Market Reverses Downward as Buying Pressure Subsides

The market reversed course and headed south this morning as buying pressure eased. Both prices and indices gradually declined, with sellers refraining from offloading large volumes. Trading volume on the two exchanges dropped by nearly 30% compared to yesterday morning, clearly reflecting this tug-of-war.

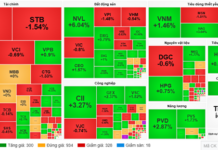

It was only after 10:45 am that the VN-Index officially turned red, but the breadth had been tilted towards declines since earlier. The VN30-Index even managed to eke out a slight gain of 0.75 points by the end of the morning session, indicating the supportive effect of the large caps. FPT, with a 2.66% increase, was the standout performer and the sole large cap in the green. As the third-largest stock by market capitalization in the VN-Index, it contributed 1.3 points to the index, which ended the session down 0.66 points (-0.05%).

VCB also had a minor impact with a 0.54% gain. It is the largest stock by market cap on the exchange. Aside from FPT and VCB, only three other stocks in the VN30 index posted gains: HDB rose 1%, MSN edged up 0.14%, and SAB climbed 0.36%.

The 19 declining stocks in the VN30 basket were not enough to push the index into negative territory, suggesting that the decline in market capitalization was outweighed by the gains in these five stocks. This implies a very narrow range of losses. Indeed, the biggest loser, STB, fell just 0.9%. Among the top 10 stocks by market cap, CTG dropped 0.71%, VHM slipped 0.47%, HPG declined 0.76%, TCB fell 0.42%, and VIC lost 0.49%—all minor decreases.

Across the entire HoSE exchange, the breadth at the end of the morning session showed 95 gainers but a substantial 254 decliners. Nonetheless, not many stocks suffered sharp losses. Specifically, only 52 stocks fell by more than 1%, accounting for 14.5% of the total trading value on the exchange. Only two stocks stood out in terms of liquidity: DCM, which dropped 1.58% with a trading volume of VND 204.7 billion, and DPM, which fell 2.2% with a volume of VND 142.5 billion. Only 14 stocks in this group had trading volumes exceeding VND 10 billion.

The phenomenon of many stocks trading in the red but with low volumes suggests a reduction in buying interest. After a rapid rally, the VN-Index entered the resistance zone around 1240 points, giving cash holders a reason to hold off on purchases. The majority of investors are now awaiting a corrective phase to take advantage of more favorable prices. Buy orders have been pushed down to lower levels, leaving sellers in control of determining how far prices will fall and the associated liquidity.

In this scenario, stocks will face varying degrees of pressure. Typically, stocks that have risen sharply in the previous rally are more likely to be sold off decisively because even with significant price declines, investors can still lock in decent profits, and liquidity tends to increase. However, this signal was not evident this morning. Out of the 20 stocks on the HoSE exchange with trading volumes of VND 50 billion or more, accounting for nearly 55% of the total exchange volume, only eight were in the red. These stocks, which concentrate the highest liquidity in the market, have not shown significant selling pressure. The remaining stocks mostly traded in low volumes, so their closing prices are not very reliable.

On the upside, there were still 95 gainers this morning, but most of them lacked substantial trading volumes. Among the approximately 35 stocks that rose over 1%, only about ten had notable liquidity. FPT, of course, led the pack, even topping the market with a volume of nearly VND 901 billion. Other notable gainers included HDB, which rose 1% with a volume of VND 103.3 billion; CMG, which climbed 1.31% with a volume of VND 76.7 billion; NVL, which advanced 1.8% with a volume of VND 72.1 billion; HAH, which gained 1.26% with a volume of VND 58.5 billion; and VTP, which rose 1.38% with a volume of VND 44.9 billion.

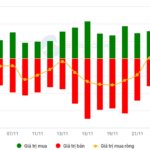

The behavior of foreign investors underwent a notable change: This morning, net buying on the HoSE exchange reached VND 709.2 billion, the highest in eight sessions. Foreign investors heavily bought FPT, with a net purchase of VND 285.4 billion. The only other notable net purchase was MSN, with a net buy of over VND 29 billion. This suggests that, in reality, foreign investors were still net sellers across a wide range of stocks, and the net buying position was achieved thanks to a few isolated transactions. The two most prominent sell-offs were in DCM (-VND 38 billion) and FRT (-VND 33.5 billion).

Shake It Off: VN-Index Remains Resilient at 1240 Points

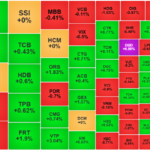

Pressure continued to weigh on the afternoon session, pushing the VN-Index down to 1240.91 points at one stage. However, buying support helped to balance out the market, and the index only experienced minor fluctuations on very low liquidity.

The Foreign Capital Net Buy, VN-Index Approaches 1240 Points

The market held its ground in the afternoon session, maintaining its highs without surging or plunging significantly. Notably, foreign investors turned net buyers again, with a net purchase value of over VND 165 billion on the HoSE, marking the second consecutive net buying session. Despite the continuous upward momentum offering attractive short-term gains, investors seem reluctant to offload their positions.

Vietstock Daily Recap: Can We Expect a Resurgence in Liquidity?

The VN-Index witnessed a modest gain while staying afloat on the Middle Line of the Bollinger Bands. If, in the upcoming sessions, the index persists above this threshold, coupled with trading volumes surpassing the 20-day average, the upward trajectory will be fortified. Notably, the MACD indicator has already flashed a buy signal by crossing above the Signal Line. In tandem, the Stochastic Oscillator is echoing a similar signal. Should this momentum be sustained in the forthcoming sessions, the short-term outlook will brighten with optimism.