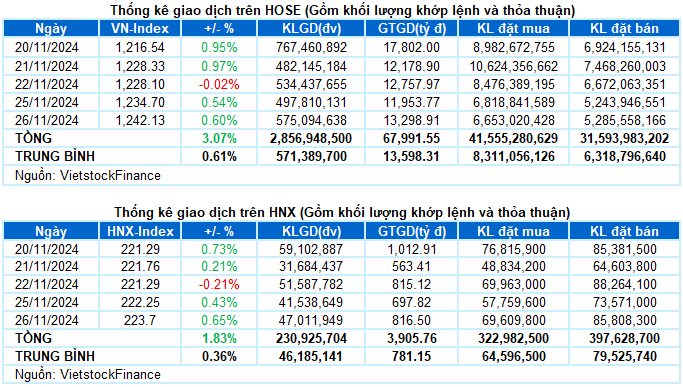

– The main indices continued to rise during the trading session on November 26. The VN-Index closed 0.6% higher at 1,242.13 points, while the HNX-Index ended at 223.7 points, a 0.65% increase from the previous session.

– The trading volume on the HOSE reached nearly 504 million units, a 23.2% increase compared to the previous session. On the HNX, the trading volume rose by 26.1% to nearly 44 million units.

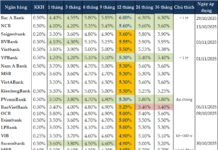

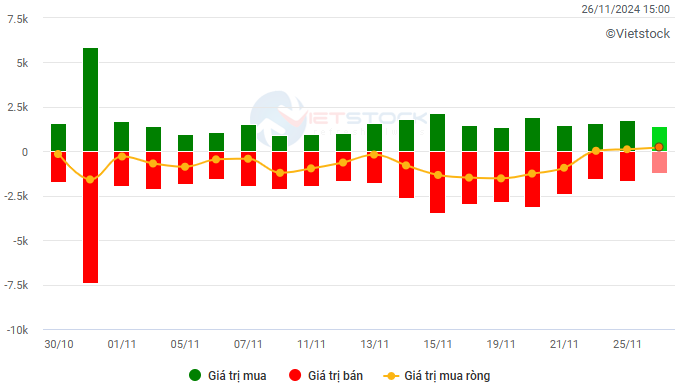

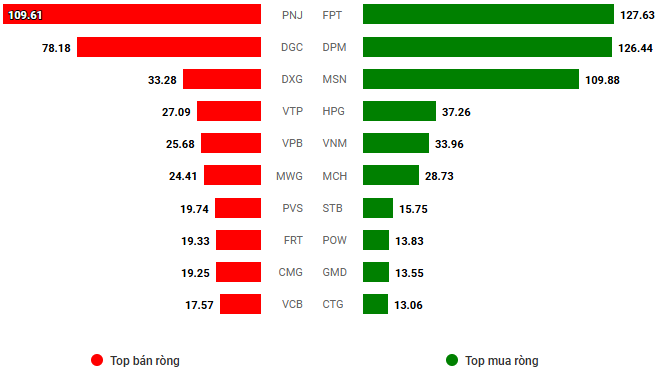

– Foreign investors net bought on the HOSE with a value of nearly VND 200 billion and net sold over VND 13 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

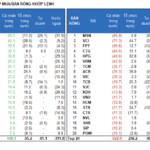

Net trading value by stock code. Unit: VND billion

– Investor sentiment improved significantly after the recent recovery sessions. Buyers dominated from the start of the session, helping to maintain the green color. Although the upward momentum slowed down considerably after the VN-Index approached the 1,245-point mark, the selling pressure was well absorbed. Moreover, the net buying by foreign investors is also a positive signal for the current context. At the end of the session, the VN-Index stood at 1,242.13 points, up 7.43 points from the previous session.

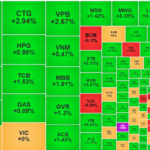

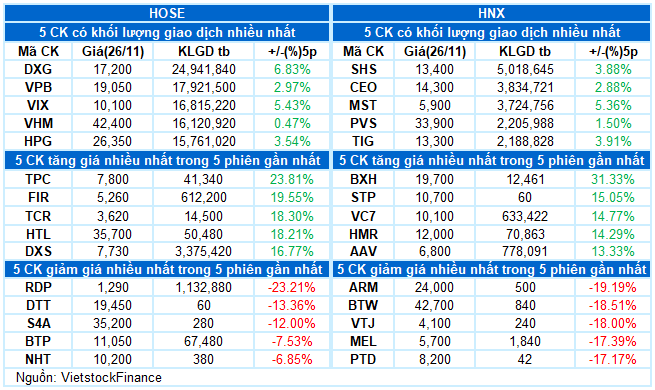

– In terms of impact, VCB, BID, and FPT made the most positive contributions to today’s gain, helping the VN-Index rise by more than 3 points. On the other hand, HVN, VHM, and VTP had the most negative influence, but their impact was not significant.

– The VN30-Index closed 0.56% higher at 1,299.22 points. The market breadth was strongly positive, with 25 gainers, 2 losers, and 3 unchanged stocks. Among the gainers, MWG, POW, and BID led with increases of more than 1.5%. VHM and PLX were the only two stocks that went against the overall trend, falling slightly by less than 1%.

Most industry groups were in positive territory, led by the financial sector, which witnessed a strong performance from many banking and securities stocks such as VCB (+1.2%), BID (+1.54%), HDB (+1.42%), STB (+1.07%), OCB (+1.44%), VND (+1.08%), HCM (+1.62%), VIX (+2.75%), FTS (+1.32%), SHS (+2.29%), and MBS (+1.1%), among others.

The real estate group was also a notable highlight, especially during the morning session. Despite the gains narrowing in the afternoon session, many stocks managed to hold on to significant increases, including KDH (+1.22%), KBC (+1.83%), PDR (+1.67%), NLG (+1.58%), DXG (+1.18%), TCH (+2.62%), CEO (+2.14%), and HDC (+2.4%), to name a few.

Telecommunications and industrials were the only two sectors that ended in negative territory, mainly due to losses in HVN (-2.67%), MVN (-5.62%), VTP (-4.06%), PHP (-5.08%), VGI (-0.49%), and CTR (-1.93%).

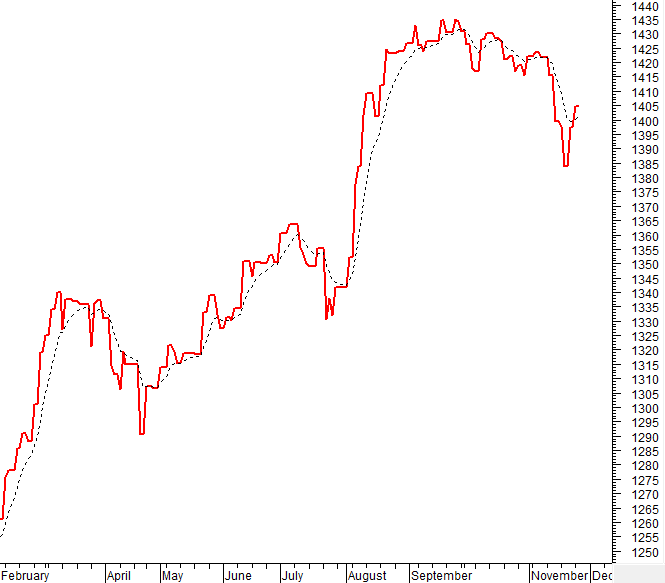

The VN-Index continued its upward trajectory and managed to surpass the Middle line of the Bollinger Bands. If, in the upcoming sessions, the index manages to hold above this threshold, coupled with trading volume exceeding the 20-day average, the uptrend is likely to be reinforced. Additionally, the MACD indicator has given a buy signal again after crossing above the Signal Line, suggesting a more optimistic short-term outlook.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Surpassing the Middle Line of the Bollinger Bands

The VN-Index continued its upward trajectory and managed to surpass the Middle line of the Bollinger Bands. If, in the upcoming sessions, the index can maintain its position above this threshold, coupled with trading volume exceeding the 20-day average, the upward momentum is likely to be reinforced.

Furthermore, the MACD indicator has issued a buy signal once again, crossing above the Signal Line, which indicates a more optimistic short-term outlook.

HNX-Index – MACD Indicator Gives a Buy Signal

The HNX-Index witnessed a strong performance, with the trading volume surpassing the 20-day average, indicating an influx of capital into the market.

At the moment, the Stochastic Oscillator is trending upward after leaving the oversold region. Additionally, the MACD indicator has provided a buy signal again, crossing above the Signal Line. If this trend persists, the outlook will become even more optimistic.

Analysis of Capital Flows

Movement of Smart Money: The Negative Volume Index of the VN-Index has risen above the EMA 20-day line. If this state continues into the next session, the risk of an unexpected downturn will be mitigated.

Foreign Capital Flows: Foreign investors continued to net buy during the trading session on November 26, 2024. If this trend persists in the upcoming sessions, it will further bolster the optimistic outlook.

III. MARKET STATISTICS FOR NOVEMBER 26, 2024

Economic and Market Strategy Analysis Department, Vietstock Consulting

The Market Tug-of-War Continues

The VN-Index witnessed a slight dip with a tug-of-war session, coupled with below-average trading volume. This cautious investor sentiment persists, as reflected by the MACD indicator, which has given a buy signal after crossing above the signal line. In tandem, the Stochastic Oscillator echoes a similar message. Should this momentum be sustained in the upcoming sessions, the outlook may not be as pessimistic as it seems.

Market Beat Nov 1: Sharp Drop, VN-Index Nears 1,250 Points

The market closed with the VN-Index down 9.59 points (-0.76%) to 1,254.89, while the HNX-Index fell 0.95 points (-0.42%) to 225.41. The market breadth tilted towards decliners with 480 stocks decreasing and 251 advancing. The VN30-Index basket witnessed a similar trend, with 25 losers, 3 gainers, and 2 stocks referenced.

Is a V-Shaped Recovery in the Cards for the Market Post-Deep Pullback?

The afternoon session witnessed a surge in trading activities, with momentum picking up towards the end. The depletion of selling pressure from the morning session triggered a rapid upward swing in prices. As buying momentum improved, sellers became imbalanced, leading to a dominant wave of rising prices across the board. The HoSE trading volume soared by 130% in the afternoon session compared to the morning.