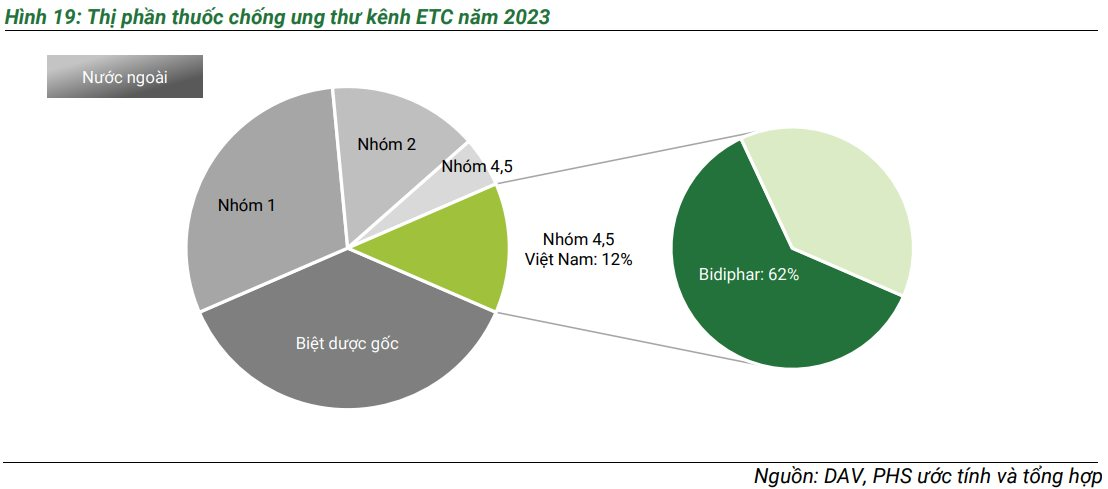

In Vietnam, the production of cancer treatment drugs is presenting significant challenges for domestic pharmaceutical companies due to the lengthy research and clinical trial process, coupled with high R&D costs. Additionally, developing cancer medications requires substantial financial investment, complex manufacturing technology, production lines that meet high international standards, and less competitive advantages compared to imported drugs in terms of quality and branding. Consequently, approximately 88% of cancer treatment drugs in Vietnam are imported.

The Vietnamese stock market recognizes Bidiphar JSC Pharmaceutical – Medical Equipment Binh Dinh (Bidiphar – stock code DBD) as the only domestic pharmaceutical company capable of producing cancer drugs. This company is also one of the top three product groups that have built its reputation and competitive advantage, along with two other groups: antibiotics and dialysis solutions.

Attractive and industry-leading product portfolio, investing in the construction of new EU-GMP-compliant factories

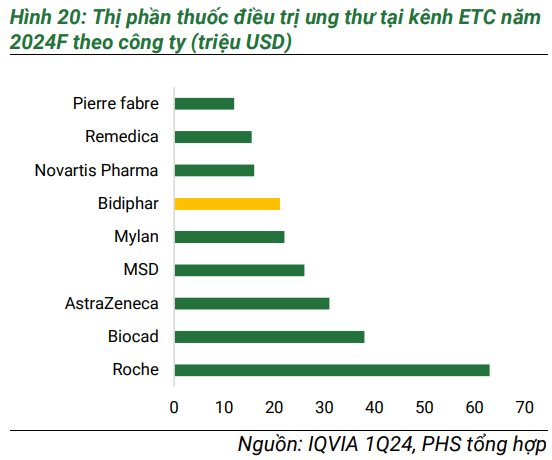

In its latest report, Phu Hung Securities (PHS) assesses that Bidiphar possesses strong competitive capabilities with a highly attractive product portfolio. Bidiphar is a leading domestic pharmaceutical company in the production of anti-cancer drugs, with its products being utilized in central-level hospitals and healthcare facilities nationwide. After more than a decade of developing cancer treatments, the company has introduced over five million product units to the market, trusted by central-level hospitals. Notably, Bidiphar’s cancer treatment drugs are very competitively priced, approximately 40% lower than imported drugs from Europe and 20% lower than those from Asia. This offers hospitals and patients more economical choices for cancer treatment while demonstrating the effectiveness and competitiveness of domestic pharmaceuticals in this field.

The dialysis solution product line also has a relatively low level of industry competition, with only five companies involved in its production and distribution in the hospital channel. Bidiphar currently ranks third among these companies, holding a 24% market share in the ETC channel.

Conversely, the antibiotic market in Vietnam is highly fragmented and bears high risks due to the ease of drug formulation. Nevertheless, Bidiphar’s antibiotic segment has witnessed robust growth, as 70% of its antibiotics are formulated as injectables for hospitals. Antibiotic revenue accounts for about 28% of total pharmaceutical revenue, achieving a compound annual growth rate (CAGR) of 8% during 2019-2023.

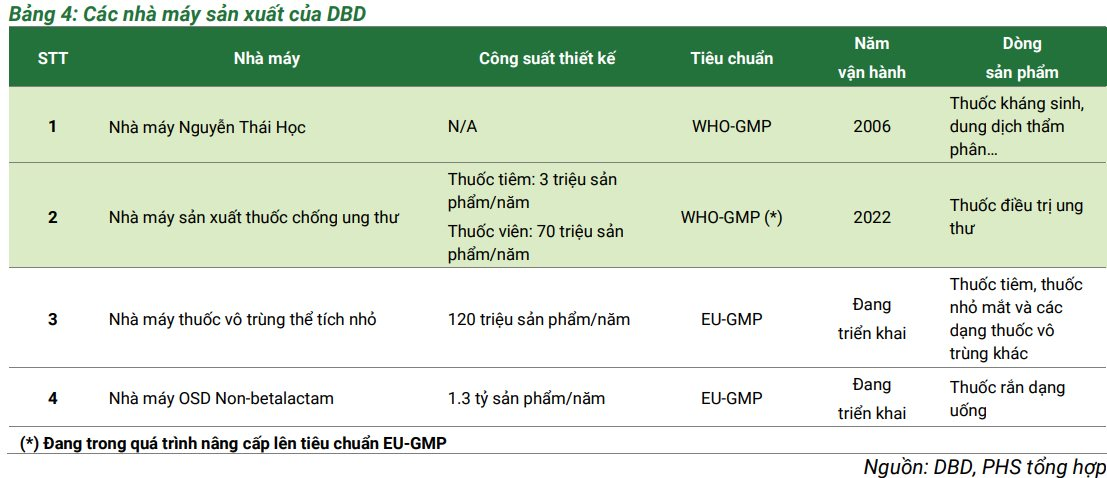

DBD currently operates two factories that meet WHO-GMP standards, enabling the company to enhance its production capacity and ensure quality in pharmaceutical provision. The company is also in the process of upgrading two production lines to EU-GMP standards, with plans to submit the application in 2025 and complete the procedure by 2026. Upon completion, the cancer treatment drugs will be eligible to participate in tenders for higher-priced cancer treatment drugs, enhancing their competitiveness in the imported cancer drug segment from 2026 onwards.

Additionally, during 2024-2028, Bidiphar intends to invest in constructing two new factories that meet EU-GMP standards in the Nhon Hoi Economic Zone to boost production capacity. The construction of the sterile small-volume drug factory commenced in Q3 2023, with operations expected to begin in Q1 2027. The construction of the non-betalactam oral solid dosage (OSD) drug factory is scheduled to start in 2025, with operations commencing in Q1 2027. To finance this project, the company is considering a private placement for strategic investors, offering a total of 23.3 million shares at a minimum price of VND 50,000 per share. According to PHS, DBD is currently negotiating with four domestic and foreign investors, prioritizing the criteria of finding strategic partners who can bring new values, transfer technology, and accompany the company in the long term.

Focusing on new product research, projected profit growth expected to surge in the following year

Bidiphar is also recognized as a leading company in R&D, with numerous projects applying new technologies. It became the first Vietnamese pharmaceutical company to successfully produce injectable antibiotics (in 1992), antibiotic, vitamin, and amino acid infusion solutions (in 1997), and cancer treatment drugs (in 2010). During 2018-2023, the company developed nearly 100 new products and is expected to receive additional approvals by the end of 2024 or early 2025 in the field of cancer treatment to meet the growing market demand and enhance its competitive position. Bidiphar’s relentless efforts in R&D reflect a sustainable development strategy, significantly contributing to stabilizing drug prices in the market and strengthening the capabilities of the national pharmaceutical industry.

In terms of business performance, in Q3 2024 alone, Bidiphar recorded net revenue and pre-tax profit of VND 452 billion and VND 80 billion, respectively, reflecting a 10% and 5% increase compared to the same period last year. For the first nine months, net revenue increased by nearly 4% to VND 1,250 billion, completing 63% of the annual plan. Pre-tax profit remained stable at VND 254 billion, achieving 80% of the 2024 profit plan.

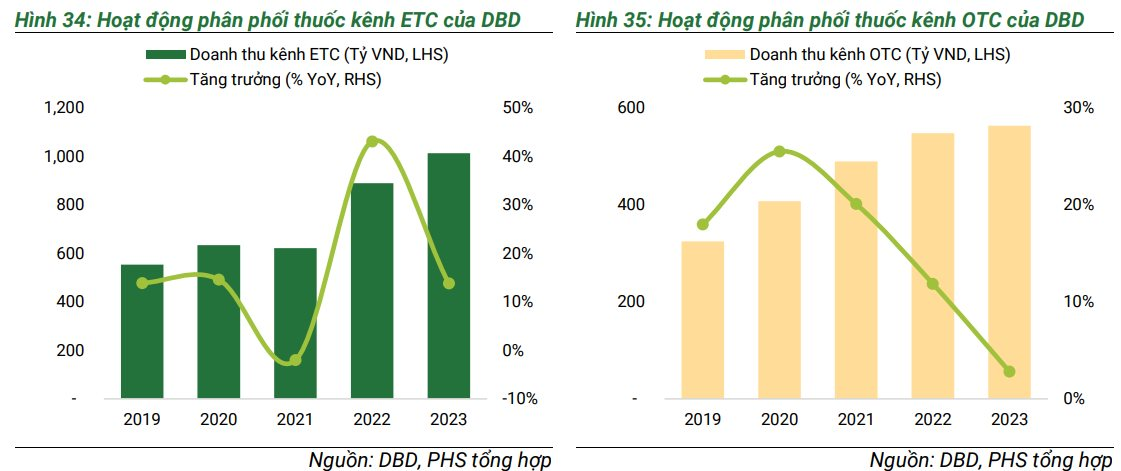

Given the saturation of the OTC drug market due to intense competition and issues with counterfeit drugs, the ETC drug market is anticipated to be the primary driver of growth in Vietnam’s pharmaceutical industry. The streamlining of regulations for drug tenders in hospitals significantly contributes to this trend. PHS assesses Bidiphar’s long-term prospects as relatively favorable, based on the expectation of participating in higher-tier tenders, supporting the strategy to expand the domestic market share through the ETC channel.

PHS anticipates that Bidiphar will exhibit strong growth potential in the future due to its expansion of the customer base through the tender channel and its robust financial health compared to peers in the industry. However, the company remains reliant on imported raw materials, mainly from China and India, which may pose risks regarding price fluctuations and supply disruptions.

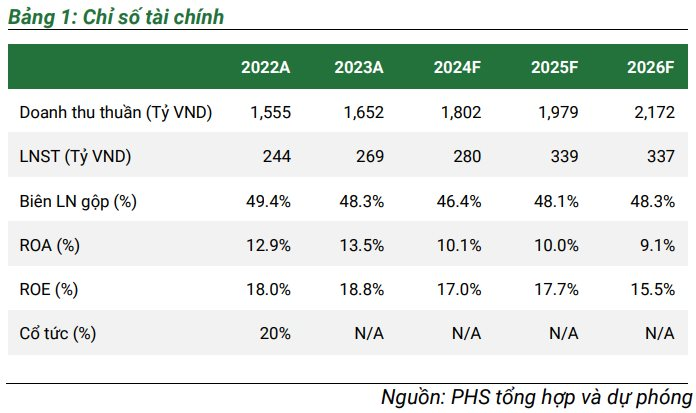

Projections indicate that Bidiphar’s net revenue for 2024-2025 could reach VND 1,802 billion and VND 1,979 billion, respectively. Most product lines in the self-produced product structure are expected to achieve a CAGR of 9.55% during 2023-2033. The gross profit margin for 2025 is forecast to improve to 48.1%, attributed to the anticipated increase in the proportion of high-margin product lines such as cancer treatment drugs, injectable antibiotics, dialysis solutions, and vitamins. Net profit for 2024-2025 is estimated to increase by 4% to VND 280 billion and then by 21% to VND 339 billion.

In the market, DBD shares closed at VND 49,400 per share on November 27, 2024, representing a 14% increase since the beginning of the year, approaching the historical peak established in October.