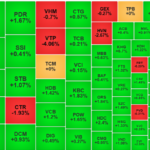

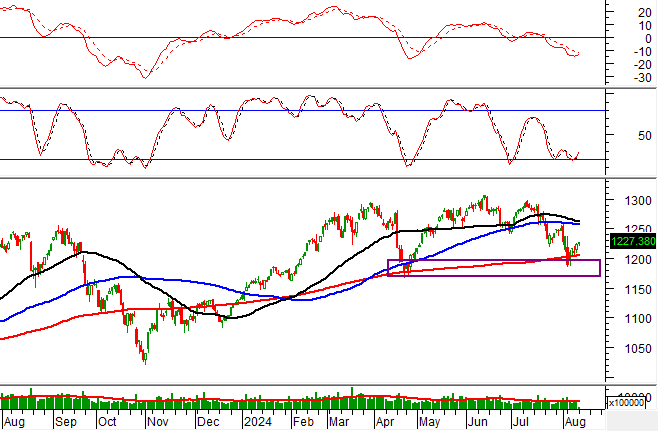

The upward momentum witnessed in recent sessions faced a significant slowdown today, with a notable lack of momentum in both the index and individual stocks. Notably, the matched order liquidity of the two exchanges dipped below the 10k billion threshold once more, indicating that stocks are being held onto rather than actively traded.

Looking at the recovery over the past six sessions and the liquidity on the upside, it’s surprising that we haven’t seen any significant sell-offs. The range of fluctuations and liquidity in the first 1-2 sessions were higher than what we’re seeing now. It appears that investors are taking a more steadfast approach, opting to hold onto their positions rather than engage in intraday trading.

Today’s session saw buyers clearly taking a step back, with orders mostly placed lower to await price movements. Even when the “field” was left to sellers, trading remained slow and largely unchanged, despite the prevalence of red. The small decline in prices and extremely low liquidity indicate that sellers are also reluctant to let go of their holdings. This stalemate is unlikely to persist for long.

A likely scenario involves a proactive move to either stimulate an upward trend or pressure key stocks to push the index lower, thereby influencing market sentiment. This was particularly anticipated today given the wide basis in derivatives and thin liquidity, which provided an opportune moment to influence the key stocks. Especially with proprietary trading holding a significant short position. However, this did not transpire, and the intraday fluctuations were frustrating, with only a few stocks experiencing pressure while the key stocks remained stable.

The range of gains in this phase has been varied, and many stocks are still in the process of forming a base. Therefore, expecting a uniform correction across stocks is unrealistic. In terms of timing, the closer we get to the end of the year, the lower the likelihood of a downward trend. If there is to be a test of expectations, now would be an appropriate time as doubts remain high.

Liquidity dipping below the 10k billion mark (excluding matching) is unusually low. In fact, two-thirds of the sessions since the start of this week have fallen below this threshold. Of course, low liquidity is primarily due to buyers refraining from purchasing or being hesitant to do so. But if sellers are also unwilling to sell, the situation becomes more challenging. Looking back at previous instances of bottom formation this year, the first 5-6 sessions exhibited low liquidity compared to the average, only to surge afterward (both in terms of liquidity and prices). It remains to be seen if the market will repeat this pattern, but the current stalemate cannot persist indefinitely.

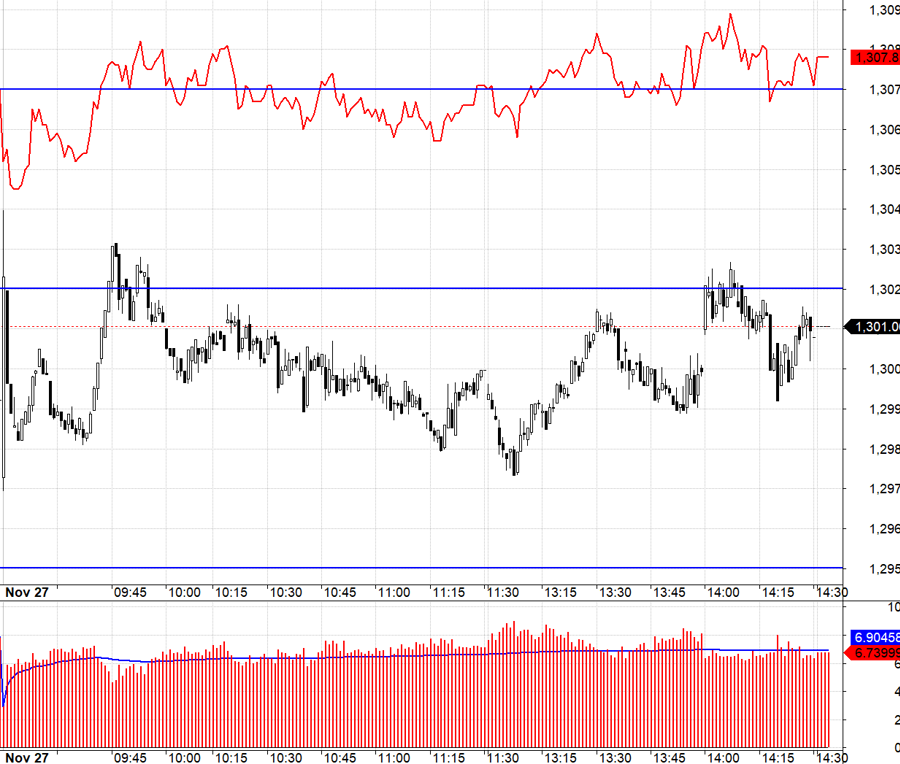

Today, the derivatives market leaned more toward short positions, especially with the wide basis in F1 contracts and proprietary trading holding a significant short position. There’s a clear resistance level for VN30 around 1302.xx, and each time it retreats from this level, the basis becomes more favorable for short positions. However, when VN30 declines, F1 contracts tend to widen the basis rather than decrease, resulting in minimal impact.

The underlying market remains in a state of supply-demand equilibrium, with neither side willing to concede. Buyers are placing orders at lower prices, while sellers remain indifferent. It appears that a push in volatility is needed to truly test the market’s sentiment. A flexible strategy of long and short positions is recommended, with a preference for short. Keep a close eye on the movements of key stocks.

VN30 closed today at 1301.06. Tomorrow’s resistances are 1302; 1307; 1316; 1321; 1326; 1333. Supports are 1295; 1290; 1285; 1278; 1271; 1266.

Disclaimer: This “Stock Market Blog” reflects the personal views and opinions of the author and does not represent the views of VnEconomy. The assessments and opinions of the author, as well as his/her writing style, are his/her own, and VnEconomy respects this. VnEconomy and the author are not responsible for any issues arising from the assessments, opinions, and information presented in this blog.

The Foreign Block Accelerates Buying, Individuals Continue to Take Profits

Foreign investors bought a net 343.8 billion VND, with a net purchase of 275.1 billion VND in matched orders. On the contrary, individual investors sold a net of 320.3 billion…

The Market Beat: Rising Pressure Wipes Out VN-Index’s Early Gains

The market remained under pressure during the afternoon session, with indices retreating from reference levels. At the close on November 28, the gains were modest, with the VN-Index edging up 0.14 points to 1,242.11, the HNX-Index climbing 0.47 points to 223.57, and the UPCoM-Index advancing 0.38 points to 92.35.

Superior Liquidity – The Core Attraction of Right Property

The real estate market is showing positive signs in the final months of 2024. While a cautious mindset still prevails among investors, there is a sense that the tide may be turning. With capital flows yet to fully recover, the industry is poised for a potential rebound, offering a window of opportunity for those bold enough to seize it.

The Foreign Block: Investing Inflows and the Liquidity Conundrum

Liquidity in the afternoon session unexpectedly dropped by 22% compared to the morning session, despite the overall breadth remaining favorable. The upward momentum showed signs of weakening. This development reflects the caution among buyers as the market enters a resistance zone, where stronger profit-taking may occur.