Vietnam’s stock market quickly regained its momentum after a deep dip below the 1,200-point mark. The VN-Index continued its upward trajectory to 1,242 points, while the matched order liquidity remained low at over 11,200 billion VND.

Sharing insights at the Khớp Lệnh program, Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities Joint Stock Company, offered his perspective on the stock market outlook for 2024 and 2025, highlighting both opportunities and risks.

Drivers: On the positive side, Vietnam’s economic growth has been promising, with a 7% GDP target for 2024 and expectations for 2025 to be equally promising. Listed companies have also seen a 21% profit growth in the last three quarters, reflecting this economic upturn.

Delving into specific sectors, several industries have experienced consecutive quarters of recovery, including retail and aviation, while others like residential real estate have successfully turned their fortunes around. These positive signals indicate a foundation for more optimistic profit growth expectations for listed companies in the coming years.

Additionally, given the impact of international issues on demand, domestic macroeconomic policies are expected to focus on stimulating local consumption and production to mitigate external volatility risks. The push for infrastructure development will benefit various sectors, including retail, consumer goods, real estate, and industrial parks.

Another anticipated catalyst is the potential market upgrade and relatively attractive market valuation as it nears its eight-year low.

Risks: On the other hand, there are concerns about heightened trade barriers and the impact on inflation as a result of Trump’s presidency, which could affect the Fed’s interest rate reduction plans. High inflation coupled with a bleak economic picture could also lead to a stronger US dollar and sustained high yields for US government bonds. These worries are reflected in the current market, with the DXY Index at 107 points and yields on 10-year US government bonds ranging from 4.4% to 5%.

For Vietnam, these factors put pressure on exchange rates, and they are also contributing to the return of net foreign selling. Fortunately, the market discount has slowed down this trend, and foreign investors are expected to stop selling altogether.

Predicting foreign investors’ behavior, the expert referred to the lesson from the Japanese market, where a large enough discount and low enough price levels led to a halt in net selling. In the case of Japan, the panic lasted only two days before the market quickly stabilized, an important observation.

“When the market is affected, if we follow suit without considering when they will stop selling, we miss out on opportunities,” said Mr. Dao Hong Duong. “In an attractively priced market, if foreign investors stop selling, the recovery will be swift.”

Investment Portfolio Strategies: When it comes to investment strategies in a market that is “rising with doubt,” VPBankS’ expert emphasizes the importance of assessing one’s risk appetite and subsequently constructing a portfolio with varying sector weights. However, it’s crucial to diversify and not put all your eggs in one basket.

For risk-averse investors with a cautious outlook, sector valuation becomes a key consideration. Industries with low valuations and evidence of bottoming out tend to be more stable and less risky.

Investors can also consider sectors with high growth potential, such as real estate, securities, and retail. Additionally, the IT sector is worth noting in the context of attractive valuations, given its stable growth.

When constructing his personal portfolio, the expert typically allocates 50% to foundational sectors like banking, real estate, and steel. He then engages in trading to adjust the remaining portion across sectors like retail, securities, and information technology.

The Market Beat: Foreigners Keep Buying, but VN-Index Stagnates

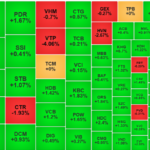

The market closed with slight losses, as the VN-Index dipped by 0.16 points (-0.01%) to finish at 1,241.97, while the HNX-Index shed 0.61 points (-0.27%), closing at 223.09. The market breadth tilted towards decliners, with 366 tickers in the red against 307 gainers. Additionally, within the VN30 basket, decliners outnumbered advancers with 14 tickers ending in the red, 9 in the green, and 7 unchanged.

The Market Beat: Rising Pressure Wipes Out VN-Index’s Early Gains

The market remained under pressure during the afternoon session, with indices retreating from reference levels. At the close on November 28, the gains were modest, with the VN-Index edging up 0.14 points to 1,242.11, the HNX-Index climbing 0.47 points to 223.57, and the UPCoM-Index advancing 0.38 points to 92.35.

Good News for Employees: 82% of Vietnamese Businesses Plan to Increase Salaries in 2025

Robert Walters has just released its 2025 Salary Survey, revealing an encouraging insight: a notable 82% of Vietnamese businesses are planning to increase salaries from next year onwards.

The Foreign Block: Investing Inflows and the Liquidity Conundrum

Liquidity in the afternoon session unexpectedly dropped by 22% compared to the morning session, despite the overall breadth remaining favorable. The upward momentum showed signs of weakening. This development reflects the caution among buyers as the market enters a resistance zone, where stronger profit-taking may occur.