M&A Vietnam Forum 2024: Unlocking Opportunities in a Dynamic Market

On November 27, the M&A Vietnam Forum 2024, organized by Dau Tu Newspaper under the patronage of the Ministry of Planning and Investment, took place in Ho Chi Minh City. This event comes at a time when the M&A market is expected to bounce back after a period of stagnation.

Dr. Nguyen Cong Ai, Deputy General Director of KPMG Vietnam, presented an overview of the M&A market, highlighting that the value of M&A deals in Asia-Pacific surged by 54% year-on-year in the first nine months, reaching $273 billion due to several large transactions.

However, the situation in Southeast Asia was rather subdued. Despite interest rate cuts and accommodative monetary policies aimed at boosting economic growth, global and regional challenges made investors and businesses cautious, leading to limited M&A activity.

According to KPMG’s data, Vietnam’s M&A market still recorded a total transaction value of $3.2 billion in the first three quarters, with over 220 deals, a 45.9% increase year-on-year. The average deal value stood at $56.3 million.

M&A Vietnam Forum 2024 held in Ho Chi Minh City on November 27.

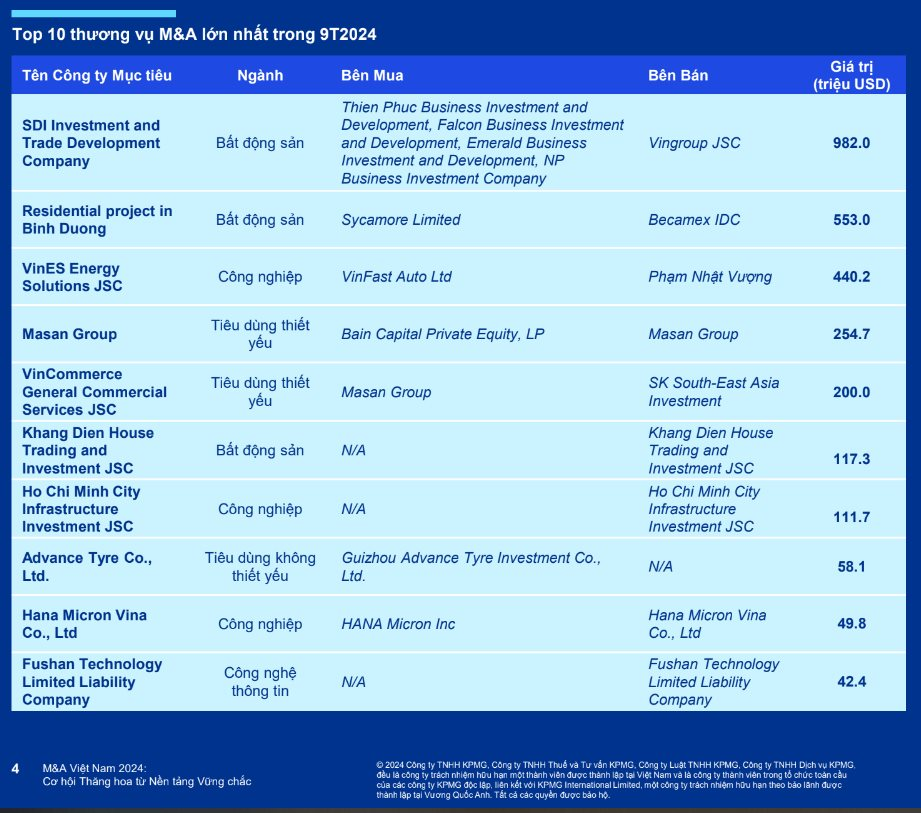

The largest deal of the year so far, valued at $982 million , took place in early April. Vingroup transferred a 55% stake in SDI Trading and Development Investment Company Ltd. – which owns over 99% of Sado Commercial Trading JSC – to a group of four Ho Chi Minh City-based enterprises. Sado was the largest shareholder of Vincom Retail, holding 41.5% of its capital.

As a result, neither Sado nor Vincom Retail is a subsidiary of Vingroup anymore. However, the group still directly owns over 18% of Vincom Retail’s shares and will be the second-largest shareholder.

The second-largest M&A deal in the first nine months in Vietnam was in the real estate sector, with Becamex IDC transferring a $553 million housing project in Binh Duong to Sycamore Limited, a subsidiary of CapitaLand Group from Singapore.

The third-largest deal involved billionaire Pham Nhat Vuong, Chairman of Vingroup, donating 99.8% of VinES Energy Solutions JSC to VinFast, valued at over $440 million. Post-merger, VinFast will have autonomy over battery technology – a crucial component of electric vehicles, while also gaining control over the production chain, enhancing its competitive advantage in the market.

In the consumer sector, a notable transaction was Bain Capital’s $255 million investment in Masan Group through a private placement. Additionally, Masan Group also acquired shares worth $200 million in WinCommerce from SK South-East Asia Investment. These two deals were the fourth and fifth largest M&A transactions in the first nine months.

Source: KPMG

KPMG attributes the growth in Vietnam’s M&A market to significant domestic deals, particularly the four transactions involving Vingroup and Masan Group , totaling $1.9 billion, or 58% of the total M&A transaction value.

” This is a result of the business restructuring process undertaken by domestic enterprises. The trend also indicates that foreign investors are approaching the M&A market in Vietnam with increased caution,” KPMG stated in its recently published report.

In terms of sectoral breakdown, M&A transactions in the first nine months were mainly concentrated in real estate (53%), essential consumer goods (14%), and industrials (21%), accounting for 88% of the transaction value and featuring among the top five M&A deals.

Looking ahead to 2025, a more positive shift is expected, with previously postponed deals likely to resume. Foreign investors, primarily from Japan, South Korea, Singapore, and the US, who once led M&A activities in Vietnam, are anticipated to return from next year onwards.

These transactions are driven by investors’ confidence in Vietnam’s stable economic outlook and the government’s proactive and comprehensive policies. Notably, tax incentives, business regulation reforms, and strategic support for high-growth sectors are not just symbolic but practical measures to position Vietnam as an attractive destination for cross-border capital.

Coupled with a focus on infrastructure development and digitalization, these factors could provide a significant boost to M&A activities in Vietnam, making it a bright spot in the Southeast Asian region.

The Heiress of Masan Group Purchases Nearly 8.5 Million Shares of MSN

Ms. Nguyen Yen Linh, daughter of Mr. Nguyen Dang Quang, Chairman of the Board of Directors of Masan Group Corporation (HOSE: MSN), purchased nearly 8.5 million MSN shares out of the registered 10 million shares from October 29 to November 18, 2024.