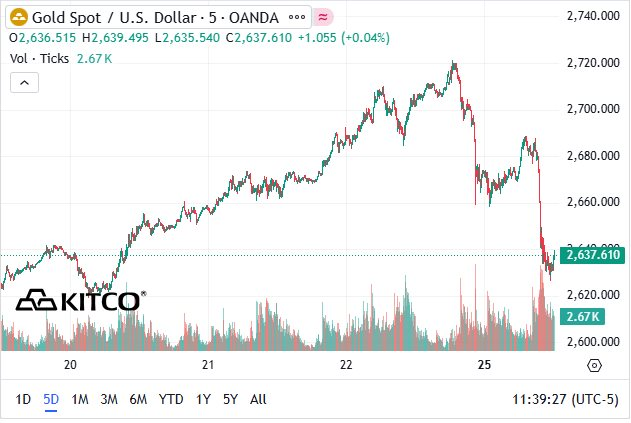

Gold prices plunged by $85/ounce to $2625/ounce on the evening of November 25, marking a sharp decline after a significant increase of over $150/ounce in the previous week.

According to Kitco News, the sudden drop in gold prices can be attributed to increased risk appetite among investors and significant profit-taking pressure from short-term futures traders. The US stock market began the shortened Thanksgiving week on a more positive note, which worked against safe-haven metals. There are also reports suggesting that Israel and Hamas may be nearing a ceasefire agreement. Additionally, the improved risk sentiment can be partly attributed to President-elect Donald Trump’s choice of Scott Bessent, a hedge fund manager, as the Secretary of the Treasury. Market analysts believe that with Bessent at the helm of the Treasury, the US financial system is in “safe hands.” This has been cited as one of the reasons for the rise in US Treasury bond yields over the past few weeks.

The gold price movement came as a shock, given the strong recovery witnessed in the previous week, surpassing the $2700/ounce mark – a crucial level for determining the trend. In Kitco News’ weekly gold price survey, 18 analysts participated, and none of them predicted a decline in gold prices in the short term. Sixteen experts, or 89%, anticipated an increase in gold prices for the week, while the remaining two analysts, accounting for 11%, expected prices to hold steady.

The online poll by Kitco attracted 189 votes, reflecting a return to an optimistic sentiment among Main Street participants in line with price movements. Small investors showed a positive outlook, with 125 respondents, or 66%, predicting a rise in gold prices for the week, whereas 36 respondents, or 19%, anticipated a decline. The remaining 28 investors, accounting for 15% of the total votes, expected gold prices to remain unchanged in the near term.

Domestic gold prices also underwent a significant correction on November 25, falling by VND 0.5-1 million/lauro. By the end of the day, SJC gold prices stood at VND 84.6-86.6 million/lauro. Gold ring prices also retreated to around VND 84.3-85.8 million/lauro.

Gold Prices Slip: Where to Sell Your Gold for the Best Price?

The gold market is abuzz as the buying price of SJC gold bars has surged past 83 million VND per tael, while gold bullion and 99.99% purity gold rings have stabilized after a downward trend.

Gold Prices Plummet Following Israel-Hezbollah Ceasefire

“Donald Trump’s selection of Scott Bessent as his pick for US Treasury Secretary has dampened the allure of gold. “