The foreign investment fund group Dragon Capital, represented by Ms. Truong Ngoc Phuong, has sent a report to the State Securities Commission of Vietnam, the Ho Chi Minh City Stock Exchange (HoSE), and the Vietnam Oil and Gas Technical Services Corporation (PVS: HNX) regarding changes in ownership of the group as a major foreign investor holding more than 5% of the shares.

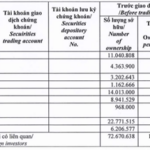

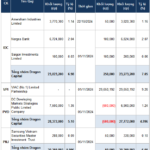

On November 21, 2024, Dragon Capital, through its two member funds, purchased 170,000 PVS shares and sold 1.4 million shares through another member fund. Amersham Industries Limited bought 20,000 PVS shares, Norges Bank acquired 150,000 shares, and Vietnam Enterprise Investments Limited sold 1.4 million PVS shares. As a result, Dragon Capital sold a net total of 1.23 million PVS shares, reducing their holdings from nearly 33.6 million shares to over 32.3 million shares, equivalent to a decrease in ownership percentage from 7.0209% to 6.7636%.

Illustrative image

Based on the closing price of PVS shares on November 21, 2024, at VND 33,600 per share, Dragon Capital’s sales transaction amounted to more than VND 41.3 billion.

The change in ownership percentage for the group of related foreign investors exceeding the 1% threshold occurred on November 25, 2024. The day before, Dragon Capital had increased its holdings in PVS by 200,000 shares through Amersham Industries Limited and Norges Bank. As a result, their total holdings increased from nearly 33.4 million shares to nearly 32.6 million shares, raising their ownership percentage from 6.9791% to 7.0209%.

In terms of business performance, according to PVS’ consolidated financial statements for Q3 2024, the company recorded a revenue of over VND 4,820 billion, a 15% increase compared to the same period last year. After deducting taxes and fees, the company reported a net profit of over VND 192.7 billion, a 34.32% increase. PVS attributed the rise in net profit to the reduction in deferred income tax expenses for unrealized foreign exchange differences and provisions as per regulations.

For the first nine months of 2024, PVS achieved a revenue of over VND 14,101 billion, a nearly 12% increase compared to the same period in 2023, with a net profit of VND 706.7 billion, a nearly 16.6% increase.

As of September 30, 2024, PVS’s total assets were valued at nearly VND 27,342.5 billion, a 3.51% increase from the beginning of the year, while its total liabilities stood at nearly VND 13,400.8 billion, a 4.11% increase.

Why Hasn’t the Late Chairman Nguyen Thien Tuan’s Wife Accepted Her Full Inheritance of Shares?

Mrs. Le Thi Ha Thanh, the wife of the late Chairman Nguyen Thien Tuan, has inherited nearly 12.22 million DIG shares out of the total of almost 16.97 million registered for trading.

The Market Beat: VN-Index’s Unique Path

As global stock markets rally, Vietnam’s story takes a different turn as it finds itself among the few to witness a decline.