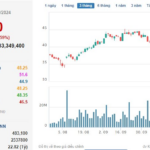

QCG shares of Quoc Cuong Gia Lai unexpectedly surged in price at the opening of the trading session on November 26, with a ceiling price of 11,750 VND/share and a rapidly increasing volume of buy orders at the ceiling price.

Although the share price has recovered slightly, it is still 34% lower than the short-term peak in mid-April 2024.

The positive movement of QCG shares followed the company’s announcement regarding Ms. Nguyen Thi Nhu Loan, former CEO of QCG, on November 25.

Specifically, on November 11, 2024, Ms. Nguyen Thi Nhu Loan had her preventive measures changed by the Investigation Agency of the Ministry of Public Security. Currently, Ms. Loan is out on bail during the investigation process.

“After the change in preventive measures, Ms. Nguyen Thi Nhu Loan continues to support the investment and business activities of Quoc Cuong Gia Lai Joint Stock Company by accompanying the Board of Directors and the Executive Board to continue resolving ongoing tasks and projects,” the QCG document stated.

With her role as a major shareholder and her deep understanding of the company’s management, operations, and investment projects, the Board of Directors and Executive Board of QCG expressed their confidence in Ms. Loan’s accompaniment and counsel, demonstrating their determination to achieve stable development and meet the goals set by the General Meeting of Shareholders and investors.

Previously, on July 19, 2024, Ms. Nguyen Thi Nhu Loan was arrested by the Police Department for Corruption, Economy, and Smuggling Investigation (C03, Ministry of Public Security) for Violation of regulations on the management and use of state assets, causing loss and waste under Clause 3, Article 219 of the Penal Code. She was accused of legal violations in the transfer of the 39-39B Ben Van Don project.

Regarding business operations, Quoc Cuong Gia Lai’s business results in the third quarter of 2024 showed a significant improvement, with revenue and profit increasing sharply compared to the same period last year. The company attributed this improvement to the better performance of its apartment handover activities to customers. Specifically, QCG recorded more than VND 178 billion in net revenue and nearly VND 26 billion in net profit, almost three times higher than in the third quarter of 2023. However, due to significant losses in the first two quarters, the company’s nine-month cumulative profit was nearly VND 11 billion.

In related news, the SSC has recently issued a document regarding the 2023 audited financial statements of Quoc Cuong Gia Lai, audited by DFK Vietnam Audit Company Limited. According to the document, the audit team did not fully perform the necessary audit procedures and failed to obtain appropriate audit evidence to form an audit opinion as required by auditing standards. Therefore, the SSC will impose sanctions on the auditors who signed the audit report on the company’s 2023 financial statements.

The Dragon’s Breath: QCG Stock Plunges as VN-Index Faces Headwinds

The QCG stock of JSC Quoc Cuong Gia Lai unexpectedly surged to its daily limit of VND6,560 per share, with the trading volume doubling that of the previous session.

The Luxury Property Developer’s Uninsured Workforce: A Year On.

As of the end of July 2024, Lyn Property, the company owned by entrepreneur Nguyễn Quốc Cường’s sister, had reportedly not paid employee insurance contributions for 15 months. This concerning revelation raises questions about the company’s commitment to its employees’ well-being and compliance with labor regulations. The situation warrants further investigation and highlights the importance of holding businesses accountable for their obligations to their workforce.