|

Source: VietstockFinance

|

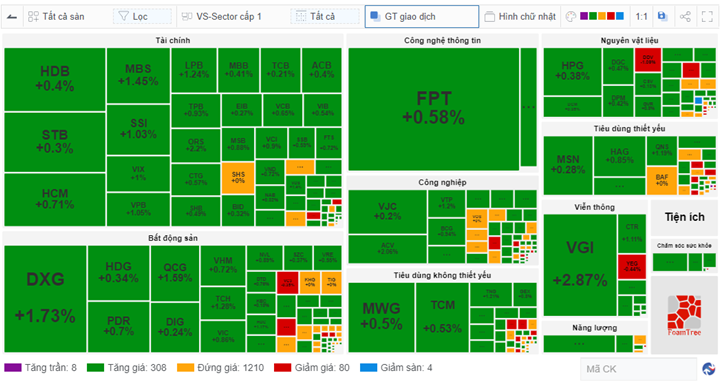

The market width pressure was evident with 305 codes decreasing, including 22 floor-decreased codes, a sharp increase compared to the morning session. The market also had 412 increasing codes and 890 unchanged codes.

On the VN-Index, VHM was the stock that took away the most points with nearly 0.8 points, followed by BID with more than 0.3 points. Conversely, CTG was the stock that made the most positive contribution, but it only brought in more than 0.3 points.

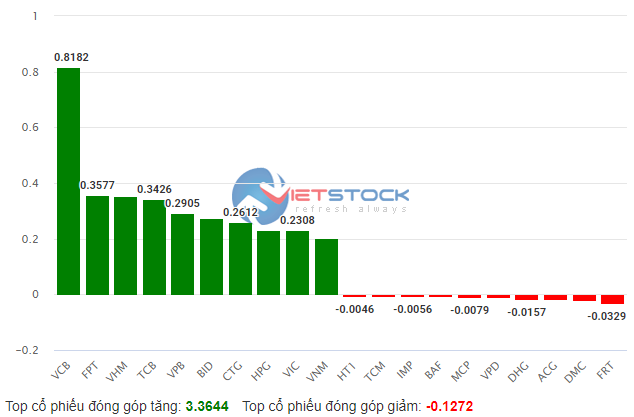

| Top stocks affecting the VN-Index index |

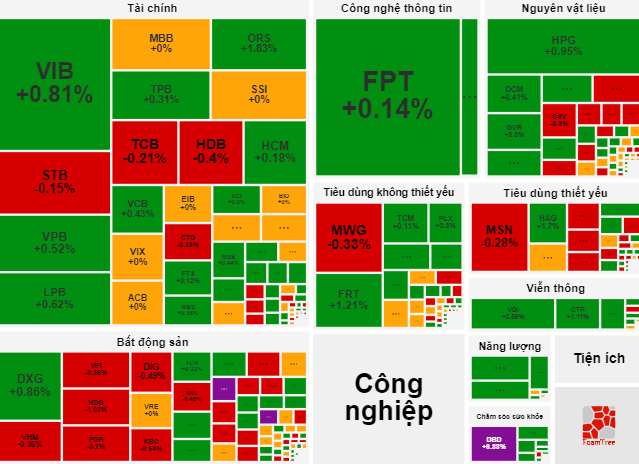

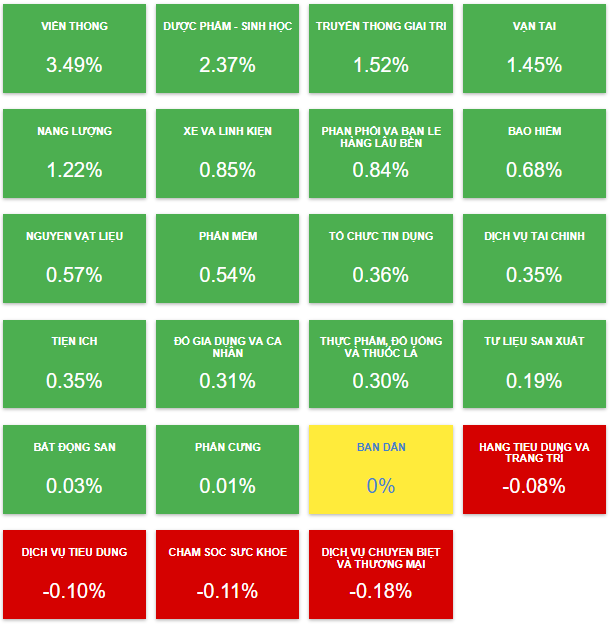

Considering the sectors, only 6 sectors decreased today, however, there were many names with significant weights in the market, including real estate, financial services, and insurance.

Among the increasing sectors, telecommunications led with a 4.34% increase, supported by VGI increasing by 5.26%, CTR by 0.77%, FOX by 0.85%, SGT by 1.36%, etc. Following were 6 sectors increasing by more than 1% including pharmaceuticals – biology, vehicles and components, media entertainment, transportation, consumer services, and energy.

The trading value of the afternoon session recorded nearly VND 6,400 billion, slightly higher than the morning session’s over VND 5,900 billion, thereby ending the day with more than VND 12,300 billion. In general, today’s liquidity was not strong, even lower than the 5- and 10-session averages.

| HOSE floor liquidity on 11/28/2024 |

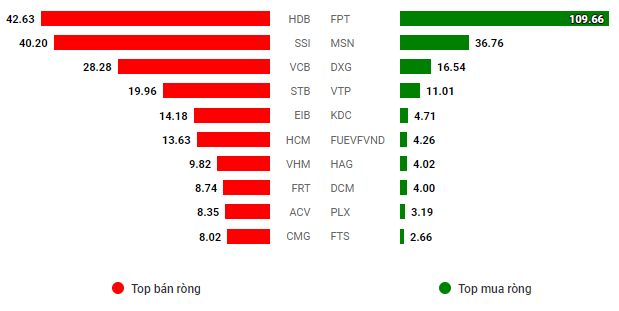

Foreign investors narrowed the trading range, with nearly VND 1,058 billion bought and more than VND 1,028 billion sold, thereby net buying slightly less than VND 30 billion, marking the 5th consecutive net buying session.

| Net buying for the 5th consecutive session |

Morning session: Adjustment pressure in the latter half of the morning session, the market narrowed its increase

Although still in the majority with 21 increasing sectors, the fact that groups with high weights such as banks and real estate narrowed their increases, especially real estate returning to reference, made the market narrow its increase significantly compared to the first half of the morning session.

At the end of the morning session, VN-Index only increased slightly by 2.01 points to 1,243.98, similarly, HNX-Index increased by 0.76 points to 223.86 and UPCoM-Index increased by 0.3 points to 92.26.

|

The increase in points was continuously narrowed in the second half of the morning session

Source: VietstockFinance

|

Looking at the market map, it is easy to see that the red patches were more present, especially in bank stocks such as STB, TCB, HDB, CTG and real estate stocks such as VHM, VPI, HDG, PDR, DIG, NVL, etc. In addition, large-cap retail stocks such as MWG, MSN or fertilizer and chemical stocks such as DPM, DDV, CSV, etc. were also decreasing.

|

Many bank and real estate stocks decreased

Source: VietstockFinance

|

The market liquidity was not too prominent with more than 259 million shares traded, corresponding to a value of nearly VND 5,937 billion.

Of which, the trading scale of foreign investors was also quite gloomy, with only VND 435 billion bought and nearly VND 507 billion sold, temporarily net selling slightly less than VND 72 billion.

The net selling force was more evenly distributed with HDB at nearly VND 43 billion, SSI at more than VND 40 billion, VCB at more than VND 28 billion, STB at nearly VND 20 billion, etc., while the buying force focused mainly on FPT with nearly VND 110 billion or MSN with nearly VND 37 billion, far ahead of the group behind.

|

Trading value by code (VND billion)

Source: VietstockFinance

|

10:45 am: Maintaining the upward momentum, many sectors booming

As of 10:40 am, the indexes continued to maintain their green color, with VN-Index increasing by 4.16 points to 1,246.13, HNX-Index increasing by 0.83 points to 223.92, and UPCoM-Index increasing by 0.47 points to 92.43.

Compared to the beginning of the morning session, the number of decreasing codes has increased to a total of 181 codes, including 12 floor-decreased codes. However, the increasing group still dominated with 366 codes, including 13 ceiling-increased codes.

The sector with the strongest increase in the market was telecommunications, reaching 3.49%, driven by VGI increasing by 3.47%, CTR by 1.97%, etc.; Pharmaceuticals – Biology increased by 2.37%, supported by DBD ceiling-increasing, DHT increasing by 8.67%, IMP by 4.17%, or DHG by 1.1%, etc. In addition, there were 3 sectors increasing by more than 1% including media entertainment, transportation, and energy.

In the remaining increasing group, banking, insurance, real estate, retail, and materials did not increase too strongly but with large weights in market capitalization, they also positively supported the common score.

|

Most sectors are increasing

Source: VietstockFinance

|

Opening: A cheerful start

In the first 25 minutes of November 28, the indexes quickly accelerated with VN-Index increasing by 6.55 points (equivalent to 0.53%) to 1,248.52 points, HNX-Index and UPCoM-Index slightly increasing to reach the milestones of 224 points and 92.3 points, respectively.

|

The green color covered the market

Source: VietstockFinance

|

The green color covered a larger area than the red, with 316 increasing codes (8 ceiling-increased codes) while only 84 decreasing codes (4 floor-decreased codes). Liquidity was not too prominent, with nearly 33 million shares traded, corresponding to a value of nearly VND 733 billion.

The stock that contributed the most to the VN-Index score was VCB with more than 0.8 points, followed by FPT, VHM, and TCB, all with nearly 0.4 points. Conversely, the score was not significantly affected in the context of very few decreasing codes.

|

Top stocks affecting the VN-Index index

Source: VietstockFinance

|

Looking at the Asian markets, although still generally increasing by 0.71% during the opening time, the picture showed a contrast, with Nikkei 225 increasing by 0.36% to 38,247.5 points, Singapore Straits Times increasing by 0.22% to 3,716.14 points, while Hang Seng decreased by 1.02% to 19,403 points and Shanghai Composite decreased by 0.2% to 3,303.05 points.

Last night, Wall Street fell ahead of the Thanksgiving holiday, as investors seemed to take profits on large-cap tech stocks that had performed well so far this year.

Specifically, the S&P 500 index fell by 0.38% to 5,998.74 points, breaking the 7-session winning streak. The Nasdaq Composite index fell by 0.6% to 19,060.48 points. The Dow Jones index lost 138.25 points (equivalent to 0.31%) to 44,722.06 points, reversing the increase after rising more than 140 points at the peak of the session.

These moves came after the Personal Consumption Expenditure (PCE) index, released on the morning of November 27. The Fed’s preferred inflation gauge rose 0.2% in October and 2.3% from a year earlier, in line with forecasts from economists polled by Dow Jones. Excluding food and energy prices, core PCE rose 0.3% from the previous month and 2.8% from a year earlier, also in line with forecasts.

The Foreign Block: Investing Inflows and the Liquidity Conundrum

Liquidity in the afternoon session unexpectedly dropped by 22% compared to the morning session, despite the overall breadth remaining favorable. The upward momentum showed signs of weakening. This development reflects the caution among buyers as the market enters a resistance zone, where stronger profit-taking may occur.

The Most Notable Stocks of the Day: A Pre-Market Rundown

“A deep dive into the recent stock market trends: Unveiling the top gainers and losers as per Vietstock’s statistical insights.”