The market maintained its highs quite well in the afternoon session, despite not gaining much but also not plummetsection, the foreign bloc turned to net buying again with more than 165 billion VND, marking the second consecutive net buying session on the HoSE. Although the continuous uptrend brings good short-term profits, investors still seem reluctant to sell in large quantities.

>p> VN-Index closed up 6.6 points, or +0.54%, to 1,234.7 points. The 1,240-point region, which corresponds to the October low and served as a support for the index’s two-week sideways movement before breaking down, now presents a technical challenge as the market attempts to recover and retest this level, potentially leading to more intense conflicts in the short term.

>However, at least until the afternoon session when the VN-Index advanced to 1,236.57 points, selling pressure remained subdued. The HoSE witnessed a modest decrease in trading volume, with a turnover of nearly 5,114 billion VND, an 18% drop from the previous session and the lowest in the last 14 sessions.

>Low liquidity and rising stock prices indicate that sellers are not offloading their holdings. While there was a significant buy order, it did not translate into actual transactions, suggesting a mismatch between supply and demand.

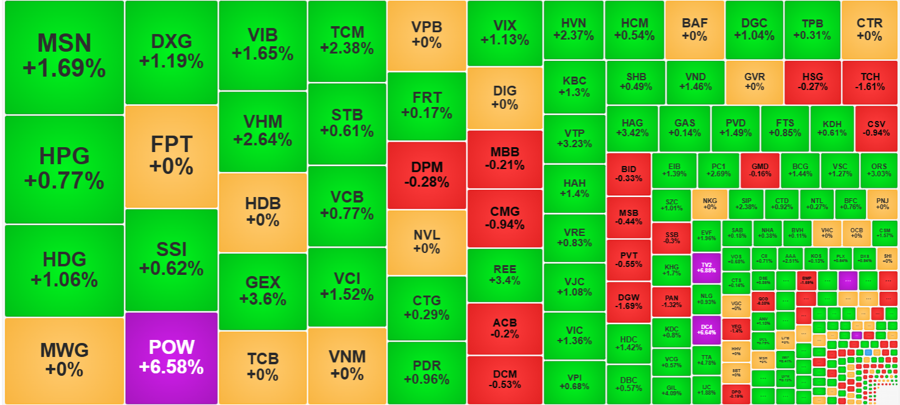

>Blue-chip stocks continued to lead the market in the afternoon but lacked the support of several large-cap stocks. BID extended its morning losses, ending the day down 0.33% from the reference price. VCB couldn’t maintain its morning strength, giving back some gains to close 0.44% higher, a decline from its intraday peak. GAS also witnessed a pullback, ending 0.14% higher after surrendering most of its morning gains. TCB, FPT, VPB, and VNM closed flat. On the other hand, VHM, VIC, MSN, and VIB provided solid support, with VHM rising 2.64%, VIC climbing 1.36%, MSN advancing 1.69%, and VIB gaining 1.65%. Additionally, POW, despite its smaller market cap, contributed significantly with a jump to the daily limit.

>

>The VN30-Index, representing the performance of the 30 largest stocks by market capitalization and liquidity, closed up 0.46%, underperforming the broader market due to weakness in bank stocks. Meanwhile, the Midcap index rose 0.61%, and the Smallcap index gained 0.5%, indicating a broad-based but gradual price increase. Nevertheless, several stocks stood out with impressive gains, although they didn’t represent specific sectors. In addition to the aforementioned blue chips—MSN, POW, VIB, and VHM—HDG rose 1.06% on a turnover of 286.4 billion, DXG climbed 1.19% with a turnover of 251.1 billion, GEX surged 3.6% with a turnover of 177.9 billion, TCM advanced 2.38% with a turnover of 167.7 billion, VCI rose 1.52% with a turnover of 162.6 billion, VIX gained 1.13% with a turnover of 129.9 billion, and REE climbed 3.4% with a turnover of 106.5 billion.

>In a context of generally small trading volumes, opportunities lie in stocks that attract significant liquidity or have extremely low liquidity. Most of the stocks that stood out today with notable price increases had relatively low trading volumes, such as HTL, TV2, DC4, KHP, IMP, TTA, and GIL.

>A notable development in today’s subdued trading session was the reversal of foreign investors’ sentiment, who turned net buyers with a net purchase value of 165.3 billion VND, compared to net selling of 103.1 billion VND in the morning session. Specifically, they increased their new investment value to 1,205.5 billion VND, triple the morning session’s figure. Gross sales reached 1,040.2 billion VND. These new investment transactions reversed the net position for the entire session to a net buy position of over 62 billion VND. The most bought stocks were MSN (+89.4 billion VND), CTG (+55.1 billion VND), KBC (+51.9 billion VND), VHM (+45.7 billion VND), VIC (+29.7 billion VND), VCI (+26.6 billion VND), CTR (+23 billion VND), and DGC (+22.7 billion) billion VND). On the selling side, the most significant net selling was observed in KDC (-68.3 billion VND), VCB (-43.3 billion VND), HDB (-41.3 billion VND), VIB (-39.1 billion VND), CMG (-33.2 billion VND), FRT (-32 billion) VND), DGW (-29.5 billion VND), and HPG (-29 billion VND)…

>The VN-Index closed today at 1,234.7 billion VND and is poised to retest the former support area around 1,240 points, which now acts as a resistance level. The lack of significant volume during the last four positive sessions suggests that there aren’t many investors eager to enter the market. In fact, the market’s recovery could be technical, and skepticism remains high. We may see an increase in the volume of stocks with short-term accumulated profits in the next few sessions as the market approaches a notable resistance level.

Unlocking the Power of Words: Reigniting Interest in the VN-Index’s Journey to 1,260 Points While Navigating the Ever-Present Risk of Reversal

Looking ahead to the next trading session, most securities companies anticipate a continuation of the market’s upward trajectory. However, they also caution against potential reversals as the market approaches resistance levels.

Vietstock Daily Recap: Can We Expect a Resurgence in Liquidity?

The VN-Index witnessed a modest gain while staying afloat on the Middle Line of the Bollinger Bands. If, in the upcoming sessions, the index persists above this threshold, coupled with trading volumes surpassing the 20-day average, the upward trajectory will be fortified. Notably, the MACD indicator has already flashed a buy signal by crossing above the Signal Line. In tandem, the Stochastic Oscillator is echoing a similar signal. Should this momentum be sustained in the forthcoming sessions, the short-term outlook will brighten with optimism.

The Stock Market Shows Bottoming-Out Signals: VPBankS Expert Names Undervalued Stock Group

According to experts, investing in lower-priced regions may mitigate risks, but to gauge the potential profits, one must delve into the industry’s future outlook.