The foreign investment fund Dragon Capital, represented by Ms. Truong Ngoc Phuong, has recently submitted a report to the State Securities Commission of Vietnam, the Ho Chi Minh City Stock Exchange (HoSE), and the DXG Corporation (listed on HoSE with the ticker symbol DXG). The report disclosed changes in ownership among affiliated foreign investors holding more than 5% of the company’s shares.

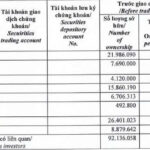

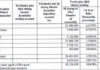

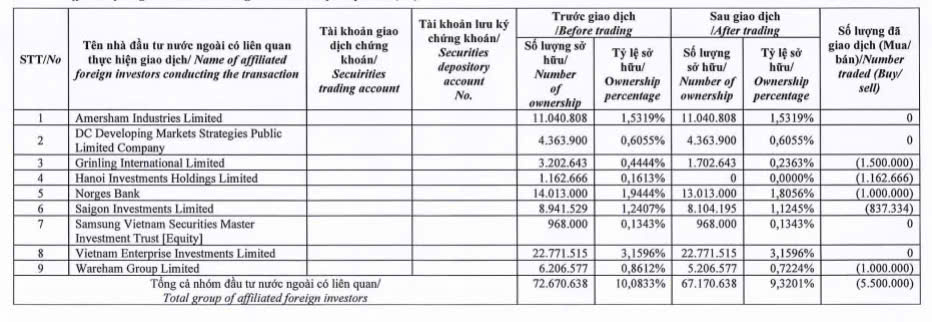

On November 20, 2024, Dragon Capital, through five of its member funds, sold a total of 5.5 million DXG shares of the DXG Corporation. Specifically, Grinling International Limited sold 1.5 million DXG shares, Hanoi Investments Holdings Limited offloaded over 1.16 million, Norges Bank sold 1 million, Saigon Investments Limited divested 837,334, and Warcham Group Limited sold 1 million DXG shares.

Source: DXG

Following this transaction, Dragon Capital’s holdings in DXG decreased from over 72.67 million shares to more than 67.17 million, resulting in a reduction of their ownership stake in the corporation from 10.0833% to 9.3201%.

Based on DXG’s closing price of VND 17,100 per share on November 20, 2024, Dragon Capital is estimated to have garnered approximately VND 94.05 billion from this sale.

In terms of financial performance, according to the consolidated financial statements for the third quarter of 2024, DXG reported a 17% year-over-year decrease in revenue, amounting to VND 1,013 billion. Gross profit also declined by 15%, reaching VND 505 billion.

During this period, financial income exceeded VND 13 billion, compared to VND 7.6 billion in the same period last year. Both financial expenses and selling expenses were reduced, amounting to VND 105 billion and VND 166 billion, respectively. Conversely, management expenses increased by 31% to VND 105 billion.

Notably, DXG incurred a negative impact from other income, which stood at a loss of VND 12 billion, compared to a profit of VND 2.5 billion in the previous year’s third quarter.

Consequently, DXG’s profit after tax amounted to VND 73 billion, representing a 34% decline year-over-year. Even more significantly, the profit after tax attributable to the parent company plummeted by 54%, reaching only VND 31 billion.

DXG attributed the decrease in third-quarter profit to slower-than-expected product deliveries to customers. Revenue from apartment and land sales in the third quarter of 2024 totaled VND 597 billion, less than half of the VND 1,000+ billion achieved in the corresponding period last year.

For the nine months ended September 30, 2024, DXG’s total revenue reached nearly VND 3,204 billion, reflecting a 39% increase compared to the same period in 2023. Profit after tax amounted to VND 244 billion, a substantial improvement of 63%. This growth was attributed to the low base effect, as DXG incurred a loss of over VND 100 billion in the first quarter of 2023.

As of September 30, 2024, DXG’s total assets were valued at nearly VND 28,851 billion, a slight increase from the beginning of the year. Inventory accounted for 48% of total assets, amounting to VND 13,830 billion, with real estate under development comprising over VND 11,300 billion. Construction in progress stood at nearly VND 716 billion.

Accounts receivable totaled VND 11,284 billion, including VND 2,865 billion in deposits and escrow payments for real estate marketing and distribution contracts. Additionally, VND 2,418 billion was classified as advance payments for investments. DXG also had investments in joint ventures and associates totaling VND 356 billion.

On the liabilities side, DXG’s total liabilities as of September 30, 2024, amounted to VND 13,216 billion, a decrease of nearly VND 1,400 billion from the beginning of the year. Short-term advances from customers stood at VND 983 billion, a 44% reduction compared to the start of the year.

The Vinhomes Record-Breaking Deal: Unveiling the Biggest Transaction in Stock Market History

The recent repurchase of approximately 247 million VHM shares has resulted in a significant shift for Vinhomes. The number of voting shares has decreased from over 4.35 billion to nearly 4.11 billion, leading to a consequent reduction in the company’s chartered capital. This decrease is reflected in a change from over VND 43,544 billion to just over VND 41,000 billion.

“Foreign Fund Group Offloads Over 1.2 Million PVS Shares”

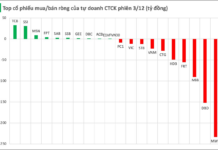

On November 21, 2024, Dragon Capital demonstrated its strategic acumen in the stock market by purchasing 170,000 PVS shares while offloading 1.4 million, thereby reducing its ownership stake to below 7%.