Sellingsection>

Selling pressure continued to weigh on the afternoon session, even pushing the VN-Index down to 1240.91 points at one point. However, the balancing act from buying power remained quite strong, keeping the fluctuations mild and liquidity very low.

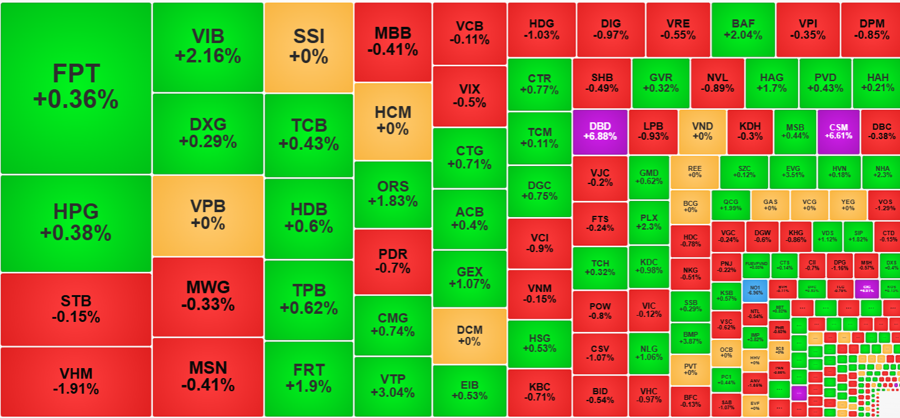

The VN-Index edgedsection> closed slightly above the reference price, up 0.14 points to 1242.11 points, with a good breadth of 193 gainers and 181 losers. The index hit its intraday low at 2:15 PM, sheddingsection> losing more than 1 points, with a breadth of 134 gainers and 224 losers. This was the weakest point for the market, where selling pressure had the most significant impact. However, the small decline indicated that the supply-demand gap was only temporary. By the end of the session, the breadth turned positive with a positive tug-of-war.

In fact, the VN-Index could have recovered better if it weren’t for some large-cap stocks. In the ATC session, VHM saw significant trading that pushed its price down by an additional 2 steps, resulting in a 1.91% decrease compared to the reference price. VHM alone took away 0.9 points from the index. BID and SAB were the other two large-cap stocks that closed at the day’s lowest price, falling by 0.54% and 1.07%, respectively.

The rest of the VN30 basket remained largely unchanged, with minor fluctuations. The representative index of this basket closed up 0.04% with 12 gainers and 15 losers. However, it’s undeniable that the large-cap stocks’ price levels have weakened. Statistics show that 17 out of 30 stocks in the basket declined compared to the morning session’s close, with only 8 stocks improving. VCB, VHM, VIC, BID, VNM, GAS, and HPG were all among the declining stocks and are among the Top 10 stocks by market capitalization. At the morning session’s close, the VN30 basket had 12 gainers and 8 losers, meaning 7 stocks fell enough to drop below the reference price. The positive sign was that, despite being in the red, the decline was not significant. Except for VHM and SAB, the declines in the other stocks were negligible.

Expanding to the entire HoSE floor, the number of stocks with increasing prices and adjustment ranges was not significant. At the morning session’s close, the exchange had 45 stocks falling more than 1%, and by the end of the day, there were only 48. Of course, the breadth was weaker, with 193 gainers and 181 losers compared to 182 gainers and 155 losers. A few dozen stocks falling into the red is not a large number compared to the hundreds of stocks traded.

Among the 48 stocks that fell deeply today, only 8 had trading values exceeding 10 billion VND. VHM, of course, led the group in liquidity, reaching 270.5 billion VND. Additionally, HDG fell by 1.03% with a match of 97.4 billion, CSV decreased by 1.07% with 59.6 billion, VOS declined by 1.29% with 28.5 billion, SAB dropped by 1.07% with 19.2 billion, DPG fell by 1.16% with 18.2 billion, NO1 decreased by 6.96% with 15.5 billion, and ANV fell by 1.65% with 15 billion. In fact, this level of trading volume can hardly be considered a “sell-off.” It’s possible that the buying power was too weak, which is why the decline was so significant despite the relatively low liquidity.

On the upside, the number of gainers unexpectedly increased, and the trading atmosphere became more vibrant. Of the 193 gainers, 67 rose more than 1% (compared to 46 in the morning session). Many high-liquidity stocks, such as VIB, FRT, ORS, VTP, and GEX, matched over 100 billion VND. Mid-range stocks like BAF, HAG, DBD, CSM, NLG, and EVG also traded actively and showed strong prices. Together, this group of best-performing gainers accounted for 15.3% of the total trading value on the HoSE floor. All gainers accounted for approximately 51% of the total trading on the exchange.

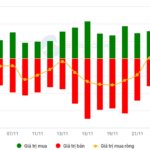

Foreign investors increased their buying in the afternoon session, with net buying on the HoSE rising by 29% compared to the morning session, reaching 658 billion VND, while net selling decreased by 5% to 545.9 billion VND. The net buying value was 112.1 billion VND, reversing the net selling value of 63.8 billion VND in the morning session. FPT remained the most net bought stock, with 228.3 billion VND, followed by MSN (+77.4 billion), DGC (+37.2 billion), DXG (+27.5 billion), and TCB (+25.9 billion). On the net selling side, SSI (-70.8 billion), HDB (-67.9 billion), VCB (-60.5 billion), VIB (-379 billion), STB (-33.8 billion), EIB (-25.6 billion), VRE (-25.2 billion), and CMG (-24 billion) were among the top net sold stocks.

While the VN-Index didn’t decline today, the intraday price slide of about 8.4 points was quite large. In the previous two sessions, the index was also pushed down, but the range was much smaller. These consecutive occurrences confirm the presence of profit-taking selling pressure, but it hasn’t been strong enough to reverse the market’s direction.

The Foreign Capital Net Buy, VN-Index Approaches 1240 Points

The market held its ground in the afternoon session, maintaining its highs without surging or plunging significantly. Notably, foreign investors turned net buyers again, with a net purchase value of over VND 165 billion on the HoSE, marking the second consecutive net buying session. Despite the continuous upward momentum offering attractive short-term gains, investors seem reluctant to offload their positions.

Vietstock Daily Recap: Can We Expect a Resurgence in Liquidity?

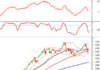

The VN-Index witnessed a modest gain while staying afloat on the Middle Line of the Bollinger Bands. If, in the upcoming sessions, the index persists above this threshold, coupled with trading volumes surpassing the 20-day average, the upward trajectory will be fortified. Notably, the MACD indicator has already flashed a buy signal by crossing above the Signal Line. In tandem, the Stochastic Oscillator is echoing a similar signal. Should this momentum be sustained in the forthcoming sessions, the short-term outlook will brighten with optimism.

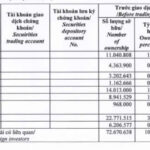

“Dragon Capital Divests 5.5 Million DXG Shares of Dat Xanh Group”

Dragon Capital has offloaded 5.5 million DXG shares, reducing its ownership stake in Dat Xanh Group from 10.0833% to 9.3201%.