On November 25, Mr. Craig Richard Bradshaw submitted his resignation from the positions of Member of the Board of Directors and CEO of Masan High-Tech Materials JSC (stock code: MSR) before the end of his term. His resignation will take effect from January 1, 2025.

Mr. Craig Richard Bradshaw, born in 1971, is an Australian national and holds a Bachelor of Business from the University of Southern Queensland. He has over 25 years of experience in the mining industry, spanning across mining and processing, warehousing, trading, and marketing in Australia, Thailand, and Laos.

He previously held the position of Senior Commercial Manager at Lang Xang Mineral Limited, Sepon Mine. He also served as Country General Manager of Toll in Thailand, the largest integrated logistics service provider in Australia. Prior to that, Mr. Bradshaw worked in management roles at Mount Isa Mines Limited (“MIM”) and Xstrata.

He became the CEO of Nui Pho Mine in May 2015 and has been the CEO of Masan High-Tech Materials since August 2018, as well as a Member of the Board of Directors. Mr. Craig Richard Bradshaw is known for being one of the highest-paid CEOs on the Vietnamese stock market.

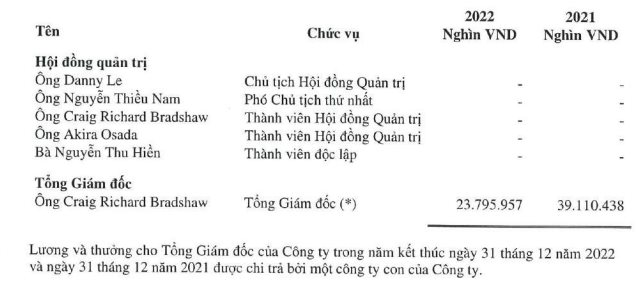

Specifically, in the last disclosed income report of Masan High-Tech Materials’ management, Mr. Craig Richard Bradshaw received VND 23.8 billion in salary and bonuses as the CEO of the company. This corresponds to an average monthly income of nearly VND 2 billion. While serving as the CEO of both Nui Pho Mine and Masan High-Tech Materials, Mr. Bradshaw’s income mainly comes from Nui Pho Mine.

Compared to 2021, when he received VND 39.1 billion, Mr. Craig Richard Bradshaw’s income decreased by VND 15.3 billion (-40%). This means his monthly income decreased from VND 3.3 billion to VND 2 billion.

As of 2022, many CEOs in the market were earning billions of VND per month. For example, Mr. Le Huu Thang, former CEO of Vinacafe, earned approximately VND 1.8 billion/month, while Mr. Danny Le, CEO of Masan Group, earned about VND 992 million/month, and Ms. Tran Mai Hoa, CEO of Vincom Retail, earned around VND 976 million/month. Mr. Bradshaw’s income as the CEO of Nui Pho Mine remains the highest among these prominent executives.

The Ultimate Headline:

“The Big Shake-Up: Unveiling the Lucky Stocks for FTSE and VNM ETF’s Portfolio Restructuring”

As we approach the year-end portfolio restructuring, two large foreign ETFs, the FTSE Vietnam ETF and the VanEck Vietnam ETF (VNM ETF), with a combined NAV of nearly VND 18,000 billion, are expected to make significant adjustments to their investments.

Don’t Miss: “Trump 2.0: Opportunity or Challenge for Goods and Stocks in 2025?”

The US Presidential Election has concluded with Donald Trump reclaiming the White House. With his controversial policies from the previous term, there are expectations for significant global economic shifts. In light of this, Ho Chi Minh City Commodity Trading Joint Stock Company (HCT) hosted a unique offline event titled “Trump 2.0: Opportunities and Challenges for Commodities and Securities in 2025.” This pioneering program in Vietnam offered a comprehensive analysis of the top two investment channels: commodity derivatives and securities, providing insightful predictions for the upcoming year.

The Stock Market’s Wobbly Tightrope Walk: Will it Tumble to 1,200 Points?

The Vietnamese stock market has been struggling to break through the 1,300-point mark, resulting in a sideways downtrend. The small-cap recovery sessions were followed by deeper corrective dips, erasing the index’s gains.

Unveiling a New Policy: Welcoming the Wave of Foreign Investment to Vietnam’s Stock Market

Vice President of the SSC shared that Circular No. 68/2024/TT-BTC is a result of an expedited and transparent regulatory process, showcasing the strong collaboration between regulatory bodies, operators, and market participants. This collaborative effort is aimed at upgrading and building a securities market that is safe, comprehensive, robust, integrated, and sustainably developed.