VN-Index is currently at a low valuation level

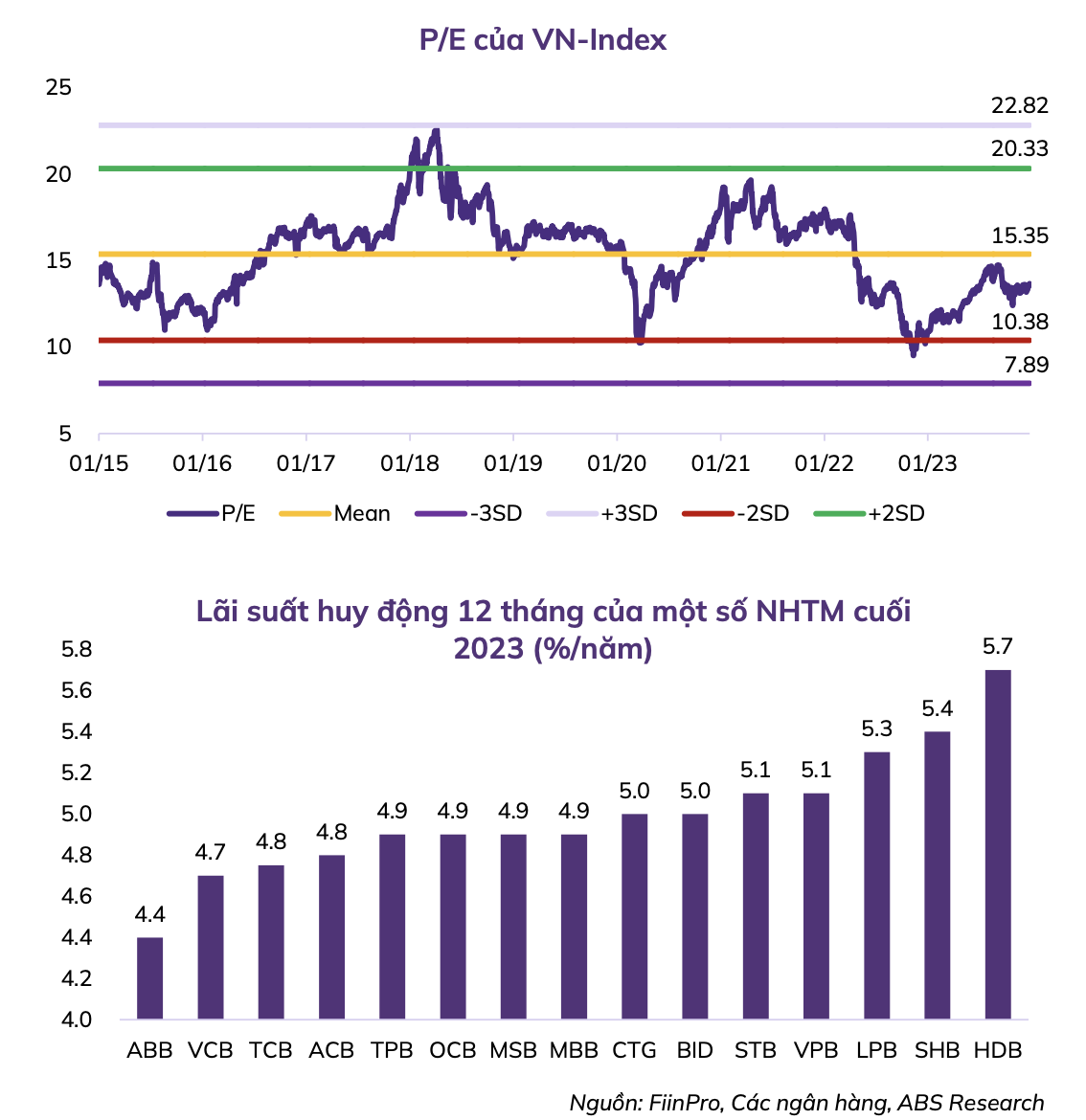

VN-Index has dropped to the long-term bottom level since November 2022. Since then, VN-Index has rebounded with a current P/E ratio of 13.6x for 2023. However, the estimated P/E ratio for 2023F is at 12.4x, below the -1 standard deviation of the past which was 12.9x. The estimated P/E ratio for 2024F is at 11.5x, lower than the -1 standard deviation of the past. This valuation level is quite attractive in the medium and long term. In particular, the P/B ratio is currently at 1.68x, compared to 1.62x at the end of last year, still at a 10-year low.

Compared to other countries in the Southeast Asia region, VN-Index is currently trading with a higher P/B ratio but a lower P/E ratio. This reflects the high return on equity (ROE) of VN-Index in the region, while the profit growth prospects of VN-Index remain positive.

Regarding investment channels, An Binh Securities (ABS) believes that the current term deposit interest rate of 4.2-5.7% per year is popular, equivalent to a P/E ratio of 17.5-23.8x, higher than the valuation level of VN-Index. In addition, the expected low interest rate trend will continue in at least the first half of 2024 due to the slow credit recovery and abundant liquidity in the banking system. With the expected improvement in profit growth of businesses in 2024, ABS believes that the savings deposit channel will yield lower returns compared to stock investment.

The market capitalization-to-GDP ratio of Vietnam is also at its lowest level in the region, only 1/2 of Malaysia. Moreover, this ratio has decreased by about 50% compared to 2021 TIn contrast, the average market in the region only decreased by about 15-20%.

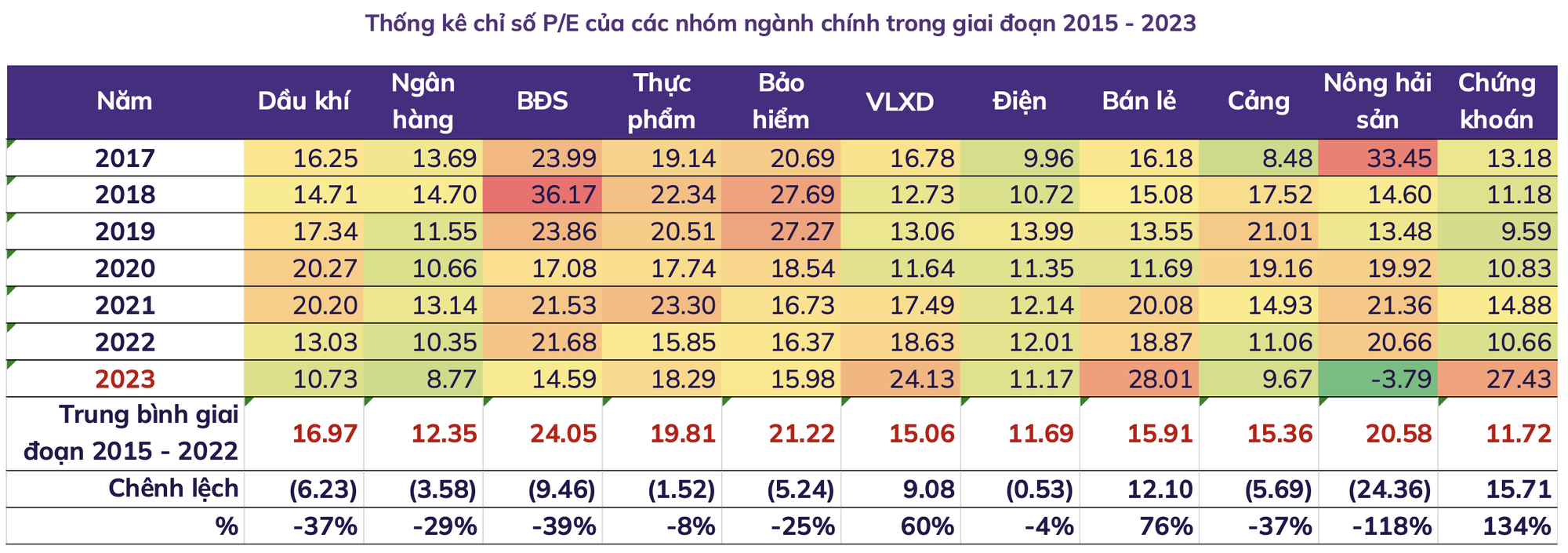

Sectors with the deepest P/E discount compared to the 6-year average

Regarding the valuation of industry groups, ABS believes that in 2023, there are 4 out of 11 industries with a significant increase in P/E compared to the previous year, including construction materials, securities, retail, and food. Meanwhile, there are 7 out of 11 industries with a significant decrease in P/E compared to 2022, mostly major industry groups with large market capitalization.

In terms of P/E ratios of industry groups compared to the 6-year average, ABS believes that large-cap industry groups have a significant discount, including: Real estate, Oil and gas, Ports, Banks, Insurance, Agriculture and seafood.

Both of the top 2 industries with large market capitalization, Real estate and Banks, already have a deep discount. ABS believes that they will be the factors attracting bottom-fishing capital – the driving force for market recovery in 2024.

With the positive recovery forecast for the economy in 2024, ABS predicts that VN-Index will surpass the 2023 peak and target 1320-1340 -1,358 points in the dominant scenario. The valuation level will be raised thanks to the improvement in business performance and market liquidity, against the backdrop of the low-interest-rate environment.