While these areas are predominantly segmented for land plots, ultra-luxury products priced at tens of billions of VND have become the new supply focus towards the end of the year. However, compared to primary prices of townhouses and villas in Ho Chi Minh City, these prices are only about 30-40% higher, and the potential is forecast to remain favorable.

Recently, Nam Long released a few dozen canal-side Park Village villas in Long An to the market, with prices starting from 17.7 billion VND per unit. The Aqua line, priced from 10 billion VND per unit, comes with attractive payment policies. These limited-edition products are part of the 355-hectare Waterpoint urban area, which already boasts a range of amenities catering to living, learning, working, shopping, and entertainment needs, hence the interest from buyers. On December 1st, the developer will introduce a collection of canal- and river-side mansions from The Aqua and Park Village compounds, featuring breakthrough sales policies and gift values of up to tens of billions of VND.

In Dong Nai, Can Tho, and Ba Ria – Vung Tau, a number of townhouses and villas priced at around 10 billion VND per unit have been launched towards the end of the year, attracting attention. Notably, there has been considerable interest in the context of limited supply and already high prices for this type of property in Ho Chi Minh City. For example, in Bien Hoa, Dong Nai, the completed townhouse line in the 170-hectare Izumi City urban area by Nam Long and Hankyu Hanshin Properties (Japan) is currently trading from 7 billion VND per unit, with attractive policies, attracting both real demand and investment. A large proportion of buyers are from Ho Chi Minh City.

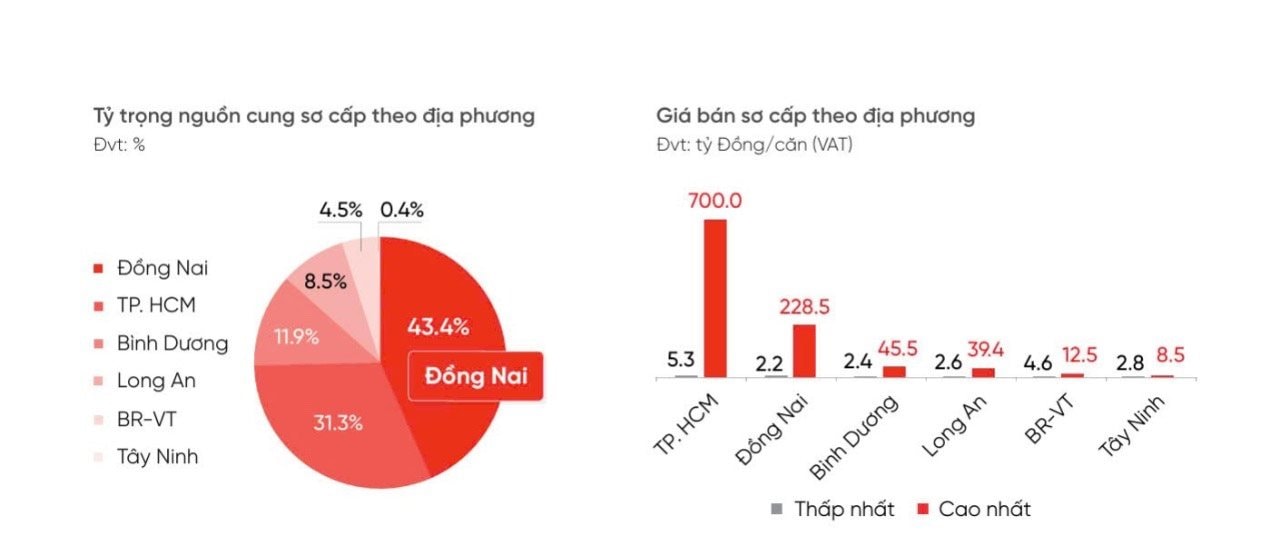

Compared to primary prices of townhouses and villas in Ho Chi Minh City, prices for this type of property in neighboring urban areas are still competitive. Additionally, improved transportation infrastructure has stimulated the demand for real estate on the outskirts of Ho Chi Minh City. DKRA Group’s October 2024 report indicates that prices of townhouses and villas in Ho Chi Minh City reached a peak of 700 billion VND per unit, while in Dong Nai, they were 228.5 billion VND per unit. In contrast, prices in Binh Duong were 45.5 billion VND, Long An nearly 40 billion VND, and Ba Ria – Vung Tau 12.5 billion VND per unit.

In the context of continued scarcity of primary supply of townhouses and villas in Ho Chi Minh City, with peak prices reaching 700 billion VND per unit, projects from reputable developers in satellite towns, close to the inner city, are creating a strong pull. According to DKRA Group, the primary price level in satellite towns is still lower than in Ho Chi Minh City, and with a slight increase in new supply, demand has returned to the periphery, significantly improving the liquidity of townhouses and villas. Specifically, the absorption of primary supply and new absorption were 6.3 times and 4.4 times higher, respectively, compared to the same period in 2023.

High prices, limited supply, and opportunities in the townhouse and villa market are being “shared” with neighboring satellite towns. Source: DKRA Group.

Compared to the satellite towns of Ho Chi Minh City, Dong Nai leads the supply market. Transaction volume is mainly distributed among projects with safe legal status, guaranteed construction progress, and developed by reputable/well-known investors in the market. According to DKRA Group, there have not been significant fluctuations in primary prices of townhouses and villas in Ho Chi Minh City and its vicinity compared to the previous quarter, and they remain high due to input cost pressures. Along with this, pre-sale discount policies for customers, rental guarantees, and stretched payment schedules have been widely applied to increase liquidity.

Sharing recently, Dr. Su Ngoc Khuong, Senior Director of Savills Vietnam, said that the demand for housing in large cities like Ho Chi Minh City and Hanoi is always high, while land funds are limited. This has become more urgent as the number of immigrants to large cities for living and working increases.

Therefore, neighboring provinces such as Long An, Binh Duong, and Dong Nai have become attractive destinations for investors and homebuyers. Convenient transportation between provinces has helped solve, to some extent, the housing needs of residents, while also creating momentum for the development of the regional real estate market.

However, according to Dr. Khuong, investors need to carefully consider factors such as legal status, infrastructure, and development potential before making a decision.

Sharing the same view, Dr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, stated that in the period of 2024-2030, the southern real estate market is accelerating its recovery, driven by new supply. In the short term, supply is expected to grow from the fourth quarter of 2024, with most options coming from new localities with abundant land funds and growth potential, as well as policies to develop modern infrastructure.

Especially in places with large-scale projects from leading real estate developers, there will be a large population and a stable flow of customers. Dr. Dinh estimates that the value of real estate in satellite towns will increase by an average of about 10% per year.

The Southern Surge: As Ho Chi Minh City’s Real Estate Market Bounces Back

As we move into the final quarter of 2024, Ho Chi Minh City’s real estate market has experienced a notable recovery in terms of interest, supply, and selling prices. This positive trajectory has caught the attention of investors and property businesses from the north, who are now eyeing opportunities in the southern market.

Winter Beach Bathing Privileges for the Elite 2.4%: An Exclusive Offering at Vinhomes Ocean Park 3

Embracing the VinWonders Wave Park, the exclusive community of just 192 quad-villas at Vinhomes Ocean Park 3 offers its residents a unique lifestyle with year-round access to a beachfront retreat. With the park’s proximity, the villas provide an unparalleled opportunity to indulge in a seaside escape, no matter the season.

The Race to Build HCMC’s Metro Line 2: Unveiling the $2 Billion Project

The Ho Chi Minh City administration has made a strategic decision to utilize its own budget to construct the highly-anticipated Metro Line 2, connecting Ben Thanh and Tham Luong. This marks a shift from the previous plan of relying on ODA loans, showcasing the city’s commitment to taking charge of its infrastructure development.

The Endless Commute: Navigating the Unemployment Benefits Maze

Streamlining processes and procedures while remaining agile in the acceptance and handling of unemployment benefit claims is pivotal to upholding the principles of unemployment insurance.

Hiring Leadership Talent: Join BIDV at Saigon Central Branch

We are seeking talented individuals to join our dynamic team at BIDV – Saigon Center Branch, one of the leading banks in Vietnam. With a commitment to fostering growth and development, we invite passionate professionals to embark on a rewarding career journey with us. This is an exciting opportunity to contribute to our continued success and make a lasting impact in the banking industry. Join us and be a part of a vibrant community that values innovation, excellence, and a strong dedication to shaping the future of finance.