Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 366 million shares, equivalent to a value of more than 9.2 trillion VND; HNX-Index reached over 30.8 million shares, equivalent to a value of more than 511 billion VND.

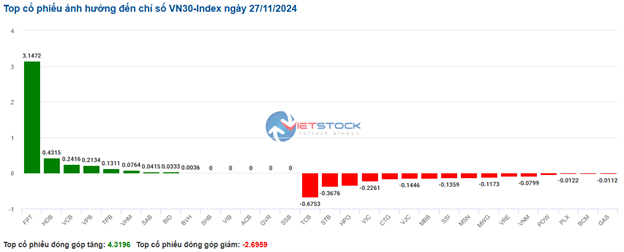

VN-Index continued to fluctuate around the reference level in the afternoon session despite continuous support from buyers. However, selling pressure remained slightly stronger, causing the index to end the day in negative territory. In terms of impact, VHM, VIC, CTG, and GAS were the most negative stocks, taking away more than 1.1 points from the index. On the other hand, FPT, VCB, LPB, and EIB were the most positive stocks, contributing over 2.2 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on November 27, 2024 |

Similarly, the HNX-Index also witnessed a lackluster performance, impacted negatively by stocks such as DTK (-5%), IDC (-0.54%), NTP (-1.18%), and BAB (-0.85%)…

| Enter Title |

|

Source: VietstockFinance

|

The healthcare sector witnessed the sharpest decline in the market, falling by -0.93%, mainly due to losses in TTN (-1.23%), DCL (-3.14%), DVN (-7.22%), and IMP (-1.14%). This was followed by the energy and utilities sectors, which decreased by 0.79% and 0.76%, respectively. On the other hand, the information technology sector witnessed the strongest recovery in the market, surging by 2.65%. FPT (+2.74%), CMG (+1.31%), ITD (+10.58%), VBH (+0.39%), and CMT (+0.75%) led the sector higher. The telecommunications and industrial sectors also rebounded, increasing by 1.48% and 0.38%, respectively.

In terms of foreign trading activities, foreign investors continued to be net buyers on the HOSE exchange, focusing on stocks such as FPT (241.75 billion VND), MSN (100.78 billion VND), VNM (45.36 billion VND), and POW (34.52 billion VND). On the HNX exchange, foreign investors were net buyers, with a focus on SHS (8.74 billion VND), MBS (4.06 billion VND), DTD (1.49 billion VND), and LAS (1.18 billion VND).

| Foreign Trading Activities |

Morning Session: Lackluster Liquidity, Market Continues to Fluctuate

The market continued to fluctuate within a narrow range, with sellers slightly gaining the upper hand. At the end of the morning session, the VN-Index edged lower by 0.66 points, or 0.05%, closing at 1,241.47 points; the HNX-Index decreased by 0.48%, settling at 222.64 points. The market breadth was negative, with 363 declining stocks and 221 advancing stocks.

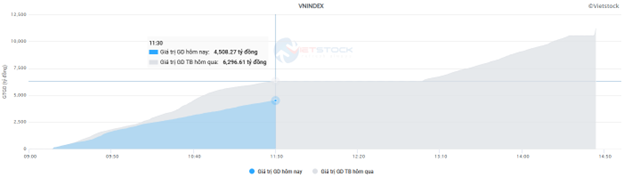

Market liquidity returned to a lackluster state in the morning session. The matching volume of the VN-Index reached over 167 million shares, equivalent to a value of more than 4.5 trillion VND, a decrease of more than 28% compared to the previous morning session. The HNX-Index recorded a matching volume of over 15 million shares, with a value of over 245 billion VND.

Source: VietstockFinance

|

While the number of declining stocks outnumbered advancing stocks, no single stock had a significant impact on the overall index. CTG and HPG were the most negative stocks in the morning session, but their impact was limited to around 0.3 points. On the other hand, FPT was the main driving force on the positive side, contributing more than 1.3 points to the VN-Index. This stock also attracted strong buying interest from foreign investors, with net buying value exceeding 285 billion VND.

The red color gradually spread across various sectors, although the declines were relatively mild, with most stocks falling by less than 1%. The healthcare sector was the worst performer, declining by 0.79%. Notable losers in this sector included DHT (-1.61%), DVN (-6.46%), TNH (-0.74%), IMP (-0.46%), and OPC (-1.92%)… Meanwhile, some stocks managed to stay in positive territory, including DBD, DTP, TRA, VDP, and PMC…

In the real estate sector, selling pressure was concentrated in large-cap stocks such as VHM (-0.47%), BCM (-0.76%), VRE (-0.82%), PDR (-1.17%), NLG (-1.56%), SIP (-1.54%), SZC (-1.23%), and CEO (-1.4%). However, gains in NVL (+1.8%), NTC (+2.1%), QCG (+6.81%), and SGR (+1.87%)… helped to limit the sector’s decline.

In contrast, the information technology sector stood out as the brightest spot in the market’s gloomy backdrop, with FPT (+2.66%) and CMG (+1.31%) contributing the most to the sector’s impressive 2.58% gain.

10:40 AM: Market Sentiment Turns Cautious Again

The market witnessed a state of divergence, with the main indices fluctuating around the reference level and moving in opposite directions. As of 10:40 AM, the VN-Index edged higher by 0.09 points, hovering around 1,242 points. Meanwhile, the HNX-Index declined slightly by 0.49 points, trading around 223 points.

The breadth of the VN30-Index basket turned slightly negative, with 16 declining stocks, 12 advancing stocks, and 2 stocks remaining unchanged. Specifically, on the negative side, TCB fell by 0.67 points, STB decreased by 0.36 points, HPG dropped by 0.34 points, and VIC slipped by 0.22 points. Conversely, some stocks managed to stay in positive territory, although the gains were modest. These included HDB, VCB, VPB, and notably FPT, which contributed the most with a gain of 3.14 points to the index.

Source: VietstockFinance

|

The information technology sector continued to be the best-performing group in the market, recording a solid gain of 2.25%. Within this sector, buying interest was mainly concentrated in the heavyweight stock FPT, which climbed by 2.22%, along with CMG, which advanced by 1.69%. Additionally, from a technical perspective, FPT has been trading within a sideways range since July 2024, forming an Ascending Triangle pattern after a long-term uptrend. Moreover, the MACD and Stochastic Oscillator indicators have generated positive signals, reinforcing the positive short-term outlook.

Source: https://stockchart.vietstock.vn/

|

The healthcare sector also experienced a mixed performance, with some stocks facing selling pressure. Notable decliners in this sector included TNH (-0.98%), DCL (-0.92%), DVN (-6.46%), and DVM (-1.32%)… Conversely, some stocks managed to stay in positive territory, including DBD (+0.51%), FIT (+1.2%), TRA (+0.65%), VDP (+1.71%)…

On the positive side, the telecommunications sector maintained its upward momentum, supported by gains in stocks such as VGI (+0.24%), CTR (+0.6%), FOX (+1.42%), and TTN (+3.59%)…

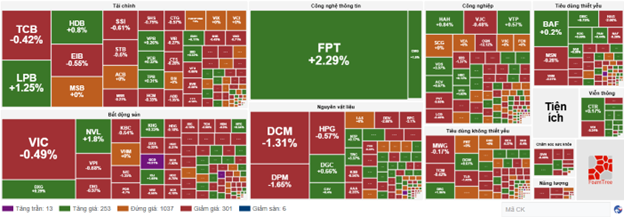

Compared to the opening, the selling pressure slightly intensified, although the market breadth remained largely balanced, with over 1,000 stocks trading around the reference level. There were 301 declining stocks (including 6 stocks hitting the lower limit) and 253 advancing stocks (including 13 stocks reaching the upper limit).

Source: VietstockFinance

|

Opening: Market Opens with Caution

The market opened with a slightly negative tone, indicating a cautious sentiment among investors. The main indices fluctuated around the reference level, with the VN-Index trading slightly above 1,242 points, while the HNX-Index hovered around 223 points.

U.S. stocks advanced on Tuesday (November 26), with the S&P 500 and Dow Jones indices reaching new highs.

On November 26, the Dow Jones index rose by 123.74 points (equivalent to 0.28%) to close at 44,860.31 points, recovering from an intraday loss of more than 300 points. The S&P 500 index gained 0.57% to reach 6,021.63 points. Both the Dow Jones and S&P 500 indices hit new intraday and closing highs. The Nasdaq Composite index climbed by 0.63% to 19,174.30 points.

As of 9:30 AM, the VN30 basket witnessed a slightly negative tone, with 13 declining stocks, 6 advancing stocks, and 11 stocks trading around the reference level. Notably, BCM, MWG, and POW were the worst performers, while FPT, BVH, and SAB were the top gainers.

The materials sector was one of the best-performing groups in the market during the morning session. Notable gainers in this sector included DMC (+1.08%), DPM (+0.41%), CSV (+1.6%), LAS (+1.81%), NKG (+0.51%), DGC (+0.56%), and GVR (+0.16%)…

The Market Beat: Rising Pressure Wipes Out VN-Index’s Early Gains

The market remained under pressure during the afternoon session, with indices retreating from reference levels. At the close on November 28, the gains were modest, with the VN-Index edging up 0.14 points to 1,242.11, the HNX-Index climbing 0.47 points to 223.57, and the UPCoM-Index advancing 0.38 points to 92.35.

The Foreign Block: Investing Inflows and the Liquidity Conundrum

Liquidity in the afternoon session unexpectedly dropped by 22% compared to the morning session, despite the overall breadth remaining favorable. The upward momentum showed signs of weakening. This development reflects the caution among buyers as the market enters a resistance zone, where stronger profit-taking may occur.

Technical Analysis for the Session on November 26: Investor Sentiment Improves

The VN-Index and HNX-Index rose in tandem, with a significant surge in trading volume during the morning session, indicating a renewed optimism among investors.