Investors Withdraw Before Deadline, Owe Land Rent

Recently, the Government Inspectorate (GI) publicly announced the findings of its inspection into the restructuring of state-owned enterprises and the conversion of land use purposes from production and business activities of state-owned enterprises and equitized companies to land trading and housing development (for the period 2011-2021) at the Ministry of Transport (MoT).

An important aspect of this inspection was the equitization process of enterprises under the MoT, including the Construction Corporation for Transport No. 8 – JSC (Parent Company – Cienco 8).

Firstly, the GI pointed out that Cienco 8’s lack of specificity in setting criteria for selecting strategic investors (in cases where they are not credit institutions) led to the early withdrawal of strategic investors, namely the Construction Investment Joint Stock Company Vinaconex – PVC and Long Bien Bridge Road Joint Stock Company. Specifically, these two investors withdrew their capital one year after Cienco 8 officially became a joint-stock company.

Secondly, Cienco 8 failed to clearly analyze and assign responsibility for compensating when there was a shortage of fixed assets during the inventory check at the Southern Branch and when there was a lack of raw materials, tools, and equipment during the inventory check at the Southern Project Management Board. The total value of these missing assets amounted to 520 million VND.

Cienco 8 determined the land price according to the market price to calculate the enterprise value for a piece of land in Ward 2, Binh Da, Bien Hoa City, Dong Nai Province, with an area of 162m². Therefore, a review is necessary to ensure compliance with legal regulations and prevent state asset losses.

Thirdly, the GI noted that Cienco 8 determined the enterprise value for equitization without the approved enterprise value and equitization plan for two companies: Construction Transport No. 875 Limited Liability Company and Construction Transport No. 892 Limited Liability Company.

Fourthly, Cienco 8 was one of the enterprises that did not fully reconcile accounts receivable and payable and did not determine the responsibility of collectives and individuals as per regulations.

Fifthly, Cienco 8 was also among the enterprises that did not report to the Prime Minister and did not agree with the Ministry of Finance on adjusting their charter capital.

Cienco 8 Group Headquarters

In terms of land management and usage during the equitization process, Cienco 8 had two land-based properties. One was a property at 8 Ho Tung Mau, Mai Dich Ward, Cau Giay District, Hanoi, with an area of 1,451 m², consisting of a 7-storey building and a land area of 1,265.57 m² with a 5-storey building. Cienco 8 leased this land from the Hanoi People’s Committee for a period of 30 years (expiring in 2032).

The company rented out the entire 1,451 m² of land with the 7-storey building to the Vietnam Industrial and Commercial Bank (VietinBank). Simultaneously, Cienco 8 contracted the entire 1,265.57 m² of land with the 5-storey building to Kinh Do Hotel Joint Stock Company in March 2009, before the equitization date. This was not in accordance with regulations. Moreover, the company rented out the property with a one-time payment clause and a fixed price for the entire 50-year lease, exceeding the state-leased period.

At the time of equitization, the Hanoi Department of Finance, in its Document No. 7337/STC-QLCS dated December 25, 2013, agreed on the land use plan without being reported by Cienco 8, and also failed to detect the aforementioned land lease, leading to an inaccurate approval of the equitization plan.

Additionally, as of June 20, 2022, the property at 8 Ho Tung Mau had not fulfilled its financial obligations, owing over 13.2 billion VND in land use tax to the state.

As for the other land lot at 222 Nguyen Trai, Thanh Xuan District, Hanoi, with an area of 1,306 m², Cienco 8 leased this land from the Hanoi People’s Committee for a period of 20 years starting from July 27, 1998 (ending in 2018) for the purpose of building a business service center. However, to date, the Corporation has not signed a new land lease contract with the Hanoi People’s Committee. Instead, on August 16, 2018, Cienco 8 signed a Business Cooperation Contract No. 01/HĐHTKD with Roxa Restaurant Chain Joint Stock Company, allowing the use of 1,306 m² for a restaurant, which is not in compliance with the 2013 Land Law.

The above violations regarding the equitization plan for these two land-based properties need to be inspected, reviewed, and handled according to legal regulations.

Given these violations, the GI proposed administrative sanctions, suggesting that the Members’ Council of Cienco 8 – JSC be held accountable and take responsibility for the shortcomings, limitations, faults, and violations in the restructuring of state-owned enterprises (reorganization, equitization, capital withdrawal) and the conversion of land use purposes as mentioned above. They also proposed measures to handle the situation according to legal regulations.

In terms of economic sanctions, the GI stated that due to equitization, the state lost a total of 66.16 billion VND. Additionally, Cienco 8 failed to clarify responsibility and provide compensation for the loss of assets worth 520 million VND.

Finally, the GI requested that Cienco 8 – JSC review and calculate the amount of land use tax debt of over 13.1 billion VND for the property at 8 Ho Tung Mau, Mai Dich Ward, Cau Giay District, Hanoi, and pay it to the state budget.

Struggling IPO Due to Losses

The Construction Corporation for Transport No. 8 – JSC, formerly known as Construction Team 64, was established under Decision No. 597/QD-TC dated June 23, 1965, of the Ministry of Transport (MoT).

On June 25, 2010, the MoT issued Decision No. 1761/QD-BGTVT to establish the Parent Company – Construction Corporation for Transport No. 8 (Cienco 8) as a one-member limited liability company wholly owned by the State.

Following the Party and State’s policy on state-owned enterprise equitization and the MoT’s Decision No. 49/QD-BGTVT dated January 8, 2013, Cienco 8 proceeded with enterprise equitization.

Compared to other enterprises in the same “family” as Cienco, the IPO of Cienco 8 faced more challenges due to its poor financial performance.

According to Cienco 8’s report to the MoT, the Corporation’s accounts receivable as of June 30, 2013, amounted to 1,300 billion VND, while its accounts payable were 2,800 billion VND.

At that time, the subsidiary companies owed the parent company more than 700 million VND, and the parent company owed investors nearly 800 million VND. Additionally, there were 500 regular employees without work.

On March 10, 2014, the Prime Minister issued Decision No. 357/QD-TTg approving the equitization plan for the Parent Company – Construction Corporation for Transport No. 8.

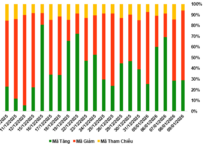

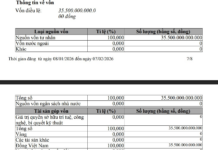

According to this plan, Cienco 8’s charter capital was 350 billion VND, equivalent to the issuance of 35 million shares with a par value of 10,000 VND/share.

Of this, the State held 17.15 million shares, accounting for 49% of the charter capital; 21% of the shares were offered to strategic investors; more than 10 million shares, equivalent to 28.6% of the charter capital, were sold by auction; and the remaining 1.4% were issued to employees.

Cienco 8’s three strategic investors were: Long Bien Bridge Road Joint Stock Company, contributing 35 billion VND (10% of the charter capital); Construction Investment Joint Stock Company Vinaconex – PVC, contributing 21 billion VND (6% of the charter capital); and Vietnam Foreign Trade Joint Stock Company Securities, contributing 17.5 billion VND (5% of the charter capital).

On May 6, 2014, Cienco 8 offered more than 10 million shares with a par value of 10,000 VND/share for auction. However, only 26 investors registered to participate. In this auction, Cienco 8 sold only 37,000 shares at an average price of 10,000 VND/share, resulting in a total value of 370 million VND.

Cienco 8 held its first shareholders’ meeting on May 30, 2014, and officially transitioned to operating as a joint-stock company from June 30, 2014.

The meeting elected a Board of Directors consisting of five members: Mr. Vu Cao Dam, Mr. Pham Xuan Thuy, Mr. Nguyen Tuan Anh, Mr. Nguyen Huu Hoa, and Mr. Truong Quoc Dung.

After the first meeting of the Board of Directors, Mr. Vu Cao Dam was elected as Chairman of the Board, and Mr. Pham Xuan Thuy was appointed as General Director.

The meeting also elected a Supervisory Board consisting of three members: Mr. Nguyen The Hung (Head), Ms. Le Thi Ngoc Tram, and Mr. Nguyen Van Thanh.

Cienco 8 set its first-year targets as a joint-stock company, aiming for an output of 1,321 billion VND, revenue of 1,082 billion VND, after-tax profit of 13.5 billion VND, and an average dividend rate of 4.9%/year.

In August 2015, Cienco 8 again offered more than 19.1 million shares for auction at a starting price of 10,100 VND/share. The auction attracted two bidders (one organization and one individual, both domestic investors) who registered to buy 8,266,000 shares, equivalent to 43.5% of the auctioned shares.

The highest and lowest successful bid prices were both 10,100 VND. Thus, the average successful bid price was 10,100 VND. After this auction, the MoT still held nearly 10.8 million shares of Cienco 8, equivalent to 40.5% of the charter capital.

According to the information disclosure before the aforementioned auction, as of June 30, 2015, Cienco 8’s total assets amounted to 1,566 billion VND. Its consolidated revenue in 2014 was 1,500 billion VND (a 50% decrease compared to 2013), but it incurred a loss of 20.5 billion VND.

Phuc Loc Group-affiliated Shareholders Gain Control

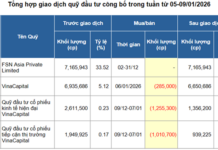

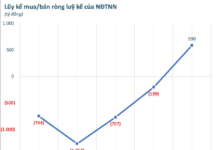

During 2014-2015, Cienco 8 continued to publicly offer shares multiple times, but they were often undersubscribed. Meanwhile, Cienco 8’s strategic investors quietly withdrew their capital.

Specifically, in September 2015, Construction Investment Joint Stock Company Vinaconex – PVC (code: PVV) announced its resolution approving the transfer of 2.1 million Cienco 8 shares (equivalent to 7.9% of the charter capital) to Phuc Loc Group Joint Stock Company at a price of 7,500 VND/share, totaling 15.75 billion VND, through a private placement.

Mr. Luong Minh Tuong, Chairman of Cienco 8

In October 2015, Cienco 8 surprised the market by announcing the appointment of Mr. Luong Minh Tuong, Chairman of Phuc Loc Group, as its new Chairman and General Director.

At this point, it became clear that Mr. Luong Minh Tuong, his wife, Ms. Dinh Thi Huong Giang, and Phuc Loc Group had completed the purchase of state capital and shares from strategic investors, acquiring a total of 51.99% of Cienco 8’s shares.

After Mr. Tuong and Phuc Loc Group took control, Cienco 8 increased its charter capital to 589.9 billion VND. At this point, the state-owned stake decreased to about 18% of the charter capital, while the Phuc Loc Group-affiliated shareholders held a controlling stake of 78.51%.

In 2016, the Chairman of Cienco8, Mr. Luong Minh Tuong, sent a document to the MoT requesting their opinion on increasing the charter capital from 589.9 billion VND to 2,000 billion VND. The proposed method was for the major shareholders to contribute capital according to the capital increase needs in each phase.

The reason for this massive capital increase was to serve the production and business activities of the Corporation, including investing in projects under the BOT and PPP models, real estate business, machinery investment, and renovation of office buildings.

In the event that the MoT did not participate in the capital contribution, the Board of Directors of Cienco 8 wanted the state-owned shareholders to agree to allow the major shareholders, including Phuc Loc Group, Mr. Luong Minh Tuong, and Ms. Dinh Thi Huong Giang, to contribute the entire additional capital.

If this capital increase had been implemented, the state’s ownership in Cienco 8 would have been reduced to approximately 5.4%. Meanwhile, Phuc Loc Group’s ownership would have been almost absolute.

It is likely that this capital increase did not materialize, as the state’s ownership in Cienco 8 remained at 18% for many years. In 2017, the MoT transferred the state capital representation rights in Cienco 8 to the State Capital Investment Corporation (SCIC).

In May 2023, SCIC announced a list of divestments for the first phase of 2023, which included 73 enterprises, one of which was Cienco 8. At this time, SCIC still held 18% of Cienco 8’s capital.

It is worth mentioning that after the acquisition of Cienco 8, the Phuc Loc – Cienco 8 Consortium consecutively won bids for several infrastructure projects. Notable projects include the urgent construction of a flood prevention system for the Cau River, along with the completion of urban infrastructure on both banks of the river (the Cau River Project) under the PPP model – BT Contract in Thai Nguyen province, with a total investment of over 18,211.61 billion VND.

Other significant projects include the Bach Dang Bridge in Quang Ninh Province (7,600 billion VND) and Package XL 01 of the Phan Thiet – Dau Giay Expressway project, valued at 1,069.5 billion VND.

According to the latest business registration update in April 2024, Mr. Luong Minh Tuong remains the Chairman of Cienco 8’s Board of Directors, with Mr. Nguyen Van Phu as the General Director and Mr. Le Van Hau as the Deputy General Director. The company currently employs 86 people.

Mr. Luong Minh Tuong (born in 1973) is a permanent resident of Hanoi but is also a well-known businessman in Ninh Binh. In this province, he built the Phuc Loc Group into a prominent name in the construction and infrastructure industry.

The Perils of Delaying State-Owned Enterprise Privatization: Navigating Financial Insecurity

As one of the key pillars of the economy, state-owned enterprises (SOEs) control significant resources. However, the slow pace of privatization over the years has led to financial risks and a waste of state resources.

The New Land Price Policy: A Concern for Manufacturers

Many businesses in Ho Chi Minh City are concerned that the implementation of the new land price list will significantly increase their land lease costs. This could have a profound impact on their operations and profitability, especially for those in the manufacturing and trading industries. With the new land prices, businesses may have to reevaluate their strategies and find ways to mitigate the potential rise in overhead costs. The implications of these changes could be far-reaching and warrant careful consideration by all involved parties.

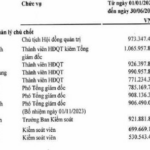

The Ruling Elite: Unveiling the Astronomical Salaries of Vietnam’s Maritime and Aviation Titans

A number of state-owned enterprises have recently gone public on the stock exchange, revealing the salaries and remunerations of their top executives. These include well-known companies such as VIMC, Vietnam Airlines, the Vietnam Rubber Group, and Vinafood II. As these companies open up to public scrutiny, it will be interesting to see how their executive compensation packages compare to those of their peers in the industry. With shareholders now having a say in these matters, we can expect greater transparency and accountability in the way these businesses are run.

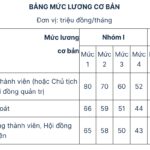

The Highest Salary in a State-Owned Enterprise is 80 Million VND/Month

The proposed highest base salary for the Chairman of the Members’ Council (or Chairman of the Company) and the Chairman of the Board of Directors of a state-owned enterprise is an impressive 80 million VND per month. This figure represents a significant sum and is indicative of the value and importance placed on these pivotal leadership roles within the organization.